Visa stock has been a solid performer for me through the past three years. You can view the VISA Stock trades for 2009, 2010 and 2011. The great thing about selecting specific stocks and then studying them, is that as an investor I can begin to understand the trends in the stock both up and down. Because of this I can picks specific put strikes to sell puts against.

Many stocks I want to eventually own, in order to earn the dividend and sell covered calls against them.

Visa stock on the other hand is a stock that I want to sell options against, both puts and calls, but I have no interest in owning the shares for any period of time. You can read my article on my rules of how I sell puts against stocks for income and to avoid assignment. These rules pertain to stocks that I do not have any interest in owning shares in for lengthy periods of time. These rules encompass Visa Stock.

It therefore becomes necessary in trades in my Visa Stock to know when it is better to accept Assignment rather than buy back sold puts that have fallen in the money due to a stock pullback or in the most recent case a severe market downturn.

VISA STOCK – Picking Strikes To Accept Assignment

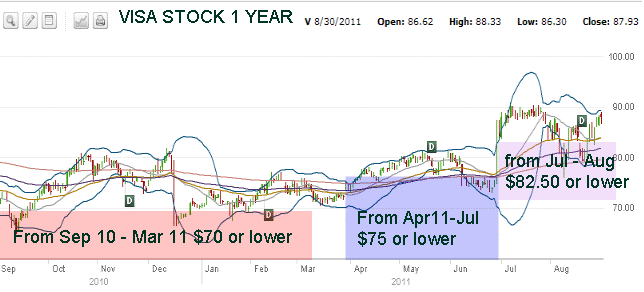

However the terrific thing about following specific stocks is not only beginning to understand the stock moves, but also knowing at what strike it is worthwhile to accept shares. For example, let’s look at this 1 year chart of VISA Stock. I have marked strike points where I would accept shares if I was assigned because, based on the chart, I should have the opportunity to sell those shares in Visa Stock for a profit. This is because based on the charts as below, I am accepting shares near the bottom of the trading ranges Visa stock is in.

From September 2010 to March 2011, the $70.00 put or lower would be excellent price points to accept shares. From April 2011 to Jul 2011 the $75.00 put or lower would be good and from July to the end of August, the $82.50 put strike or lower would be good areas to accept stock as well.

I make up charts like this one, for all my stocks. I use these charts to assist in selecting put strike points to sell. I also use them to know what strikes I believe would be advantageous to accept shares is assigned. This is because based on these chart I feel I have a very good chance to sell my shares in any rise in the stock, because the charts indicate that the stock should move higher at some point if I am assigned shares.

VISA STOCK ASSIGNED AUGUST 19 2011

A great example is my trade from July. On July 25 2011 I sold 10 naked puts for August $82.50 put strike. The stock was at $88.25 when I sold the $82.50 put. If you look at the chart above you can see that $82.50 is a strike that falls within my criteria.

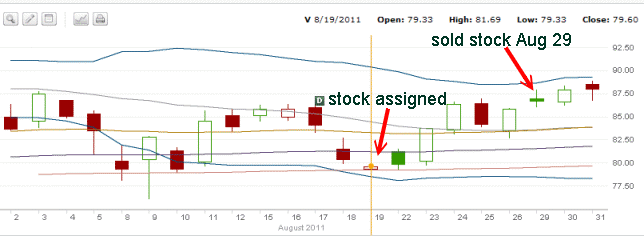

On August 19, with all the volatility and heavy selling, Visa stock fell to $79.60 and I was assigned 1000 shares of VISA at $82.50. The chart below shows the decline in VISA over the month of August. On August 29th the stock had recovered and I sold my shares.

The market could just as easily have sold even steeper following August 19th when I was assigned, but then, that’s the whole point of having charts, studying them, picking put strike points and selling them. I have to have confidence in my stocks and in my selection of puts to sell and when to sell, otherwise I cannot be consistent at earning profits as an investor. If Visa Stock had not recovered and I had ended up holding VISA Stock at $82.50, I have confidence from studying the charts that the stock will recover at some point and I will unload my shares. In the meantime I could sell covered calls to earn additional income while waiting for the stock to recover.

You can view the entire VISA Stock trade for 2011 here. Scroll to August 19 to view the assignment of the shares. In the end the return from selling the shares was 6%. Not bad for a few days of holding stock.

VISA Stock and AT&T Stock

My strategy of picking strike points I would accept stock at, if assigned shares, in the hopes of getting a bounce, is the same strategy I used today when the news about AT&T came out and the stock fell. I sold the Sept $27.00 AT&T Puts for .34 cents because the 1 year chart on AT&T indicates that I have a very good chance the stock will bounce higher than $27.00 if I am assigned shares in September.

Visa Stock – Simple Concept Has Created Large Profit Opportunities

My strategy which I applied to Visa Stock, while simplistic in its concept, has saved me many times from selling puts at too high a valuation.

As well, should I have stepped beyond my own rules and sold puts at too high a level, this simple concept of knowing what strikes to accept shares at, assists me in knowing when to buy back those puts I have sold that go in the money, rather than accept shares. There is no point in being assigned shares on stocks you would rather not own, if the valuations are too high and the chance of a bounce or a recovery in the stock is limited simply by the fact that the put strike points sold were too high in the first place.

It is this simple concept that has consistently assisted me in trades like my VISA Stock. The August options expiry was a good example of knowing that accepting shares of Visa Stock was a better strategy than buying back the in the money puts and rolling down.

View Visa Stock 2011 Trades

View Visa Stock 2010 Trades

View Visa Stock 2009 Trades