Market timing technical tools since April 10 have not supported the idea that stocks can rally to new highs in the present environment. Instead market timing indicators have continued to show weakness in stocks and market direction lower. Today’s downturn in stocks continues to confirm my market timing technical indicators that reflect weakness in the stock markets. However leaving the market timing indicators aside, it is surprising how many large cap stocks that I follow, continue to trade in very tight ranges. This shows that there remains a large number of investors who feel that the market will get through this phase and move higher. Indeed many factors within the stock market itself point more to a consolidation among stocks as the market continues to look for support. Even today the market pushed lower and then tried to close near the highs for the day. There remains among traders, enough interest in stocks to continue to have them churn away at this level.

Market Timing Indicators Signal Warnings

As explained in a number of articles, I use market timing technical tools to tell me when I should be cautious with selling too many puts. I will always have some sold puts no matter what the market, but at specific times it is best to remain cautious. This brings to mind my cautious bull strategy which I used in 2010 and 2011 with such great success.

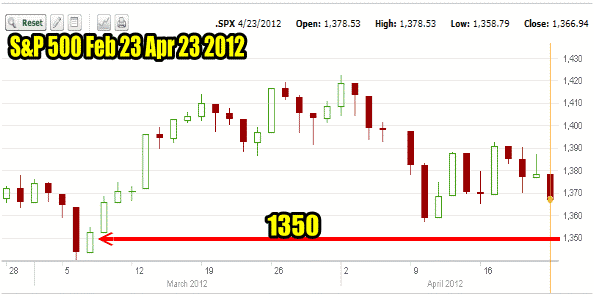

The key to put selling is to realize that there is always another day. When I sell puts I realize that there will be opportunities and other days when it is best to wait. Looking at the S&P 500 chart, you can see that today’s low was almost as low as April 10. However it remains for the market to fall even as low as 1350 yet. So despite all the doom and gloom by the perma-bears, the S&P has not even managed to fall to 1350.

Market Timing Chart For S&P 500 Show Market Direction Remains Down

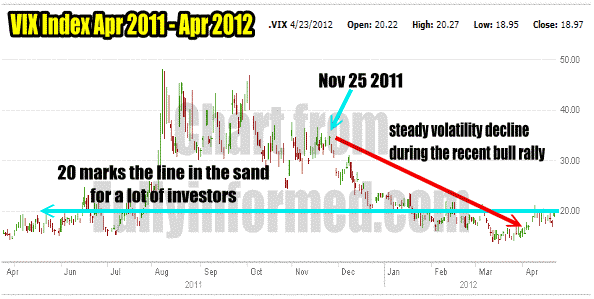

The VIX As A Market Timing Indicator

Another important market timing indicator is the VIX. The volatility index for the S&P today broke above 20 for a short time and closed at 18.97. For many investors anywhere BELOW 20 confirms that the bull market remains intact. Since November 25 when the VIX was above 34, it has fallen and only just recently begin to climb back toward 20. Many investors though remain convinced that unless the VIX breaks above 20, then this is just a consolidation period.

VIX Index Is Considered A Good Market Timing Indicator

Historically there is a lot of truth to the consolidation theory. Every bull market rally always pushes too far. There is then a correction of anywhere from 5 to 15 percent before the market direction continues higher. This recent period of weakness has not come close to those types of corrections. A correction of over 10 percent will get investors worried and many will begin to liquidate positions, worried that a 10 percent correction will become a 20 percent one. This is what many traders and investors wait for.

So at this phase of the stock market weakness, the consolidation theory must be considered as a possibility.

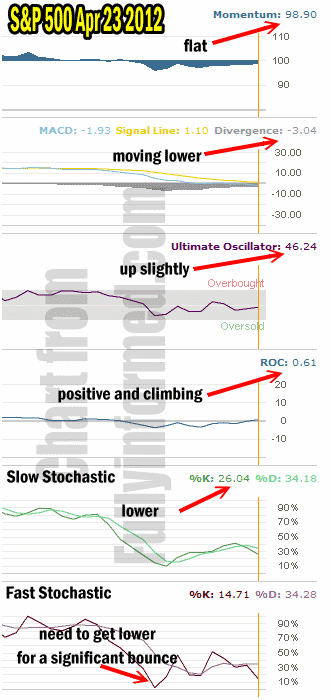

Market Timing / Market Direction Technical Indicators For Apr 23 2012

There are some interesting developments today. Momentum remains flat which with the selling today you might expect it to be solidly negative.

The MACD Histogram is continuing to erode but it is interesting to note that on April 10 the reading was negative 5.65 and continued to slowly climb from there. On Friday the reading was negative 2.72 so today’s reading which is lower, could signal that the market is going to slide further.

The Ultimate Oscillator is up from Friday despite today’s selling and Rate Of Change has moved from a negative 0.27 to today’s positive 0.61. The last two indicators, Slow Stochastic is lower than Friday’s reading as is the Fast Stochastic but they do not indicate any kind of bounce in the works.

The Fast Stochastic was much lower of April 10 which I have marked with an arrow. For a strong rally to commence the stock market needs a lower fast stochastic reading. The market could climb higher but without a lower fast stochastic reading I would not expect a strong bounce up, but instead a wandering movement higher.

Market Timing Technical Indicators Continue To Show Market Direction Is Sliding

Market Timing Technicals Indicate The Market Direction Is Sliding Lower

Despite the past few rally attempts, my market timing technical indicators continue to show that the market direction is lower. My market timing columns for several trading sessions has continued this signal. Overall I have seen this type of signal many times before. What the timing indicators are showing is that stocks remain weak and there is no conviction among investors to buy stocks at this level. The market timing indicators are not saying that the market is going to pull back severely at this stage. They do not however show that market direction will change strongly back up. So as in past market timing columns, the signals are still the same. They are telling me to be careful when selling puts and not sell too many put contracts because the market could slide lower from here which would make for better put selling opportunities should that happen.