Put selling has many different strategies that can be applied to different markets. Put selling works in bear markets, bull markets and neutral or sideways markets. The key to consistent and successful profit and income from put selling is knowing which put selling strategies to use to match the market environment. For example, presently stock markets are in a bull phase and therefore a number of put selling strategies can be used that work well in a bull market but not a bear market.

The put selling strategy of using Deep In The Money Puts is a highly profitable strategy to use in bull markets against rising stocks.

Surprisingly though, many investors stay away from put selling in a bull market as they hate the thought of selling a put for perhaps .50 cents to $1.00 only to watch the stock rise $2.00, $3.00. $4.00 or even more leaving them with a very small profit while the “big” profit escapes them. While put selling is indeed a strategy where small amounts of income are earned through selling put options, it doesn’t always have to be this way. Using the put selling strategy of deep in the money puts allows an investor to capture the rise in a stock while still offering some protection against losses and if applied with a protective put it can guarantee a profitable trade.

Put Selling With Deep In The Money Puts

Selling deep in the money puts is an exceptional strategy that pays enormous dividends and has distinct advantages over buying stock and waiting for it to rise. Put selling by using deep in the money puts is a strategy I enjoy using on large cap dividend paying stocks. While many investors are busy chasing the latest hot stock or a high flyer I prefer to stay with my large cap dividend stocks and while many investors may feel that stocks such as Johnson and Johnson Stock or Clorox Stock or PepsiCo Stock or dozens of others are boring, go nowhere stocks, I can attest through my trades that they can be highly profitable and less volatile if the right strategies are applied to them.

There are distinct advantages to put selling through deep in the money puts but before delving into some of the advantages let’s look at a typical trade such as the put selling trade I put in place on Feb 10 2012 on Coca Cola Stock (KO Stock). For interested investors select this put selling link to review Coca Cola Investor Relations information to learn more about this great company and its stock.

Coca Cola Stock (KO Stock) Deep In The Money Put Selling Trade

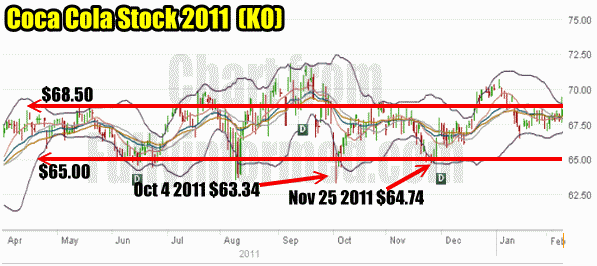

For most of last year Coca Cola Stock traded in a narrow range of between $68.50 and $65.00 making put selling very easy. In the fall of 2011 the stock held up very well in the face of the returned bear market and in Nov 2011 it fell to just below $65.00 before moving back to the $67.50 range.

Coca Cola Stock (KO Stock) For 2011 was very easy for put selling.

Put Selling Coca Cola Stock In January 2012

In January the range tightened considerably making put selling at $67.50 very easy. It was obvious that even the slightest weakness in Coca Cola Stock was being scooped up probably by fund managers and institutional investors. A tightening of the range with each pullback being quickly bought always tells me that the stock is going to be pushed higher.

Put Selling Coca Cola Stock in January 2012 was too easy. The tight range is a sign that Coca Cola Stock was being accumulated and would probably be pushed higher.

PepsiCo Stock And Deep In The Money Puts

Another good example of using the put selling strategy of deep in the money puts occurred this week when on March 23 I sold puts against PepsiCo Stock. As many readers know I have been in and out of PepsiCo Stock since January and in February analysts downgraded the stock which saw a sharp pullback.

However every pullback was snapped up quickly. It is obvious when a pullback commences and fails to drop but is instead bought in volume that money managers, fund managers or institutional investors, or probably all 3, are busy accumulating the stock.

Stock Manipulation Happens Every Day

It is important for investors to understand that stocks in all companies are at one time or another manipulated through buying and selling pressures. When a stock such as Coca Cola Stock presently or PepsiCo Stock or hundreds of others are determined as having potential to possible have surprise upside earnings or other such announcements, these large investors with millions of dollars turn to large cap stocks to accumulate them and then push them higher in valuation to eventually unload their shares. Stock manipulation happens every day and it is important to watch stock volumes to understand and profit from this accumulation.

To read more about my PepsiCo Stock trades select this PepsiCo Stock Articles Link which lists all articles dealing with PepsiCo Stock.

The Small Investor

While as a small investor I do not have the millions of dollars at my disposal to play in the “big boys” league, I can still benefit from their style of investing by selecting a handful of quality companies and follow their stock daily. Through this daily analysis which takes only a few minutes per stock, I can watch for support and resistance levels and learn the signs of stock accumulation knowing that eventually the “big boys” will push this stock higher.

This also means that through using put selling strategies like deep in the money puts, I can place a small amount of capital at risk and piggy-back their push of stock to benefit from the rise of the respective stock. This also means I no longer end up buying stock at the top of valuations but instead through watching accumulation patterns I can get in on the “ground floor” of when a stock is about to move.

If I am wrong and the stock is not pushed higher I have only risked a small amount of capital and can usually buy to close my deep in the money puts with a small net credit or net debit.

Basically I do not have the capital to manipulate a stock, where they do, but I can benefit from their capital by watching for the signs of stock accumulation and movement.

Feb 10 2012 Deep In The Money Put Selling Trade Commenced On Coca Cola Stock

On Feb 10 2012 Coca Cola Stock fell to $67.42 and then closed at $67.94 as once again the fund managers and institutional investors had snapped up shares on the day’s weakness. I knew that I could buy call options on Coca Cola Stock (KO Stock) which would need a smaller outlay than buying KO Stock, but I wanted a different strategy.

The reason I don’t normally buy call options is primarily because they are a wasting asset. I like owning a wasting asset that works in my favor as the options expiry period approaches. I have bought call and put options in the past for a variety of reasons and strategies but that is beyond the scope of this article.

In Part 2 of this article on Put Selling With Deep In The Money Puts I will look at the actual trade which was put in place AND the advantages and disadvantages of using deep in the money puts as a put selling strategy.