Market Direction may have looked dicey this morning but these are the opportunities I wrote about last night. The morning opened and the market direction fell. This is only natural for the markets after setting another new 52 week high in the S&P on Friday, but the market direction higher remains in place. Stocks like Nucor Stock this morning, Visa Stock and Bank of Montreal Stock set new 52 week highs again this morning in the face of selling pressure. They join a growing list of stocks setting new 52 week highs as the underlying strength in the market direction is pushing stocks into new 52 week heights.

These are dips, often being orchestrated by the larger investors, hedge funds and institutional investors as they jostle to set themselves up for another move higher. These market direction movements are opportunities for Put Selling against a variety of stocks. All my Nucor Stock naked puts are far out of the money now and yet just weeks back they were in the money.

Market Direction Outlook Remains Positive For Put Selling

For Put Selling the market direction outlook is solidly bullish against a growing number of large cap stocks. Earnings begin tomorrow with Alcoa Stock reporting. This earnings season will either be the catalyst stocks need to retake the highs from 2007 or will disappoint and see stocks pull back or at least trend sideways in a range.

The larger investors are betting on earnings surprises as they establish new positions and adjust older ones.

Many Larger Investors Failed To Follow Market Direction in 2012

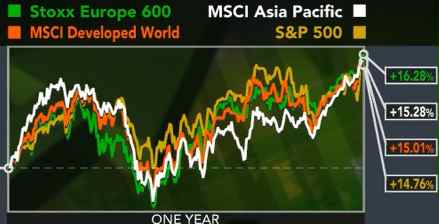

In 2012 many larger investors failed to follow the world’s markets direction. Europe which many felt would implode, myself included, had the best year among all the major indexes with a total gain of 16.28%. The S&P 500 actually was the worst despite the big rally back during from the spring market direction sell-off with a rise of 14.76%.

Yet the majority of institutional investors, mutual funds and large investors failed to even meet the S&P 500 return. It is this same level of pessimism that remains in the market and is assisting in keeping stocks and the market direction moving higher.

Stock markets around the world rallied in 2012

Dips Are Being Bought In Any Market Direction Change

Daily volume throughout the day show that dips are being bought into which indicates investors are cautiously bullish going into tomorrow. I won’t be surprised to see the market close near Friday’s close.

Fed’s Quantitative Easing Coming To An End?

But with so many larger investors now scrambling to jump into the market on any market direction dip, I am not sure they are too late for this party. I will be staying with Put Selling but I will still keep my 30% of capital sitting in cash. With the Federal Reserve Bond buying possibly stopping this year, the Fed could be signaling that they see the economy growing enough to support itself without the Federal Reserve’s further intervention. This could in the end, be the show stopper for stocks, but we will have to wait and see.