Microsoft Stock has been in my USA Portfolio for years. In January 2012 I started my retirement portfolio on fullyinformed.com and purchased 500 shares of Microsoft Stock. I have always enjoyed double-digit annual returns with Microsoft Stock and while many investors feel it is a go nowhere stock, I believe investors need to look at alternative option strategies to significantly juice their returns . While Microsoft Stock might be a boring go nowhere type stock, this is exactly the type of stock that works well with put selling and covered calls. The more Microsoft Stock goes nowhere, the less chance of assignment or exercise. As well, there is the less chance of the stock plummeting as it tends not to whipsaw much and volatility is low. I love a stock like Microsoft stock. Select this Microsoft Stock link to view Microsoft Corp Investor Relations for quarterly reports, outlooks and more.

By adding Microsoft Stock to my retirement portfolio I thought it would be interesting to see how it performs with only covered calls available, because in Canada (where I obviously live) we have strict Retirement Portfolio rules and are not allowed to engage in put selling or cash secured puts.

Microsoft Stock And Pondering Covered Calls

There are two trains of thoughts by most investors when it comes to covered calls. First and foremost is that covered calls limit the return an investor can make because once a covered call is sold if the stock moves past the covered call strike sold and continues to rise, the investor who sold the covered call has effectively limited himself to his return. Put simply, when a covered call is sold the investor has already agreed upon his price to sell and has been paid for that price through the covered call premium he accepted.

I Disagree

I cannot disagree more. There are dozens of strategies to recover a covered call trade that has found the investor suddenly holding a covered call that falls deep in the money as the stock roars past their covered call strike. Just because the stock rises beyond the call sold does not mean the trade is over. I will continue to add articles to my covered calls index discussing different alternative strategies to assist an investor in enjoying the benefit of the rising stock even though they have “agreed” to sell their stock at a lower price.

Total Return Investing

Second is the believe among investors that when you buy the stock you should immediately sell covered calls. Well yes and no on that one. It all depends on the strategy you are using. If you simply want to buy stock and sell covered calls to turn it into a single entity, then trade away. I was taught years ago that this is known as total return investing and it certainly can work. You invest your money in the stock, say at $58.00 and then sell the closest covered call strike available, say at $58.00 and pick up the premium on the call. That’s your return. If it works out you are making money. If it doesn’t work out you can write another call. When the trade works out you are exercised from your stock, have captured your return and then evaluate the stock and decide whether to start a second such trade.

Patience Sometimes Is The Best Choice

Many times selling covered calls immediately when you buy the stock is not really the best course, particularly if the stock looks like it will move higher and yu are hoping to earn a capital gain on the stock as well. Instead I like to look at the historic chart pattern and see what it is telling me. Is the stock preparing to climb? If it might be then I wait. Why sell covered calls today when a few days or weeks from now it may be worth a lot more as the stock rises.

You have to decide from the outset what type of trade you are putting in place. With my Microsoft Stock trade in my Retirement Portfolio I am planning on a long-term trade which could last months to a year or longer. Therefore when I bought the stock I felt it was somewhat undervalued and as such I did not want to sell the covered call immediately. I wanted to wait for a nice rise and then sell my covered call to cap off that rise.

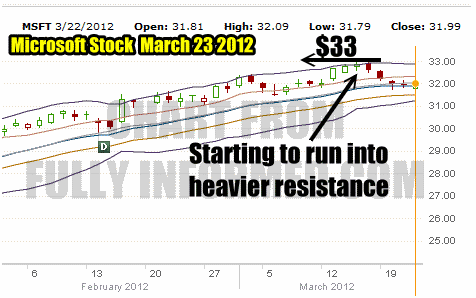

Microsoft Stock is heading into resistance

Microsoft Stock Is Up 20.7%

In my retirement portfolio I bought Microsoft Stock for $26.50 on Jan 3 2012. The stock is now hovering near $32.00 which is a gain of 20.7%. I could sell my stock and move on but I believe Microsoft Stock will move higher but perhaps not right away. After all a gain of 20.7% in less than 3 months is strong for Microsoft Stock. It should pause and try to catch its breath here.

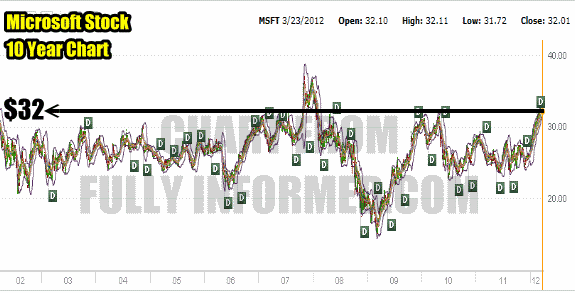

Microsoft Stock Is Deep Into Resistance

Below is the 10 year Microsoft Stock chart. How often has Microsoft been to $32.00 in the past? Not often. It is now deep into resistance. There will be lots of sellers going forward which is part of the reason I picked the $33 strike to sell the covered call at. I believe Microsoft stock will have trouble punching through for perhaps a month and that is all I need to capture most of the covered call premium.

The 10 Year Chart On Microsoft Stock Shows That It Is Now Facing Lots Of Sellers

Selling Microsoft Stock May $33 Covered Calls

I therefore sold the May $33 covered call for .47 cents. Remember “sell in May and go away?” Well according to the Trader’s Almanac that is not the case during election years in the US. Instead the weakness in the markets is in late March and into April and then the market begins to climb in May right through the summer. Microsoft stock could easily tread water here and then move higher.

I will be watching my Microsoft stock covered calls and waiting to buy them back if weakness appears and the premiums start to fall. That way if the Trader’s Almanac is correct and history repeats itself I might be able to buy these Microsoft Stock May $33 covered calls back for .10 cents and then wait for another move up to sell calls again.

Boosting the Microsoft Stock Dividend

All I am doing is boosting the dividend that is being paid to me by earning perhaps .30 cents or more every so many months. The dividend on the stock is .80 cents for the year. If I can earn .30 cents four times this year my earnings on Microsoft Stock will be $2.00 or $2.00 / $26.50 which equals 7.5% return plus whatever Microsoft stock is trading at when I sell it.

Microsoft Stock Covered Calls Trade Summary

Basically then I am hedging my bets that Microsoft stock will move higher but needs a rest. If I am right I should be able to earn some premium while waiting for the next leg higher. If I am wrong I can either sell my Microsoft stock for $33.47 (covered call price) or buy back the covered calls and wait to sell covered calls or Microsoft stock higher.

View Investment Portfolios Complete Index By Year

View 2012 US Stock Portfolio Index