Today’s uptrend action on the S&P 500 continues to look weak. While the market direction appears to be higher, I believe it may have reached a plateau of sorts.

Meanwhile during the day I was stopped out of 10 of my SPY Put contracts when they traded at 4.50 which was the first stop of my contracts. I immediately took the remaining SPY contracts, now just 20 and cancelled the stop loss tickets. I find it important however to work with a stop loss in case the market turns around and climbs, putting my puts into large losses. With the selling of 10 additional contracts this has brought me to a break even status as the first 10 puts were sold for a loss.

I am still of the belief that this is just a rebound and market direction will be lower. Meanwhile though the news from Europe is somewhat brighter with Germany and France indicating that Greece will stay in the Union. But talk is about all there is as no real concrete plans or ideas have been presented. Greece has introduced a new property tax in order to try to raise revenues. There is no real thinking outside of the box on the Greek or Europe debt issue.

An interview of Treasury secretary, Timothy F. Geithner, helped the market direction to move higher as Geithner indicated that European Leaders know they were late to react to the crisis but he believes Europe will not allow its banks to collapse or the debt problem to get worse.

Yesterday China indicated that Europe shouldn’t look to them to be a “white knight” as it were. In the end though, this could be an opportunity for China to get into Europe with their exports, in a big way.

Europe has always contended that Chinese goods are under valued and as such not priced fairly. Therefore the EU has tarrifs against Chinese goods. Maybe there will be something in the works for China if they consider helping out Europe. Just a thought.

Meanwhile here is today’s chart. This is the last 10 days of the S&P. Presently the market direction still looks up. Three times the market has been to this same height since early August. Will this time be different and the market direction continue higher?

I have a lot of doubt. I believe the main reason the market has managed to hold in is the lack of even worse news from Europe.

But the news about the US economy is anything but cheery. Best Buy is a great example of what is probably around the corner for many consumer companies, lower earnings. Best Buy has had a number of poor quarters now without any sign of improvement. This will most likely mean store closings and layoffs.

So on one hand we have President Obama’s employment action plan and on the other, more layoffs may be coming. This is definitely a market in turmoil.

Johnson and Johnson Puts

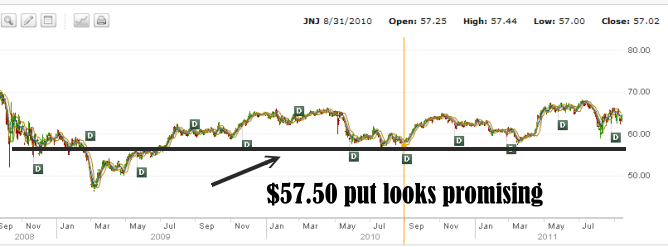

For the past two trading sessions I have been trying to sell puts on JNJ Stock. My strike has been the 22OCT11 $57.50 put which I am trying to get more than .65 cents for. I think this could be an excellent trade, but I have yet to get a fill. Nonethless I think the market should pullback and I may still get the opportunity I am looking for.

The 3 year chart on Johnson and Johnson stock is below. I believe the $57.50 value, which has not been visited since August 2010, is a great put strike for my strategy. If market direction should change to down over the next couple of sessions I should be able to get the price I want for the strike.

Market Direction Summary for Sep 14 2011

I am looking forward to Friday’s options expiry. I have a lot of options out of the money and look forward to selling more puts next week. The market direction can turn down by Friday but I do not see anything that would cause a crash at this point as Greece seems pretty determined they are going to pull it off, through their austerity measures.