Investors who follow my website know there are a multitude of market timing systems which investors have followed.

I prefer to keep watch on one of the better market timing systems I established which is based on the Weekly Initial Unemployment Insurance Claims. This article outlines how the Weekly Initial Unemployment Insurance Claims work as a market timing system. I have used this system for years and find it to be one of the more reliable systems.

Zero Interest Rate Effect

The only difference this time around is the zero interest rate effect from the Federal Reserve. Under Chair Ben Bernanke and now Chair Janet Yellen, the Fed has pursued a policy of zero interest rates which was established in the credit crisis of 2008. Since the instituting of this zero rate policy, the Weekly Initial Unemployment Insurance Claims have shown improvement year after year. There is no doubt that the zero interest rate policy has spurred growth in the economy. The biggest winners are found in housing and automobiles as well as to a lesser extent big-ticket items such as large appliances and home furnishings. These sectors of the market place responded to well to the zero interest rate environment and were among the first areas to improve following the 2008 credit crisis.

Unemployment since 2008 has also shown a recovery which in the past two years has reached some remarkable levels. While critics of the zero interest rate policy point to annual GDP numbers and the large number of food stamp recipients as just two examples of how the zero interest rate policy has failed, even in those areas the numbers show improvement. The number of families on food stamps has decreased as unemployment has dropped and while GDP numbers may not be as robust as critics are seeking, the growth rate in the United States is still high among industrial nations and considering the size and diversity of the United States, the GDP numbers are still positive and had been improved upon to some degree by this zero interest rate policy.

The Weeklies

The Weekly Initial Unemployment Insurance Claims again this week are pointing at numbers the US has not seen since the mid 1970’s. The numbers are continuing to indicate that very low levels of layoffs is occurring at the present time. That may change once the Fed raises rates. Even a quarter of a percent increase may not seem to impact the economy but the perception that rates are going to rise may impact employers who will reduce staff to “prepare” for higher rates. In economies perception is often as important as reality and decisions are often made based on a perceived prediction rather than what is actually happening in the economy.

Therefore this may affect my Market Timing System based on the Weekly Initial Unemployment Insurance Claims. It is worthwhile to be aware that this Market Timing System has never been used in an environment of zero interest rates. Any analysts who advises that an increase in interest rates by the Fed by a quarter of a point is “baked” into stock prices at present levels is wrong in my opinion. Stocks will react negatively to any increase in rates until there is ample evidence that the economy will remain largely unaffected by interest rates rising. Therefore, if the Fed does move ahead with an interest rate increase in December of even a quarter of a point, look for stocks to turn lower until such time as stats prove the economy can withstand interest rates being raised.

That said I do believe the chance that interest rates will return to “normal” levels is probably many years if not more than a decade away. Normal interest rate levels are not going to return until the economies of the world show far more strength than they are continuing to show now.

Oct 29 2015 Outlook – Stay Invested

Today’s Weekly Initial Unemployment Insurance Claims point to an economy humming along. While growth may not seem robust, it is definitely steady which may be all the Fed wants to try to start to raise interest rates. Seasonally adjusted initial claims was 260,000 for the past week which is an increase of only 1,000 from the prior week. These numbers are at levels not since 1973. These numbers also advise that I should stay invested and not worry about the daily gyrations of the market.

You can see in the chart below that the Weekly Initial Unemployment Insurance Claims have now fallen below 270,000 each week since the start of October. In the weeks leading up to Oct, the claims were always below 300,000. Only in July did claims reach 296,000 (week of July 4). But two weeks later on July 18 they were down to 255,000. These numbers point to staying invested per my Market Timing System.

Market Timing System Says Stay Invested

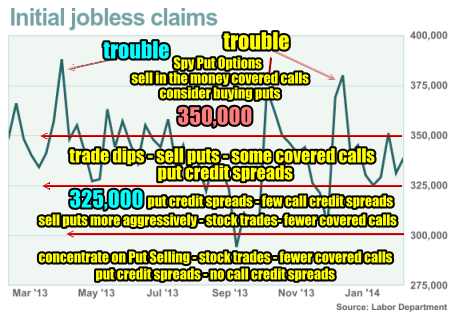

The system you see below is the market timing system I developed years ago based on the Weekly Initial Unemployment Insurance Claims. You can see in the chart below that the Weekly Initial Unemployment Insurance Claims are still placing my chart in the strongest bullish area.

Here are the guidelines again:

Weekly Numbers Investing Chart

The chart below is what I developed years ago to assist in timing when to start withdrawing capital and when to stay invested. With today’s numbers we are in the lower end of the scale which now advises to stay away from naked calls and credit call spreads and to concentrate on stock trades, Put Selling and to a lesser extent covered calls.I would be reluctant to place many covered calls on stocks I do not want exercised away such as long-term holdings in stocks like McDonald’s, Coca Cola, PepsiCo, Johnson and Johnson as these stocks could continue to rise in the present environment according to my Market Timing System chart below.

Corrections and Bear Markets

Historically stocks have rarely entered protracted corrections greatly than 15% and no bear markets in an environment where unemployment is dropping below 300,000 Weekly Initial Unemployment Insurance Claims. With today’s numbers of 260,000 the chance of a bear market commencing is slim to nil based on this Market Timing System.

Large Cap Stocks

Remember that I trade primarily in large cap blue chip dividend paying stocks and my market timing system is based entirely on that and not on speculative stocks, junior or medium size companies who tend to surprise in any market.

Remember 2015 and 2016 Could Be Different

No Market Timing System is perfect and none have been built around zero interest rates. Remember then when interest rates do rise, we could see the Market Timing System fail as it is based on a normal interest rate environment in which it was created and tested. That said, to date it has been correct since 2007 when the credit crisis actually got started. 2016 should be an interesting year for my market timing system based on the Weekly Initial Unemployment Insurance Claims.

Market Timing System Internal Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Trades (Members)

Market Timing System External Links

IWM ETF Russell 2000 Fund Info

Market Direction SPY ETF 500 Fund Info