Yesterday the market sold off, worried about the European debt situation. Today the market tried to recover the entire loss based on better consumer sentiment numbers and the belief that Europe is getting their act together and will solve their debt crisis. The debt crisis won’t be solved overnight and I am sure there will be added problems ahead for Europe. One day does not suddenly end the problem, despite investors wishful thinking.

But the talking TV analysts all pointed to today’s big up day as signs that the annual Santa Rally will finally get underway.

Earlier today I posted my market timing / market direction comment based on the noon market timing technicals. At that time I indicated that the 4 major market timing indicators that I use did not support the rally. Now at the close, have the market timing indicators changed or are they still unsure of the market direction.

Here is what my market timing indicators are telling me about today’s market rally.

Market Timing / Market Direction Technical Indicators for Dec 9 2011

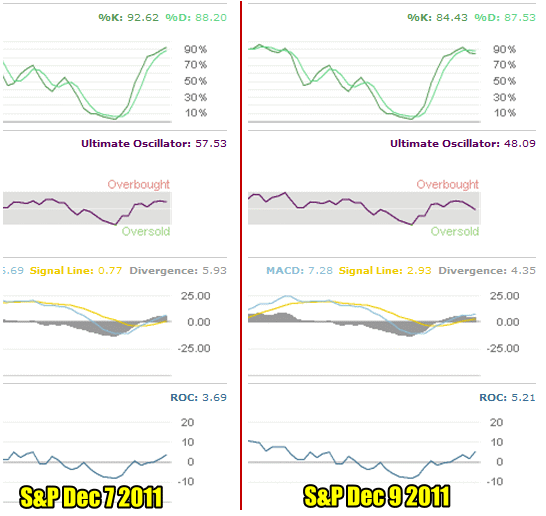

As today progressed, the market timing indicators did improve slightly over the readings done at noon. I have included below the readings from Wednesday of this week, the day before the crash and today at the close of trading.

In order for the rally to be confirmed as more than a one day rebound, it will have to break the readings from Wednesday. To the left are Wednesday’s readings. You can see that the market timing indicators are all lower except for Rate Of Change.

Rate of Change will be higher today than Wednesday as it is a momentum indicator and a rally such as today’s would post a high rate of change reading. The most important readings for my purposes are the market timing indicators from the Ultimate Oscillator and MACD. Both of these improved during the afternoon today but remain well below Wednesday’s reading. Select this market timing link to read further about the Rate Of Change momentum indicator.

The Ultimate Oscillator is still below 50.00 indicating that today’s rally was decent, but not strong enough to change the market direction trend from down to up but with a better reading at the close than at noon, it would not take much to turn the Ultimate Oscillator back to positive.

Market Timing / Market Direction Technical Indicators at the close of Dec 9 2011

Market Timing / Market Direction Summary for Dec 9 2011 At The Close

I posted the readings at noon today, to show readers that it is important when using market timing technical indicators, to check more than once in a day. I check my market timing indicators at the open, at noon and at the close of each day.

The close today was better than the noon reading. If Monday next week the market timing indicators move higher, the slow stochastic may turn back higher than Wednesday’s figure. It will however take the top 3 market timing indicators above to break above Wednesday’s readings to convince me that the market direction can be changed back to up.