The Ultimate Oscillator is one of the prime technical timing tools I use every day on just about every trade. This morning (Mar 6 2012) I used it on my latest SPY PUT Hedge trade to take advantage of today’s decline.

The Ultimate Oscillator is one of the prime technical timing tools I use every day on just about every trade. This morning (Mar 6 2012) I used it on my latest SPY PUT Hedge trade to take advantage of today’s decline.

I am continually asked what settings I would recommend for using the ultimate oscillator for investing. It is important for investors to understand that there is no “holy grail” in investing. There is no “perfect” setting that will suddenly always work and make them rich overnight.

Investors need to understand that there is no short cut in investing. Homework is required and success comes from doing that homework and figuring out what works for their particular investing style and asset class they are investing in.

Investors need to experiment and try a variety of settings for most timing tools since investors follow a variety of different asset classes and industries. I have many articles about using the ultimate oscillator on my website. However I thought I would dedicate this post to the settings I use for the Ultimate Oscillator and explain how I approach investing through its use. In this way I can direct readers to this article which should assist in handling a lot of daily emails.

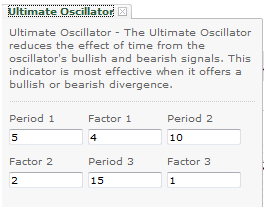

Ultimate Oscillator Settings

Like every timing tool there are different settings to consider. The Ultimate Oscillator has standard settings, which I do not use. My most often used settings are below.

These are the Ultimate Oscillator settings I use most often

Investors Need To Find Their Own Ultimate Oscillator Settings

It is important to understand that every investor needs to experiment with the settings against different time periods and even against different types of stocks and ETFs to find the settings that give the investor the most confidence of being accurate. It is this confidence that allows an investor to step in and make the trade without having to second guess whether the timing tool is accurate.

Once an investor has used a technical tool and studied it for several months or longer, they should be able to establish their own settings which meet their needs as an investor, trader, or options strategist.

No Second Guessing The Ultimate Oscillator Readings

If an investor is constantly second guessing their timing tool, then they need to spend more time adjusting settings until the readings give them the confidence that the readings are accurate in most cases.

No Timing Tool Is Perfect

No timing tool will be accurate all the time and that is not actually necessary. For investing to be successful investors need to have adjusted the timing tool’s settings to the point where it is accurate better than 70% of the time. At that point they need to add in their own judgement on the overall state of the asset they are following. As they use a timing tool such as the Ultimate Oscillator more and more, an investor will get better at reading it, analyzing the information it is presenting and taking advantage of the trends in the asset they are following.

Accuracy Takes Time To Reach

It took me several years of adjusting the Ultimate Oscillator to reach settings I was confident in. Not all technical timing tools are the same. The Ultimate Oscillator is unique in that the readings it gives for various time periods are the same. Many technical timing tools give different readings depending on whether they are being applied to weekly, monthly, or quarterly time frames. The Ultimate Oscillator does not, which makes it a valuable addition to my technical timing tools.

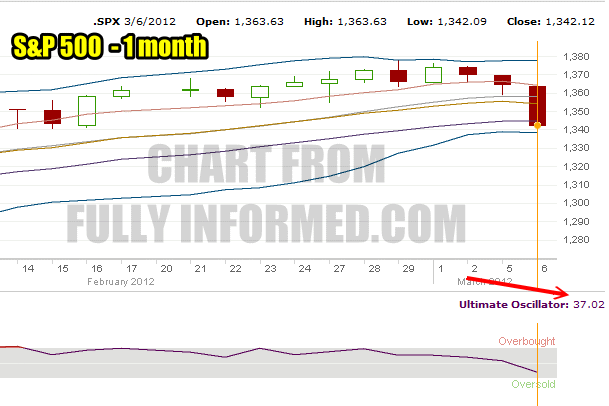

Ultimate Oscillator Readings March 6 2012

These readings of the S&P 500 were all taken on March 6 2012 during the morning. You can see how similar the Ultimate Oscillator readings are despite the time frame. If these were taken at the close of the day they would be identical. This is a 1 month reading for the Ultimate Oscillator. This was taken at 10:32 AM.

Ultimate Oscillator reading for 1 month on the S&P 500

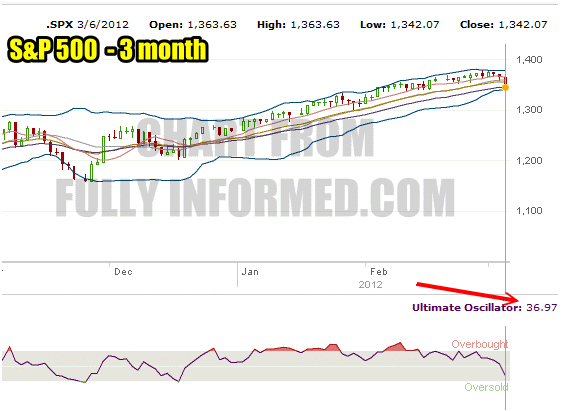

This is the Ultimate Oscillator reading for 3 months on the S&P 500 taken about a minute later. You can see that the reading is the same despite the time period selected.

Ultimate Oscillator Reading For 3 Months on the S&P 500

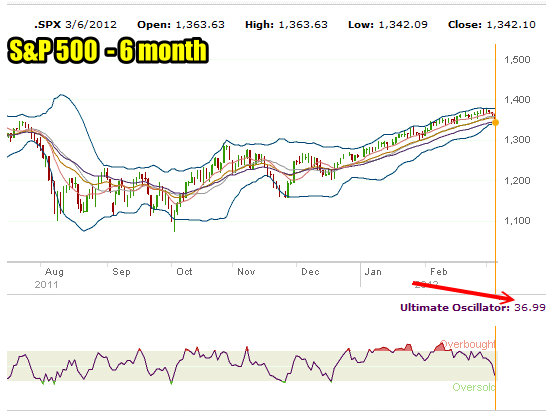

Ultimate Oscillator 6 month reading on S&P 500

DISTINCT ADVANTAGE

This is a distinct advantage for the investor. Many technical tools are complicated by the time frame being studied or the volatility in the underlying stock. This means constant adjusting to try to figure out what settings would give the most accurate readings for when to enter and exit a position.

The Ultimate Oscillator though keeps the same reading on the underlying asset whether it be a week or a year because it is not measuring yesterday or the day before but is a daily indicator which makes it excellent for reading at the end of every day. By taking readings at the same time every day an investor gets a better understanding of the direction the stock is heading.

The reading I am looking most for is an oversold and an overbought indication. Thanks to the way the Ultimate Oscillator works I can check the tool at the close every day against my favorite stocks. At a glance I can tell if I am getting closer to overbought or oversold. That is the signal I want.

Any investor can adjust the Ultimate Oscillator settings and then attach the chart of a stock against the Ultimate Oscillator and work to find that perfect setting which gives the most accurate oversold and overbought indications.

Ultimate Oscillator Settings Need Adjustment Depending On The Security

I have found that various stocks in different types of sectors need different ultimate oscillator settings. For example in Ultra ETF’s or commodity related stocks that have higher volatility, I often need faster settings to see through the volatility and still pinpoint the oversold and overbought indicators.

ULTIMATE OSCILLATOR OVERSOLD INDICATORS

When the Ultimate Oscillator flashes oversold I know it is time to watch the stock for any sign it could bottom. An oversold indication does not guarantee a bounce. It can sometimes mean that selling is so intense that the reading has become extreme but at the same time the selling could continue for a day or two still. However because my strategy is put selling I can prepare for what strikes I would be interested in and watch premiums I would prefer to aim for. I often will set up my put option contract prices and place some order in case the selling intensifies.

When selling rises I know that put premiums being offered will also rise and often I have a good chance that I will get a fill at an extremely high price for that day.

For those investors who sell covered calls, an oversold signal means it is time to watch the stock and possibly consider buying back the sold covered calls and locking in their profit.

For those investors who like to buy and sell stock an oversold ultimate oscillator reading is telling them that a bounce may be about to occur within the next day or two. Many stock traders will have their orders ready and some may commit a small amount of capital each day to pick up shares during the extreme selling that is underway during an oversold period.

ULTIMATE OSCILLATOR OVERBOUGHT INDICATORS

All the same rules apply to the extreme overbought signal. For investors looking to sell covered calls on a stock or ETF, an overbought signal tells them to prepare their covered call contracts and select a strike and a covered call premium they would be interested in. Over the next day or two the opportunity may arise to put those covered call contracts into play.

For stock traders an overbought indication is a clear signal to start unloading the stock they bought on the oversold indicator. The ultimate oscillator reading of overbought, is also telling stock traders that once they have unloaded their shares, they should wait for the next oversold signal before considering to purchase stock again.

For put sellers, the overbought indicator tells them to watch the stock for any sign of renewed weakness which would signal a move back lower in the stock. Put sellers should consider buying back their sold puts and lock in their profits. Then they should wait for the next ultimate oscillator oversold signal and sell puts again to repeat the cycle.

Ultimate Oscillator Summary

Using the Ultimate Oscillator is straight forward. Overbought indicators tell investors that buying has reached an extreme level in the underlying asset. Depending on the type of investor, a decision should be made at this point. Put sellers would consider buying back sold puts. Covered Call investors should contemplate selling their covered calls. Stock traders should consider unloading shares.

Oversold indicators are exactly the opposite. Put sellers should consider selling puts. Covered Calls investors should think about buying back their calls and stock traders should contemplate buying stock for a bounce back higher.

Establishing the settings is the key element to having the ultimate oscillator perform well. Realizing that having different settings for different types of securities and NOT for different time period lengths (month, quarterly annually) is key to establishing accurate readings for oversold and overbought conditions.

It is important for the investor to test out different Ultimate Oscillator settings and then apply those to the security they are following. This requires back-testing and then a period of paper trading to establish accuracy levels in the ultimate oscillator settings.

For my trading style, I always keep my capital out of the market until I have tweaked the ultimate oscillator settings and reached a high degree of accuracy on calling entry and exit points (overbought, oversold). At that point I then have enough confidence in my ability with the Ultimate Oscillator to commit my capital.