Market Timing indicators in my report for January 12 2012 showed that the market was pushing into overbought territory and the rate of change market timing indicator was flashing some caution signs. I indicated in that report that it was not the best time to consider put selling, but certainly covered calls could be sold.

After today’s close the market timing indicators are all warning that the market is starting to run out of steam and market direction is about to change. In my market timing / market direction article of January 11 2012 I indicated that January options expiration week normally starts strong and then weakness comes into the market.

My market timing indicators are all confirming this change in market direction trend from up to down. This could be a slight dip which would make for nice put selling opportunities going into February and March or the market direction could pull back a bit further than some analysts expect.

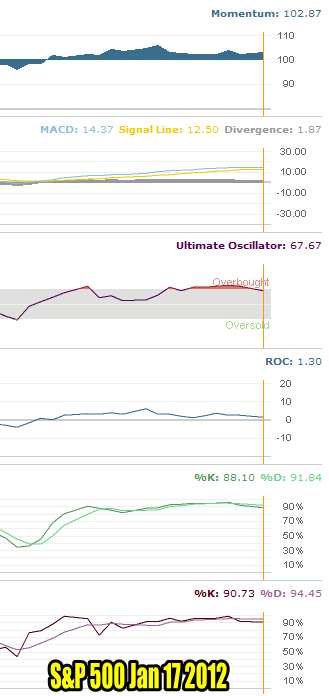

Market Timing / Market Direction Indicators for Jan 17 2012

My market timing indicators are all moving lower. Momentum is still fairly good at 102.87 , but MACD is turning lower, followed by the Ultimate Oscillator. The rate of change market timing indicator has failed to regain any traction and is continuing to move lower despite today’s move higher in the market.

Fast and Slow Stochastics are both turning down.

None of these market timing indicators are warning of anything major in the works. Just a dipping of the overall market.

Market Timing Indicators are ALL pointing lower

It has been a terrific rally from Nov 25 to today. The market has had a great move and I am expecting all my sold January puts to expire out of the money.

Market Timing Indicators How Low Could The Market Direction Go?

Looking at the S&P 500 chart below we can see that the S&P 500 has broken the October highs of 1292.66 made on Oct 27 2011, but there has been no real follow through. Today’s S&P closed at 1293.67 after being up as high as 1303.00.

Volume is declining on the S&P which would seem to indicate that many professional traders have sold and are back into cash waiting to see where the next market direction could take stocks.

I believe the first move lower could be around 1250 or about 3% to 3.5% lower. I would expect a bounce off 1250. If there is no bounce then 1240 holds the next level. After that there is support at 1210.

Market Timing / Market Direction Chart For Nov 2011 to jan 2012 shows very little follow through after breaking the Oct highs

Market Timing / Market Direction Summary for Jan 17 2012

I am expecting weakness as confirmed by my market timing indicators but unless something worst hits the market, such as Europe again, I am not expecting a decline of anything greater that 3.5%. I think today marked a good covered call selling opportunity. I am expecting some decent put selling opportunities this week and possibly into next.

While presently my market timing indicators are just warning that the rally has run out steam, they are not warning of any major in the way of market direction change lower. For this reason I have not yet bought SPY Puts. However if the market timing indicators show a stronger move lower coming I will put in place my spy put hedge and post it to my blog.