I received many questions the last few days regarding my recent Microsoft Stock articles. I thought it would be easier to answer these Microsoft Stock questions through a few articles rather than try to respond to everyone individually. First up is Microsoft Stock Covered Calls.

Microsoft Stock and Covered Calls

On March 23 I sold the May $33 strike for Microsoft Stock. I did this because the stock has had a spectacular run-up and while I do believe there is more upside left in Microsoft Stock I do not believe it will happen overnight. As explained in my article, the move up in Microsoft Stock has been rapid and steady. There has been hardly any “breathing room” in the rise. I do believe the stock needs a rest. Microsoft stock must fall back to test support before pushing higher. No stock can rise endlessly. It is always a series of patterns. The only concern in a pullback should be if the pullback becomes severe and breaks through previous support levels.

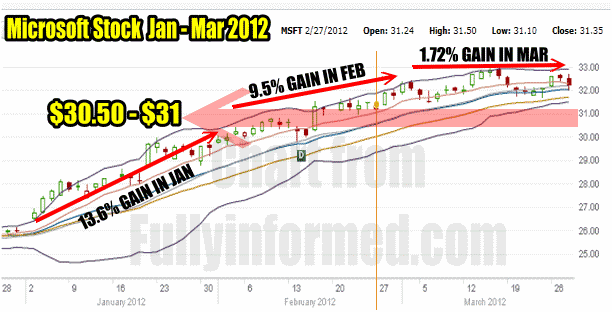

Looking at the chart below I would say based on the 3 month Microsoft Stock chart, the stock may fall back to $30.50 to $31.50 and test support at that valuation. The rise in the stock from $26.50 to $30.00 took place in the month of January. Since then the stock has trended higher but at a slower pace.

Microsoft Stock Showing The Rally Since January 2012

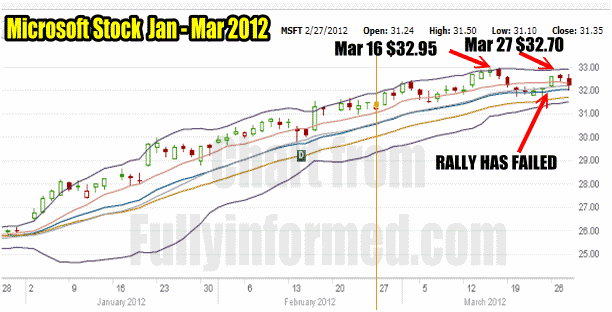

On March 16 Microsoft Stock hit an intra-day high of $32.95 and since then has fallen back, tried to rally and fallen again. This second rally is the signal that the stock needs a rest. The second rally was also when I sold my covered calls.

Microsoft Stock Chart Indicates The Failed March Rally To A New High. This stock needs a rest.

I Picked Microsoft May Covered Calls Because…

By selling the covered calls now into May, even if Microsoft Stock should push higher I do believe the chance of it falling back below $33.00 is greater than staying above $33 in May. I picked May $33 exactly for this reason.

I am NOT prepared to sell my Microsoft Stock at this stage. It is in my retirement portfolio and between the covered call income and dividend I am content to wait for the stock to continue the uptrend once it has tested support.

No Need To Hold Covered Calls Until Expiry

Remember too that I am just looking to earn a little bit more premium from the stock. There is no need to hold the covered calls until May options expiry. If the stock pulls back in April or early May and I have a decent profit in my covered calls I will close my covered calls early by buying them back. I consider 75 to 80 percent of the premium as decent. If Microsoft stock should rise higher I always have the option of buying back my covered calls and selling them further out or rolling up higher and out further in time.

One Last Word About The Microsoft Stock Retirement Portfolio Trade

Don’t forget that when covered calls are sold they can either be left to expire; they can end up with Microsoft Stock being exercised away; or I can buy back my covered calls and roll them; or I can buy back my covered calls, purchase additional shares in Microsoft Stock and sell more covered calls at a higher strike.

Buying additional shares in Microsoft Stock should it rise and stay above my covered call strike is always a possibility. It is a bit like averaging down on a stock only this time I am averaging higher. By purchasing additional shares and selling more covered calls it often will turn a net debit on a buy back of covered calls, into a net credit since I will be selling more covered calls than I am buying to close.

Considering Getting Out Of Microsoft Stock?

For those readers who wrote wondering about getting out of Microsoft Stock now, if you are undecided but somewhat concerned, you could sell an in the money covered call, perhaps at the $31.00 or even $30 strike. If the stock falls below $31.00 or $30.00 you will still have your Microsoft stock but will have benefited from the pullback more than my covered call trade at $33.00 will.

Microsoft Stock In The Money Covered Calls

Selling In The Money Covered Calls is always a strong contender. It is a conservative strategy that often performs well. If exercised out at $31 or $30, there will always be time to reconsider purchasing Microsoft Stock again and waiting for the next uptrend in the stock.

Remember though that if the pull-back is short and the uptrend continues it will be expensive to buy back in the money covered calls. Usually when investors sell in the money covered calls it is because they are concerned about a steep pullback or they want to sell their shares but would like a little more premium than where the stock is presently trading, but also want some protection in case the stock pulls back further than anticipated while they are waiting to be exercised from their shares.

Is This A Perfect Moment?

Indeed this could easily be a perfect moment to be selling an in the money covered call as the Microsoft Stock chart looks weak at this level. For myself I am not interested in an in the money covered call on my stock as I intend to hold it longer and I am seeking just a small premium while I wait for the weakness in Microsoft Stock to work itself out.