I was definitely wrong on my market direction call just two days ago on Sep 7 – Gotta Love This Volatility. While I did indicate that I think the S&P 500 will test 1000, it is just that I didn’t think it would happen overnight.

Greek Bonds are unbelievable. Two year terms are yielding over 61% and 1 year are over 90%. On June 2 2011 I wrote an article about the Greek Debt Crisis – Investors are Unprepared, in which I mentioned how my investor friends in Greece were holding no European stocks, no European debt of any kind and no Euros and basically were sitting in gold and in US dollars. They told me when the default comes, NOT IF, investors are unprepared for the coming calamity. It appears they are probably going to be right.

Obviously it is just a question of what will happen first. Will a major European Bank collapse or will it be sovereign debt default or could it be even worse – the actual collapse of the Euro itself? I am not a financial analyst aside from stocks. The rumor that the German Government is shoring up its banks to withstand a Greek sovereign default is also pushing fear into the market.

The DOW has had 19 triple digit moves in 19 of the last 24 sessions. This only happens in bear markets. It also could be getting ready for a lot worse. A Lehman type event that will no doubt crash markets.

Therefore I have to stay protected and this morning I bought SPY Puts which I will hold over the weekend.

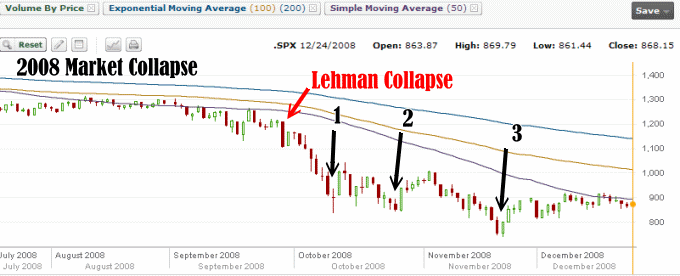

The below chart from 2008 definitely bears reviewing at this stage of the market. Following the Lehman Collapse in September 2008 the market made 3 lows before turning sideways. We all know that the market collapsed even lower in March 2009. However just like most bear markets, the market drop in September was followed by 3 market lows and then a sideways movement before the eventual panic. This is typical of most bear markets.

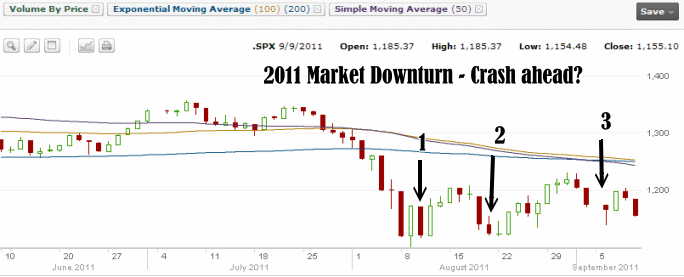

Here is the recent market downturn. Since July the market has made 3 downturns. Usually following such moves and with so many gap opens, it would seem that the market could be warning of a crash coming ahead.

I think the market is definitely going to hit the 1000 on the S&P. I am sure all the major European countries are preparing their banks to withstand the default of Greece and the aftermath. Just as when Lehman collapsed, the aftermath was ugly. I believe Greece will default and sooner rather than later.

This is why I have purchased so many spy puts today. This will also mean that I was too early on September 6 when I sold so many stock puts. At any rate I feel fully ready to withstand what may end up being a very ugly downturn for some time. Hopefully the quality of many of the stocks I am holding will make the ride lower not too unpleasant.

Market Direction calls are truly just guesses. No one can foresee what the future is in the market, either short term or mid term. Just this morning I read Bespoke’s call for the market to move higher which they announced before the market opened today. This is why I believe options are the best tool to have in my arsenal in order to protect as well as profit from the swings and volatility in the market.

In this high volatility my financial investment strategy of the cautious bull is working wonders. Stocks are risky assets and in the past few weeks, the market direction has reminded all investors of this fact.