There are a multitude of market timing systems which investors have sworn by or in many cases sworn at. One of the better market timing systems is the Weekly Initial Unemployment Insurance Claims. This article discusses how the Weekly Initial Unemployment Insurance Claims work as a market timing system. I have used this system for years and find it to be one of the more reliable systems. As of today, that market timing system is advising to continue to stay invested.

Latest Weekly Initial Unemployment Insurance Claims

The number of new claims dipped last week further than expected to 312,000 which was below the consensus for 314,000. As well the four-week average which tends to smooth out the weekly spikes and dips came in at 311,750 which was a drop of 3750. Still though unemployment has a long way to go to reach the numbers from before the credit crisis. Let’s take a look at some historic numbers.

Present and Past

With the present unemployment rate at 6.3 percent in May, the average unemployment rate from 1948 to 2014 has been 5.84 percent. Statistically the highest unemployment rate was 10.8 percent in November of 1982 and the low was 2.5 percent in May of 1953.

2006 and 2007 Unemployment

In 2006 the unemployment rate averaged 4.6 percent and in 2007 it averaged 4.7 percent.

2008 and 2009 Unemployment

2008 started out with unemployment at 5.0 percent . In August it reached 6.1 percent and in October 2008 it was at 6.5 percent. In November it rose to 6.8 percent and in December it reached 7.3 percent.

In 2009 the unemployment rate climbed until it peaked in October at 10 percent. Yet despite this, the bear market in stocks had ended back in March when unemployment stood at 8.7 percent.

2010 – 2013 Unemployment

Of interest are the figures from 2010 when unemployment in March and April peaked at 9.9 percent. Over the summer months it fell back to 9.5 percent but again moved higher in November 2010 to 9.8 percent.

In 2011 the year started with unemployment at 9.1 percent and by December it was down to just 8.5 percent.

In 2012 unemployment ended the year at 7.9 percent.

It was not until 2013 that unemployment finally fell below 7.0 percent, but not until December.

2014 – Unemployment Trend

Overall then you can see that for one of the longest periods in US history unemployment has stayed high making the recovery from the credit crisis uneven and often difficult. Because of this, the unemployment trend has only fallen to 6.3 percent in April and May. In other words, the economy has a long way to go to fall back below 6 percent and make its way down to the levels seen in 2006 and 2007 before the credit crisis commenced. Those rates were below 5.0 percent as outlined above, not below 6.0.

Fed May Be Too Early

So while the Fed was busy talking about interest rates rising in 2015, the unemployment rate has to fall not below 6 percent but back below 5 percent to see the economy actually healed and moving forward. 6.3 percent is definitely nice to see, but 4.7 percent, the average from 2007 is still a long way off which is why rising interest rates may still be a long time coming.

June Numbers

When we see June’s unemployment numbers we will get a better indication of how well the economy is doing. While the Weekly Initial Unemployment Insurance Claims are better, they still have not reached 250,000 on a regular basis which is what the economy needs to really make a big dent in the unemployment numbers.

Market Timing System Says Stay Invested

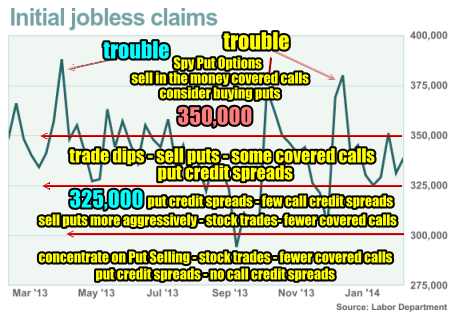

I have for years used the Weekly Initial Unemployment Insurance Claims to advise when to apply more capital, when to pull back and when to raise more cash than usual and move to the downside for trading. Years ago I developed the chart you see below as a market timing system guideline.

Weekly Numbers Above 350,000 and Climbing

I focus more on selling in the money covered calls and doing Spy Put Options aggressively. As the weekly claims rise and get closer to 400,000 I normally buy puts on stocks that based on chart patterns I believe are overvalued and will pull back if the market direction corrects. I tend to place fewer trades and begin to raise cash. Above 400,000 I raise a lot more cash.

Weekly Numbers Between 325,000 to 350,000

When the weekly numbers move below 350,000 but stay above 325,000, such as the period now, I focus on trading dips in stocks through selling puts usually naked, doing some put credit spreads and doing some covered calls. This is because in this range normally the market can still move higher but it is more difficult for it to be a straight line up. This means I can sell some covered calls when the market is pushing higher because the likelihood of it not pushing too high is greater. This will leave my covered calls normally out of the money and expired. I also pick up some stocks for short-trades often referred to as swing trades or even day trades although I do not do many day trades. This is a good place for put credit spreads as well since it offers more protection than selling puts naked. This is also not too bad an area for call credit spreads as stocks may have a more difficult time rising too quickly or high enough to place call credit spreads at risk. I tend though not to do a lot of call credit spreads. I prefer being on the Put Selling side.

Weekly Numbers Between 300,000 to 325,000

When the numbers fall below 325,000 stocks have a much easier time moving higher. This means being careful with covered calls unless I do not want to own the stock and would like to be exercised out. It also means being careful on call credit spreads which I do rarely as explained previously. I sell puts far more aggressively here and will definitely consider put credit spreads as well.

Weekly Numbers Below 300,000

Below 300,000 the market direction rarely corrects. This means I concentrate heavily on Put Selling, doing stock trades particularly using the Bollinger Bands Strategy Trade.

I do very few covered calls, although in my retirement account I do a lot of covered calls on stocks I want exercised. This is because in Canada investors are not allowed to sell puts, even cash secured puts, in our retirement or tax free accounts. Therefore I look to set up covered calls trades wherever practical to earn profits that can compare to Put Selling trades. This is not always as easy as it might appear. Put Selling is far superior to covered calls in my opinion. You can read this article to understand why.

At the level below 300,000 I increase the quantities of naked puts I sell and as the numbers fall to 250,000 or more I bring more cash into play. I do no call credit spreads but the number of naked puts is easily 4 or more times higher. When the Weekly Initial Unemployment Insurance Claims get to this level the economy is usually booming and stocks are doing well.

Market Timing System Summary

Economists now indicate that the economy has recovered all 8.7 million lost jobs from the latest recession. The past four months has seen job gains above 200,000 which has not been repeated since early 2000. The latest claims also show that people receiving benefits after an initial week of aid has dropped 54,000 to 2.56 million in the week ended June 7 which is the lowest level since October 2007. The number of people collecting unemployment benefits fell 1.9 percent last week continuing the declining trend.

All of this points to a stronger economy and better job prospects, but still, to get from 6.3 percent to 4.7 percent will take time and that means the Fed will more likely keep interest rates at historic lows for quite some time yet.

This week’s market timing system indicates to stay invested which is exactly what I am doing.

Market Timing System Internal Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Trades (Members)