Market timing indicators yesterday warned that the present rally could be running out of steam. Today though the S&P 500 pushed up another 1%. Since the beginning of the year the stock markets have only had two down days. Since mid December my market timing indicators have primarily been supportive of the rally including as stock market direction pushed into overbought territory. Yesterday though they were all beginning to show signs that the market rally was slowing. Today the stock market again pushed back into overbought territory. With so many analysts now trumping how this stock market is going to reach into the April 2011 highs and probably break them, can they all be right? Is the bear in hibernation?

Market Timing / Market Direction No Real News

Or is it a matter of no real news to speak of? When Alcoa earnings came out the stock market stumbled a bit and then continued to rise. When news out of Europe about bond auctions and debt downgrades including France hit the stock markets, there was some selling, but again the market recovered.

These are all signs of a strong stock market, rising in the face of bad news. But really, how much bad news has there been? In fact there actually has not been a lot of news at all and it is working in favor of the stock markets.

I watched a very good panel this afternoon after the markets closed where 3 professional traders commented about how they had moved almost entirely into cash in the last few days. My market timing indicators also spotted this over the last couple of days. They explained that they are wondering if they are wrong. If they are, they will be moving back into the market shortly which could mean the stock markets could move higher before any meaningful correction.

As professional traders know, when the stock market recovers to old highs and tries to push through resistance, you sell and wait for a pullback. But does today’s action mean there will be no dip in the stock markets for a few more days? Let’s take a look.

Market Timing / Market Direction Indicators For Jan 18 2012

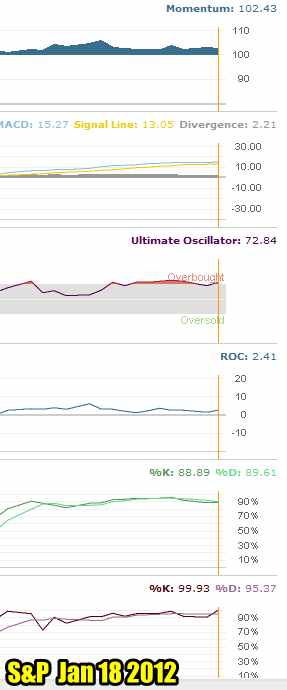

Momentum: This market timing indicator is not rising with the rally, but not falling either. It is down slightly from yesterday but it continues for the past three sessions to be non-supportive of the rally. Remember markets always outdo things both to the upside and the downside. Could this be one of those instances?

MACD: This market timing indicator is moving slightly higher today indicating that the market direction to the upside may have room to continue.

Ultimate Oscillator: My favorite market timing indicator shows that the market direction has pushed the market back into overbought territory.

Rate Of Change: This market timing indicator is a lot higher than yesterday which would indicate market direction is moving higher.

Slow Stochastic: This market timing indicator is lower today but just slightly.

Fast Stochastic: My last market timing indicator is higher today and moving back to the positive side.

- My market timing indicators for Jan 18 2012 are a mixed bag as it were.

Market Timing / Market Direction Indicators Are A Mixed Result

The market timing indicators are mixed but most are supporting a move higher. When indicators such as the past two sessions point down, many investors believe they should see an immediate sign to the downside. That is often not the case. The market timing indicators for the past two sessions were flashing warnings that the rally could be stalling out. Today it is a mixed result which continues to advises to be careful.

As I indicated yesterday, this climate is ideal for those who want to sell covered calls, but for selling puts, my last trade was last Friday on Coca Cola stock and I am watching my favorite stocks for put selling opportunities. Meanwhile though, with my market timing indicators half-heartedly supporting today’s move higher, it will be interesting to see if the market direction can continue to push higher.