Market timing indicators are flashing overbought, but no serious concerns about any major decline. Despite European concerns the bearishness in my market technicals show that any serious downtrend is well contained. All the market timing indicators are still unconcerned about the overbought condition and in general are advising that when this weakness in the stock markets is over stocks will be set to rally higher keeping the market direction in a bullish envelope. Basically the Bull Is Just Resting.

Market timing indicators from the rate of change through to the fast stochastic are showing that the market direction trend up remains intact and the market overall resilient. This means that once the overbought condition is worked out of the stock markets, they will move higher. Market direction trend remains up.

Market Timing / Market Direction Setting Up For The Next Rally

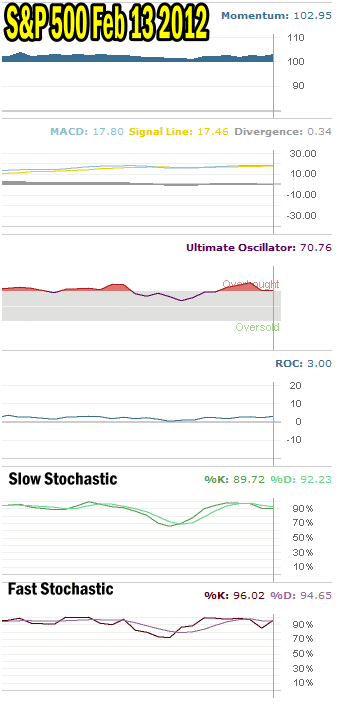

Below are my market timing indicators from Feb 13 2012.

Momentum, the first market timing indicator in the chart below, is showing resilience in the market with a reading of 102.95. Note how momentum has remained above 100.00 throughout the weakness. This is telling investors that this weakness is being bought by investors and a lot of it with fresh money which is why it remains above 100. If the rally was being bought but primarily with recycled money or money from trades that traders had already closed, momentum would be below 100.

The market timing indicator. MACD or Moving Average Convergence / Divergence is the key right now. At 0.34 it is just slightly lower than Friday but remains positive. MACD is telling investors that there is still strength in this market. Since mid December MACD has been positive but not overly bullish. The key is that it has refused to fall again indicating that fresh money continues to buy into stock market weakness which will push market direction higher soon.

The Ultimate Oscillator is now down to 70.76 and as always this prime market timing indicator is warning again. This time though the warning is that the market is strong, the rally intact and the overbought condition is being worked out by investors. Shortly the market will move higher, whether in a week or even by the end of February.

Rate of Change or ROC is higher than Friday again telling investors that the market direction remains intact and fresh money is entering the stock market.

The last two market timing indicators, slow and fast stochastic are each quite high although down from Friday. Nonetheless they too are telling investors that fresh money is coming into stocks proved by their high readings. Eventually when fresh money stops entering the market these indicators should fall lower.

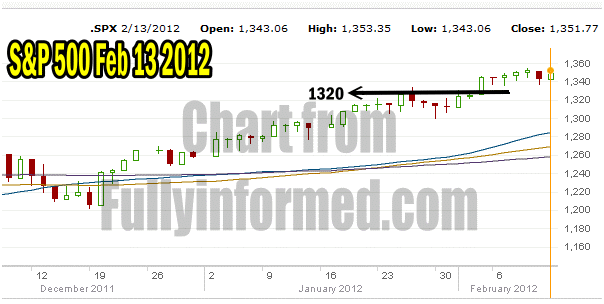

Market Timing / Market Direction S&P 500 Chart

Below is the S&P chart as of Feb 13 2012. The rally is only stalled here according to the market timing indicators and it will only be a few days or weeks for the market direction up to resume.

When To Worry About Market Direction

According to the chart above the only time to worry about this present rally is if the S&P 500 falls below 1320. At that stage investors should be very cautious. However for the market to fall back below 1320, there will have to be serious bad news. If Greece should not receive their bailout funds then that could tip the market back down.

That could then force some of the fresh money investors are putting into the stock market back out of the market which would break the 1320 level.

Right now the market timing indicators are unconcerned about the present stock market weakness and advising investors to not close their positions. This is a clear signal to me that the put selling I did recently on various large caps should trade profitably and it is safe to do even more put selling.

While nothing is perfect, the market timing indicators have continued to predict market direction accurately since the market turned back in late November. I will continue to listen to my market timing indicators as they tell me to sleep nights and remain unconcerned about the stalling of the market direction as the uptrend should resume shortly.