There was an interesting debate today on market timing technicals on the options forum. I enjoyed the debate and realized a long time ago that investors would always be on one side of the fence or the other when it comes to market timing indicators. I like to set aside arguments and use every market timing tool available for my advantage. I believe that market timing technical indicators have a place in every investor’s trading arsenal. Those investors who have used technical tools for years understand that you have to put aside your own bias and put some faith into what the market timing indicators are telling you as an investor.

Market timing indicators can also assist in keeping emotion out of investing. During the market crash of 2008, my market timing indicators are what I relied heavily on to know when to sell out of the money naked calls and out of the money naked puts depending on market timing indicators that tried to predict market direction.

But market timing indicators are just one key aspect of investing. Two other components are having a plan and the importance of strategy. Both of these are as important to consistent profits as market timing indicators are for predicting market direction.

There are many different styles of investing. There are those who like to take more risk and there are those who like to minimize risk. I am on the side of the minimize risk.

Market Timing / Market Direction for Dec 7 2011

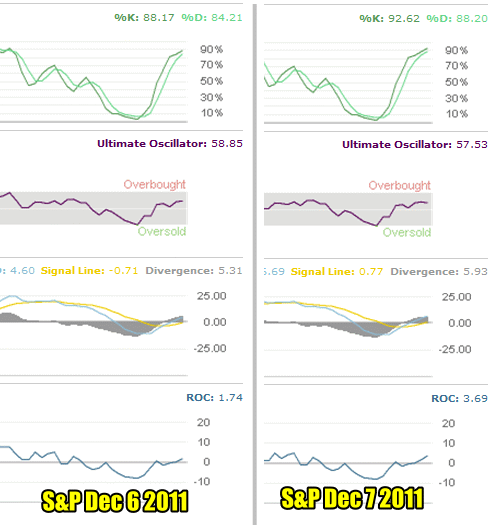

All my market timing indicators have continued to push into bullish territory but my favorite indicator has not. The ultimate oscillator has turned down. Only slightly, but it is a warning nonetheless that the market direction may stall out here for a day or two or could be unable to push higher through resistance. The ultimate oscillator is not warning of anything big happening, but certainly warning that sideways could be the new development. Select this market timing link to read more about the ultimate oscillator.

The past two days are below. You can see how the three market timing indicators are pointing market higher, while not the ultimate oscillator.

Market Timing / Market Direction Technical Indicators For Dec 7 2011

Market Timing / Market Direction Candlestick for Dec 7 2011

The candlestick for today (which I have not attached) shows a market that has reached indecision. The candlestick therefore confirms the ultimate oscillator for the short term trend as a chance we could move lower for a day or two.

Market Timing / Market Direction Summary for Dec 7 2011

The above indicators when combined are telling me that as an investor we could move back down for a day or two but the main direction still remains up. Once one or more of the above indicators comfirm the ultimate oscillator readings, then the market direction will change to down.

Market timing indicators also include stocks. Today MCD (McDonalds stock) and INTC (Intel stock) new 52 week highs. That is not the kind of action where I would be worried that a big sell off is in the works. Market timing indicators are right now saying that the market may experience a bit of weakness here, but the trend remains intact and stocks like MCD and INTC are confirming that market direction trend.