Market Timing indicators for the past week have improved daily. While it may not seem like it after the big rally and now back to sideways, but market direction is still up. Throughout the rest of this week the three main market indicators that I have used for years are all improving. Even with today’s movement, which might seem bearish, the market timing technicals have improved. They are pointing to a market direction continuing up.

After such an enormous rally as we saw on Wednesday it is often quite normal for the market to drift sideways for a few days. While I would have preferred some further follow through, a rise of almost 500 points is bound to cause some consolidation. As well investors are trying to determine if the rally was just a technical bounce. Investors have been burned a lot since August and the constant up and down in the market is leaving a lot of smart money managers with large losses.

To better understand how bad things are in Europe Banks select this market timing link to read this article.

The important thing to remember at this stage is that the market did not sell back off. Market direction is always a tricky thing even with market timing technical indicators pointing this way or that. However right now the market timing indicators are improving and that should result in the market direction remaining up for a few sessions or longer. Who know’s perhaps this is the beginning of a rally that could take the markets higher into January.

Market Timing / Market Direction Indicators Improving

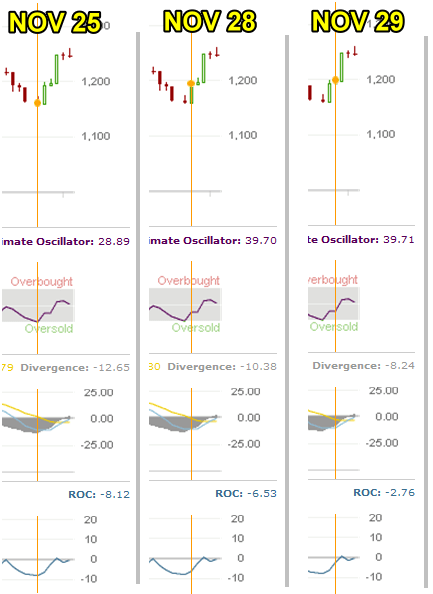

Throughout this week Market Timing indicators improved. Let’s look at the various charts below. The first chart starts last Friday Nov 25 2011. If you recallI indicated on the weekend in my article How Big A Bounce that the market was ready for a large bounce purely for technical reasons.

If you look at the three market timing indicators below, you can see how they improved throughout Nov 25 to Nov 29. The first in the chart is the S&P. Next is the ultimate oscillator market timing tool. Third is MACD and the last is market timing indicator Rate Of Change.

When joined, look at the story they are telling.

Market Timing / Market Direction indicators for Nov 25 to Nov 28 2011

It’s Important To Combine Market Timing Indicators To Get An Overall Picture

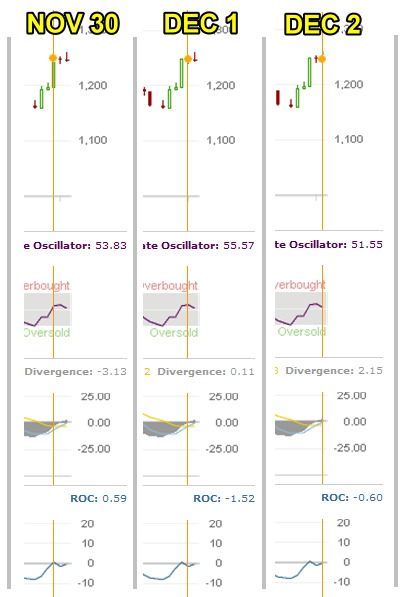

Below are the next three days, Nov 30 to Dec 2. If an investor used just one of these market timing indicators, it would be difficult to get a clear market direction picture. For example the Rate Of Change improved from Nov 25 to Nov 30 then it went negative again. However today while still negative it has improved confirming market direction still up.

The Ultimate Oscillator is a favorite market timing tool and it improved up until Dec 1, but today, Dec 2 it has pulled back. However it is still above 50.00 which is also indicating that market direction is up.

The last market timing indicator is MACD and it improved all week-long. Today it jumped to a bullish 2.15 indicating market direction is back up.

Market Timing / Market Direction for Nov 30 to Dec 2 2011

By combining all 3 of these market timing indicators an investor gets a clearer picture. Today’s rate of change at -0.60 is up from yesterday which shows the market direction is continuing up. If it was to be turning back down the rate of change should be lower today than yesterday.

The fundamentals of the market are improving and the market timing indicators are reflecting this.

Market Timing Candlestick Is Bearish

As a warning though, the only real negative to the market, technically, is today’s candlestick was bearish at the close. This could just be indicating market weakness for a few sessions next week, but if no terrible news arrives from Europe over the weekend and into next week, the market direction should continue up based on these market timing indicators.

Market Timing Isn’t Perfect on Market Direction Calls

Nothing is perfect when it comes to risky assets. There are so many influences and factors that manipulate risky assets. Meanwhile market timing technicals can only tell us what is happening at the moment. From there, investors must make their own decision about short-term market direction but for my portfolio I believe nothing is better than combining market timing indicators to aid in protecting my positions in such a volatile market.