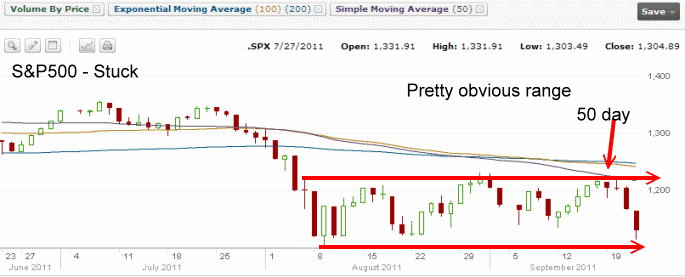

It might seem surprising to investors after watching a 500 plus point down day on the DOW, but the overall market direction trend is still range-bound, albiet at the low end of the range. Select this market direction link to view a 3 month chart on the S&P which clearly shows the amrket stuck in this range.

The markets have been range bound since August 1 and today’s action coupled with yesterday simply pushed the markets back to the low end of the trading range we have been in.

So while there was lots of selling today and I am sure lots of margin calls, the market remains trapped in this range. It will have to eventually break one way or the other. Personally I this the market direction will be lower and now that we have re-tested the August lows, we could be due for a small bounce, but then I think lower will still be the end result.

Market Direction – Range Bound

Look at the S&P 500 chart below. Since the market drop in early August, the S&P 500 market direction has been stuck in a range. Today the market pulled right back and retested that low. The 50 day moving average was literally bounced right off of, just 3 trading sessions earlier. The market direction seems range bound for certain.

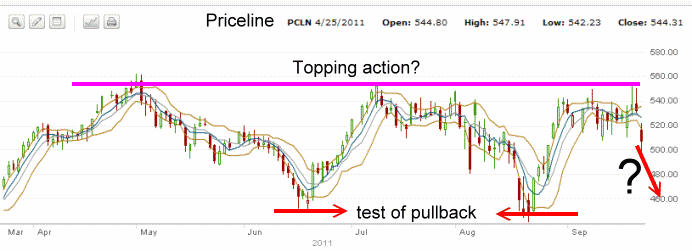

Another interesting chart has to be Priceline stock, (PCLN). If you recall from my previous post about Priceline Stock from August 11 2011, Priceline stock has lead the market direction since March 2009. Since May of this year, Priceline stock has been stuck just as the market direction has been stuck. Now forming three tops and two bottoms, the question is if Priceline stock is telling investors that the market direction is definitely changing.

At this stage you know what my opinion is – bear market. But until stocks like Priceline break their recent lows, the market direction may remain range bound. Once the leaders of the rally, stocks like Apple, Priceline, McDonalds, break and start to seriously fall, then everyone should be aware that the long term market direction trend is down.

Once this occurs, it may be time to watch closely any sold puts and close those with profits and which you do not want to be assigned against. For myself I will be selling naked calls when I see Priceline Stock break its recent lows. That tell’s me that the S&P500 will definitely fall below 1000 on the S&P.

Market Direction – Summary for Sep 22 2011 – Range Bound

Until then though, the market direction could remain range bound. The past two trading sessions has seen significant damage to the market but not the range. However eventually the range will break and I would bet on the downside. The issues facing this market are immense. Everything from continuing high unemployment, housing decline and European debt and banks to the inability of governments to think outside the box and tackle head on the actual issues at hand. At least in the United States they have been attempting all kinds of strategies. European politicians seems totally lost and unable to come up with clear strategies to address their problems.

Against this backdrop the chance of the market climbing higher I believe is nil. Market Direction long term I still think is lower. As such I am continuing to sell far out of the money puts, using my spy put hedge and once the market direction breaks lower, I will turn to selling out of the money naked calls.