Market Timing indicators today actually are not bad. The day started off poorly. Once again it was Europe. However what a lot of investors did not seem to understand is that by the ECB granting out 3 year loans at 1%, they are basically becoming a lender of last resort. In other words they are following the same steps that Japan did 20 years ago and which the United States did in 2008.

This means that the European Crisis will still be around, but it should not be to the extent we have seen. The move by the ECB not only buys time for European Banks and countries but gives the European Governments enough time to try to rein in their debt. This means lower volatility in the markets and the VIX definitely agreed as today it closed at 21.43. Remember my article about the VIX and how above 20 tells us that there are problems developing and below 20 means clear sailing ahead in the markets.

So this morning the markets didn’t like the news from the ECB and the European Banks borrowing so much capital. But think about borrowing for 1% and investing it in Spanish bonds or Italian bonds or even German Bonds. So while it may not be for us to decide whether it is a good thing, all we as investors can do is sit back analyze and make our trades based on what we see. We cannot make the policy decisions that governments will carry out. While I certainly wouldn’t buy Spanish, Italian or Portuguese Bonds that doesn’t mean it won’t work out for those who do. It just means I like to sleep nights.

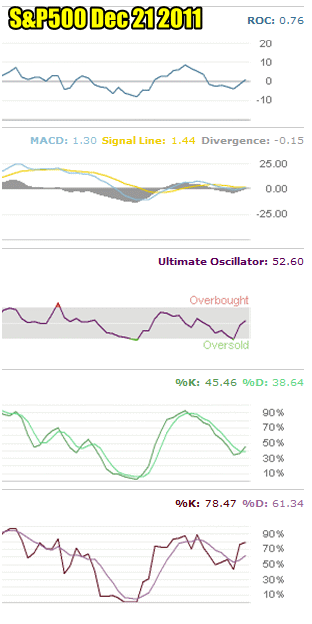

Market Timing / Market Direction Indicators for Dec 21 2011

Despite the lacklustre day, the Rate Of Change market timing indicator has turned positive advising that the market direction is changing. This is an excellent sign.

MACD (Moving Average Convergence / Divergence) is still negative but it has had a great move from yesterday’s reading and at -0.15 I am confident tomorrow will see a higher reading into positive territory.

The Ultimate Oscillator market timing tool is telling everyone that the market direction has changed to up. With its reading of 52.60, it is the best reading since Dec 9.

The Slow Stochastic is just slightly lower than yesterday’s reading but the fast stochastic is telling me that the market direction is definitely changing back to up.

Market Timing indicators for Dec 21 2011 show the majority are pointing to the market moving higher.

We needed follow through after yesterday’s big move higher and while it may not seem like there was much follow through, 3 of the market timing indicators are pointing to a higher market. My favorite market timing indicator, the ultimate oscillator is definitely pointing to a move back up and the rate of change and fast stochastic are in agreement. Select this market timing indicator to learn more about the VIX INDEX.

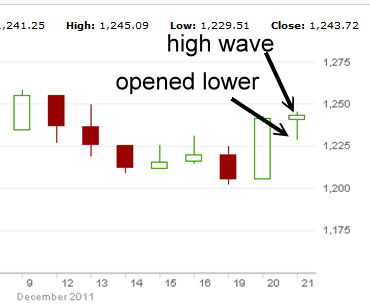

Market Timing Candlestick

While I am not a big believer in candlestick market timing I have included it for readers to enjoy and compare results. Today’s candlestick which I have shown below is known as a high wave. The problem with today’s candlestick is yesterday’s candlestick needed the market to open higher than yesterday’s close.

Instead the market opened lower than yesterday’s close and moved higher during the day. Again though the market did not close at the high showing there is still a lot of indecision in the market.

Today’s candlestick then is warning that the market could move sideways, lower or higher tomorrow as indecision rests in the market place.

Today's market timing candlestick is a high wave.

Market Timing / Market Direction Summary For Dec 21 2011

The candlestick for today actually confirms what my market timing indicators are showing. There is a lot of indecision in the S&P500. Despite the market timing candlesticks, my favorite market timing indicators tell me we are moving back up. 1200 was never breached despite my personal belief earlier last week that we could see the market fall beneath it.

Perhaps one of the more powerful market timing indicators is the VIX index. If you recall from my earlier article about the VIX index, many investors feel that anywhere above 20 is warning that the market is becoming unstable and due to correct. Below 20 is smooth sailing ahead. Today the VIX index closed at 21.43 down from above 40 back in October.

The VIX is a powerful market timing indicator. Right now it shows that fear is leaving the S&P500.

For myself I have most of my puts sold for January and I am holding off on any covered call positions to see if stocks can move higher before selling covered calls. Stocks like MCD, KO, V, PEP, YUM and many others are pushing back up.

All my market timing indicators point to the market direction changing back to up and are confirming that the much-anticipated Santa Claus rally is probably already underway.