Today’s (Oct 5 2017) Weekly Initial Unemployment Insurance Claims for the prior week shows that the employment picture is continuing to stay strong. Today’s report shows a drop of 12,000 in initial jobless claims to 260,000. This was somewhat surprising considering the economists felt that jobless claims would rise following the two hurricanes. Instead the prior week was not revised from 272,000 and this week is down 12,000.

The four week moving average was $268,250 which continue to show that employment growth continues in the jobs market.

Market Timing System Says Stay Invested

According to the market timing system that is designed around the Weekly Initial Unemployment Insurance Claims, investors should still stay invested in equities as the chance of a large plunge into a bear market is extremely slim based on a weekly claims number of 260,000.

Market Timing System Chart

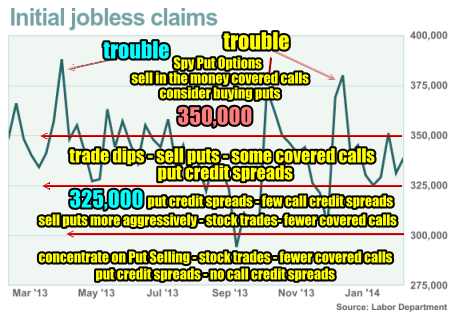

Below is the chart designed around using the Weekly Initial Unemployment Insurance Claims as a market timing system.

We are currently below the 275,000 level. That means the market is continuing to climb or will continue to climb and strategies such as setting up call credit spreads or selling naked call strikes would definitely not be a suggestion.

For investors who use covered calls, using slightly out of the money or slightly in-the-money covered call strikes should continue to provide weekly income or monthly income.

For the rest of investors Put Selling and stock trades are the main focus with the Weekly Initial Unemployment Insurance Claims being this low.

Market Timing System Summary

No Market Timing System is perfect and none have been built around zero interest rates. But today’s numbers from the Weekly Initial Unemployment Insurance Claims do support the above chart and the outlook that the economy will continue to grow and expand. Staying in equities continues to be the suggestion of the market timing system that uses Weekly Initial Unemployment Insurance Claims.

To understand how this market timing system works, read the full outline that discusses this timing system through this link.

Market Timing System Internal Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Trades (Members)

Market Timing System External Links

IWM ETF Russell 2000 Fund Info

Market Direction SPY ETF 500 Fund Info