The Weekly Initial Unemployment Insurance Claims for the week ended Feb 6 show that the number of people filing for unemployment benefits fell back to a seasonally adjusted 269,000. This is below average estimates that ranged from 280,000 to 285,000. It continues to show that the economy remains on fairly solid footings with claims showing that layoff levels are very low despite what the global economy and stocks are suggesting.

Today’s numbers had no impact on stock direction today as the selling was steady and intensive. However the Weekly Initial Unemployment Insurance Claims numbers are in contrast to what investors are currently believing. At the rate the Weekly Initial Unemployment Insurance Claims are continuing to be reported, the unemployment level next month could drop to 4.8%.

The US Labor Department advised there were no “special circumstances” and no estimates by any states.

These numbers continue to be in stark contrast to what investors are hearing about the global economic situation which at times almost seems dire. According to many media outlets and newsrooms, the world’s economies are “collapsing” but at home the economy is doing well. Can this last?

With shale producers going out of business in record numbers, the number of unemployed should be rising as every job in the shale oil industry is connected to 3 and 4 tertiary jobs.

These Weekly Initial Unemployment Insurance Claims numbers are studied by the Federal Reserve every week for clues as to where the employment is coming from, developing trends and the outlook for unemployment. Based on the Weekly Initial Unemployment Insurance Claims numbers today, the economy is healthy and continuing to expand at a record clip. This definitely is in direct contract with what investors hear and discuss.

Fed Chair Janet Yellen

In her testimony this week Fed Chair Yellen discussed the labor market strength at home but also indicated that the global market conditions and uncertainty over China’s economic growth were also factors the Federal Reserve takes into account when making interest rate decisions.

Weekly Initial Unemployment Insurance Claims Says Stay Invested

The strange thing is, the Weekly Initial Unemployment Insurance Claims as a market timing system has been quite accurate until this latest downturn. The numbers we are seeing in the Weekly Initial Unemployment Insurance Claims report continues to advise that staying invested in stocks is recommended based on the Weekly Initial Unemployment Insurance Claims market timing system. Yet stocks are down over 10%.

Disconnect

There definitely seems to be a disconnect between what the market timing system is advising and what the markets are doing.

Presently then we could say that the likelihood that this downturn in the market is a correction in an ongoing bull market is high. This outlook is based on the market timing system itself.

My personal opinion is more that the use of the Weekly Initial Unemployment Insurance Claims as a market timing system may be “skewed” due to the zero interest rate policy. If that turns out to be true then the case for the market entering a bear market could still be made.

Last week nonfarm payrolls increased 151,000 in January, and the unemployment rate fell below 5 per cent for the first time in eight years.

Another report on Tuesday showed the highest number of individuals voluntarily quitting their jobs to move to a new job was the highest in 9 years. This is considered a high level of confidence in the job market among the employed. As well the report went on to show that the number of people still receiving benefits after an initial week of aid fell 21,000 to 2.24 million in the week ended Jan. 30. A one week period is usually a sign of a strong labor force where jobs are not scarce.

Feb 11 2016 Outlook – Stay Invested? – Perhaps Not

So once again the Weekly Initial Unemployment Insurance Claims market timing system indicates that staying invested is a good choice but obviously that certainly does not seem to be what the market itself is showing. With the S&P today breaking to another new 52 week low, the market is showing more signs of becoming a bear market than staying bullish.

At this point in time it may be best to ignore the Weekly Initial Unemployment Insurance Claims as a market timing system and instead focus on protecting capital and take on only positions that are well protected. In general, moving into a cash position is certainly warranted in the present markets.

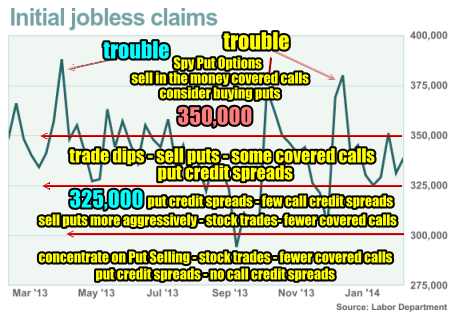

Market Timing System Chart

For what it is worth, here is what this market timing system indicates based on today’s Weekly Initial Unemployment Insurance Claims.

Corrections and Bear Markets

Historically stocks have rarely entered protracted corrections greatly than 15% and no bear markets, in an environment where unemployment is dropping below 300,000 Weekly Initial Unemployment Insurance Claims. With today’s numbers of 269,000 the chance of a bear market commencing is slim to nil based on this Market Timing System.

Large Cap Stocks

Remember that I trade primarily in large cap blue chip dividend paying stocks and my market timing system is based entirely on that and not on speculative stocks, junior or medium size companies who tend to surprise in any market.

Market Timing System Summary

No Market Timing System is perfect and none have been built around zero interest rates. In December, before the Fed raised rates I wrote that when interest rates do rise, we could see the Market Timing System fail as it is based on a normal interest rate environment in which it was created and tested. That said, since 2007 this Weekly Initial Unemployment Insurance Claims market timing system has been correct and during the 2011 market correction it continued to point to the market as being caught in a typical bull market correction. In the end it was right, but at present I am not as confident that the market timing system this time around, will be vindicated.

Market Timing System Internal Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Trades (Members)

Market Timing System External Links

IWM ETF Russell 2000 Fund Info

Market Direction SPY ETF 500 Fund Info