Investors who follow my website know there are a multitude of market timing systems which investors have followed.

I prefer to keep watch on one of the better market timing systems I established which is based on the Weekly Initial Unemployment Insurance Claims. This article outlines how the Weekly Initial Unemployment Insurance Claims work as a market timing system. I have used this system for years and find it to be one of the more reliable systems.

June 25 2015 Outlook – Stay Invested

Despite Greece and despite the worry over rising interest rates, the Weekly Initial Unemployment Insurance Claims for the past week continues to advise that I should stay invested and basically ignore the noise and concentrate on quality companies and my strategies. This does not mean I shouldn’t be aware of the possibility of downside action especially if the Greek debt situation should end with no resolution which will cause a sell-off in equities. It does mean if there is a sell-off it will be a buying opportunity or certainly an opportunity for setting up additional trades.

The past week of Weekly Initial Unemployment Insurance Claims continues to point to a labor market that is facing few layoffs. The number came in at 271,000 and last week was increased by 1,000.

Looking at the chart below you can see that since the week ending Feb 28 the Weekly Initial Unemployment Insurance Claims have ALL been below 300,000.

Market Timing System Says Stay Invested

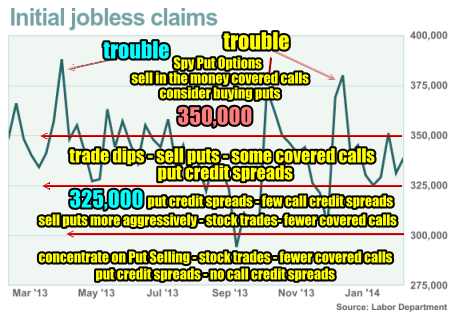

The system you see below is the market timing system I developed years ago based on the Weekly Initial Unemployment Insurance Claims. You can see in the chart below that the Weekly Initial Unemployment Insurance Claims are still placing my chart in the strongest bullish area.

Here are the guidelines again:

Weekly Numbers Above 350,000 and Climbing

I focus more on selling in the money covered calls and doing Spy Put Options aggressively. As the weekly claims rise and get closer to 400,000 I normally buy puts on stocks that based on chart patterns I believe are overvalued and will pull back if the market direction corrects. I tend to place fewer trades and begin to raise cash. Above 400,000 I raise a lot more cash.

Weekly Numbers Between 325,000 to 350,000

When the weekly numbers move below 350,000 but stay above 325,000, I focus on trading dips in stocks through selling puts usually naked, doing some credit put spreads and doing some covered calls. This is because in this range normally the market can still move higher but it is more difficult for it to be a straight line up. This means I can sell some covered calls when the market is pushing higher because the likelihood of it not pushing too high is greater. This will leave my covered calls normally out of the money and expired. I also pick up some stocks for short-trades often referred to as swing trades or even day trades. I don’t do either but instead rely on my Bollinger Bands strategy for timing entry and exit points. This is a good place for put credit spreads as well since it offers more protection than selling puts naked. This is also not too bad an area for credit call spreads as stocks may have a more difficult time rising too quickly or high enough to place credit call spreads at risk. I tend though not to do a lot of credit call spreads. I prefer being on the Put Selling side.

Weekly Numbers Between 300,000 to 325,000

When the numbers fall below 325,000 stocks have a much easier time moving higher. This means being careful with covered calls unless I do not care if the stock is exercised away. It also means being careful on credit call spreads and naked calls. I sell puts far more aggressively here and will definitely consider credit put spreads as well. Iron condors and often butterflies seem to perform well at this level.

Weekly Numbers Below 300,000

This is where the numbers are again this week. Below 300,000 the market direction rarely corrects severely lower. This means I concentrate heavily on Put Selling, doing stock trades particularly using the Bollinger Bands Strategy Trade.

I do limited covered calls unless I want to be exercised out. Buy-writes work very well here including my Super Charge Buy-Write Strategy. In general though at this level I prefer Put Selling which I consider superior to covered calls in my opinion. You can read this article to understand why.

At the level below 300,000 I increase the quantities of naked puts I sell and should the numbers fall to 250,000 or less I bring more cash into play. I do no credit call spreads but the number of naked puts is easily 4 or more times higher. When the Weekly Initial Unemployment Insurance Claims get to this level the economy is usually picking up the pace and stocks are doing well or certainly holding their own. I usually look for earnings to increase.

Large Cap Stocks

Remember that I trade primarily in large cap blue chip dividend paying stocks and my market timing system is based entirely on that and not on speculative stocks, junior or medium size companies who tend to surprise in any market.

This Year Could Be Different

This year however could be a bit different as much of the rise in the employment numbers can be attributed to a very accommodative Federal Reserve policy of zero interest rates. When rates rise, almost always there will be some give back on stock valuations. Therefore I am staying cautious with my trades this year and keeping more capital than usual out of the market. I am however continuing to build my portfolio and grow it. The USA Portfolio has now returned more than 20% for the year.

Market Timing System Internal Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Trades (Members)