Market direction today seemed positive for much of the day. Today’s market open with another GAP up, is becoming a trademark of this bear market. Bull markets don’t have these gap opens, either up or down, but bear markets have them all the time.

Meanwhile I was watching another interview today with a man whom I respect, Laszlo Birinyi. The interview was done earlier this month but I noted on his website that he has re-iterated his position on market direction. He remains on the bull side of the market and believes Greece will not derail stocks like Apple and Google.

Another interesting article was a summary on Marketwatch of a talk by noted author, former professor and ex-chief economist at Bear Stearns Carmen Reinhart. She predicts that Greece, Portugal and Ireland will default on their sovereign debt though perhaps not walking away completely but certainly leaving a large number of investors with losses. She appears to be more in my camp in believing that growth is going to be small for probably at least a decade. She also thinks the US will find itself in trouble with its debt, some time in the next few years. She believes any de-leveraging will take more than a decade which makes sense since it took more than a decade to get into this mess. Her talk was certainly interesting and again has me thinking about market direction.

MARKET DIRECTION – RUNNING ON EMPTY?

While the rally today was great to see, it was primarily on the back of some positive news in Europe. But as before it is all just gossip because they have still not come up with anything substantial, which is why I believe the market direction changed mid-afternoon.

Markets were very oversold in Europe so any positive news should have spark a bounce. But is the bounce sustainable in the short-term? I have my doubts. The problems in Europe are very large and not easily solved. This will take months and years to resolve and in the end the only real resolution could be defaults from more than just Greece.

Today’s rally which at one point had the Dow Jones market direction up more than 300 points, faltered in the mid afternoon but still closed up 146.83 points or 1.33 percent. What analysts focused on though was how the rally lost half of its upswing in a little over two hours of trading.

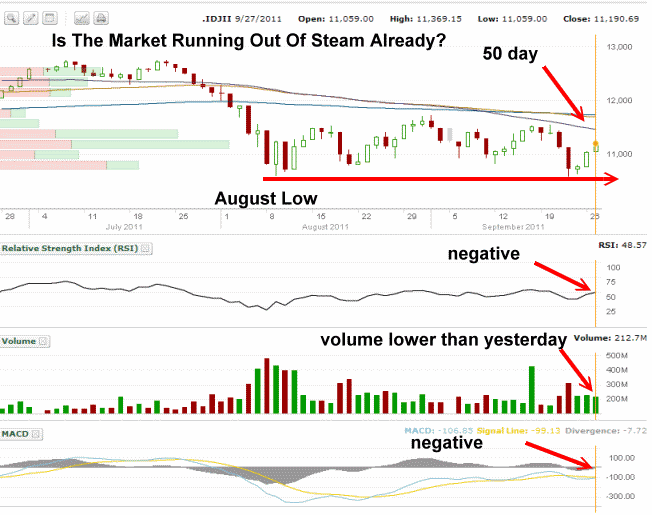

The charts remain anything but bullish. This evening I will review the Dow Jones chart (below) for the past 3 months. The range we have been in is obvious. The market’s close is half way between the 50 day moving average and the August low. Yesterday I indicated that market direction could stay bullish for a day or possible two and easily reach the 50 day over just a few sessions, but overall I am bearish on how much of a rally we can expect.

Relative Strength is negative despite today’s rally. Volume was lower than yesterday so a lot of the rally could have been short covering as many investors continue to sit on the sidelines. MACD is very negative.

MARKET DIRECTION SUMMARY FOR SEPT 27 2011 – Staying Protected For Now

So is the rally already running out of steam? Perhaps, but it could also have gotten ahead of itself. This morning’s gap open of more than 200 points was way overdone, so the market could have set itself up for a disappointing finish right from the get go. As well let’s not forget the market direction has been up for 3 days now and the market did bounce right off the August low just 4 trading sessions ago.

So that the positive side of the market direction. On the negative side, could the market be actually running on empty at this stage and needs to move lower to establish a stronger base to stage a better rally. Was the bounce just 3 days ago merely short covering and a little too much enthusiasm for a possible European solution? Volumes certainly are terrible if this is going to be a sustainable rally higher.

If something concrete comes out of Europe, then the markets should move higher but until the market direction is a confirmed up, I plan to keep to selling far out of the money puts and for my covered calls, keep them deep in the money as well. I want as much protection as I can get. I still believe there is more downside to come in the market direction before the market makes a real base to stage a serious rally from.