Today’s Weekly Initial Unemployment Insurance Claims for the prior week (April 2) show that the unemployment picture remains on a very solid footing. For the 57th week in a row the numbers show claims are below 300,000. This is best stretch of employment since 1973 and the outlook remains strong for those seeking employment.

Jobless claims dropped by 9,000 to 267,000 for the week ended Apr 2. The Weekly Initial Unemployment Insurance Claims shows that businesses are continuing to hire while layoffs are at the lowest level since 1973. All figures continue to point to employers continuing to look for new hires.

Back To Interest Rate Worries

With fewer Americans filing for unemployment benefits, investors remain concerned that the Federal Reserve cannot maintain its dovish stance for the year and talk this morning is already back on whether interest rates will be raised as early as May or June. Prior to this Weekly Initial Unemployment Insurance Claims report, analysts doubted there would be a rate increase until December. That is once more off the table and bets are rising that June will see a second interest rate increase.

JP Morgan advised clients that the bond market will begin to reflect the likelihood of earlier than expected rate rise.

Market Timing System Says Stay Invested

Meanwhile with analysts split on the next quarterly earnings outlook, this latest Weekly Initial Unemployment Insurance Claims report as a market timing system advises investors to stay invested. That does not mean there cannot be weakness, dips or even a correction. What it does mean is that any correction will be recovered and the likelihood of a severe drop is limited in US equity markets.

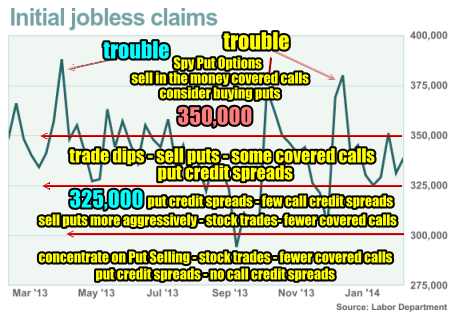

Market Timing System Chart

Here is what this market timing system indicates based on today’s Weekly Initial Unemployment Insurance Claims. With the initial jobless claims below 300,000 the concentration should be on selling put options, stock trades, fewer covered calls unless investors want to be exercised out of their stocks, credit put spreads and no call credit spreads.

Corrections and Bear Markets

As far as this market timing system is concerned, stocks have rarely entered protracted corrections greatly than 15% and no bear markets, in an environment where Weekly Initial Unemployment Insurance Claims are dropping below 300,000. With today’s numbers of 267,000 the chance of a bear market commencing is slim to nil based on this Market Timing System.

Market Timing System Summary

No Market Timing System is perfect and none have been built around zero interest rates. How accurate this market timing system can be in the present zero interest rate environment is difficult to determine. But for what it is worth, this market timing system is continuing to tell investors, be cautious but still trade for opportunities. For myself, I am sitting with about 35% cash but I am still trading in big cap stocks as opportunities appear.

Market Timing System Internal Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Trades (Members)

Market Timing System External Links

IWM ETF Russell 2000 Fund Info

Market Direction SPY ETF 500 Fund Info