Amazon stock has tumbled more than 14% on October 26 and today (October 27) the stock rose 4%. With Amazon stock now down 10% and with probably more risk of selling ahead, is Amazon stock a buy?

Today I received an email from a reader wondering if I could come up with a financial investment strategy that would take advantage of the fall in Amazon stock and the increased stock volatility.

If an investor was interested in Amazon stock, what might be a good strategy to use to profit from the higher volatility in Amazon stock and yet not end up owning a stock that may fall a lot further.

It wasn’t the squeeze on the profit margins that hurt Amazon stock on its recent earnings announcement. It was the revenue growth which did not meet analysts projections. Most analysts knew that earnings would be down because Amazon.com had spent so much money on the research, development and bringing to market of the new kindles. This is going to heat up the tablet war for Christmas and Amazon.com is determined to be a big player.

They may just become that if their Kindle Fire, well, catches fire.

Amazon Stock – Highly Volatile And Very Expensive

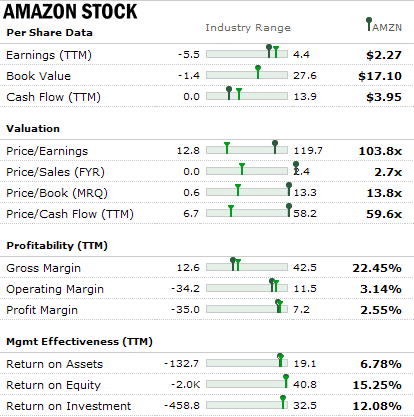

Amazon stock though, from an investor’s viewpoint, is tough to get excited about. The book value on Amazon stock is just 17.10 and yet it trades at a whopping 103.8 times price to earnings. That’s pretty incredible for today’s NASDAQ marketplace. It reminds me of the dot.com period in NASDAQ history when stocks with little to no revenue had high PE multiples that made me shake my head. Below are Amazon Stock fundamentals as of October 27 2011.

APPLE STOCK – Who’s Stats Look Better?

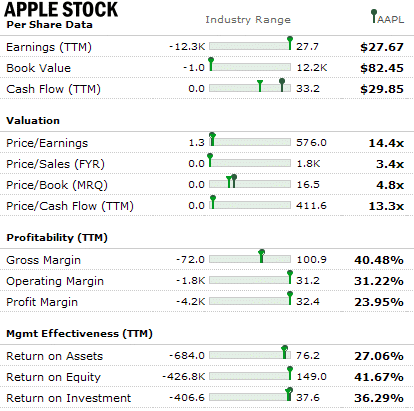

Apple stock has a book value of 82.45 and trades at a much more modest 14.4 times Price To Earnings ratio. The rest of the fundamentals you can read for yourself in this recent chart below .

Still Interested In Amazon Stock?

If I haven’t persuaded investors to think twice about Amazon Stock, then what should they consider as a possible strategy? Readers know that my favorite strategy is selling naked puts. But can a stock as volatile as Amazon stock be worth selling puts against?

Amazon Stock – It’s The Volatility That Is Tempting

It the volatility that makes for a tempting trade. With the recent downturn in Amazon stock, volatility is up and so are option premiums and the volatility may stay until at least after the Christmas season. Analysts everywhere are busy redoing all their projections worried that revenue will again be short of their expectations. This should keep option premiums up.

How To Pick The Amazon Stock Put Price To Sell

To decide what Amazon Stock strike puts to sell the strategy must include receiving a decent premium to warrant the risk of possible assignment, yet minimizing as much as possible the risk of assignment.

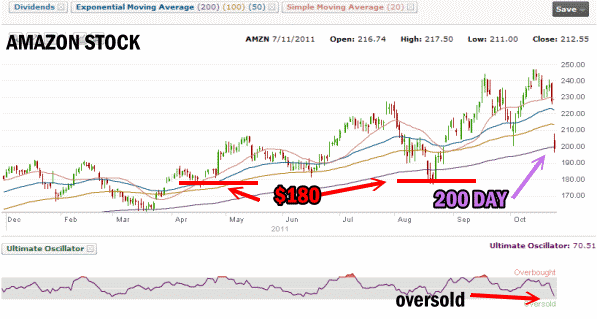

At $200.00 and a PE of 103, the stock is definitely not for those who are risk averse such as myself. Looking at the one year chart below, brings a very interesting trade strategy to light. The 200 day exponential moving average. Each pullback has seen the stock have a tough time breaking the 200 day EMA.

Presently this would put the $180 strike as the best strike to consider selling which also marks a good support level in the stock. It is important to realize however that the $180 support was created as the stock was moving higher. Should Amazon stock continue to fall, this $180 may not have much support. Use this Amazon Stock link to see how pronounced the $180 strike is.

Adding The Ultimate Oscillator To Amazon Stock

Despite this, a case could be made for selling at the 200 day moving average. By adding the Ultimate Oscillator, the investor could watch Amazon stock and during periods of extreme weakness such as now when the oversold indicator is flashing, he could consider selling another round of puts contracts at the 200 day EMA.

By carefully watching the Ultimate Oscillator and being aware of movements and changes in the 200 day EMA an investor could continue to benefit from selling the 200 day EMA on Amazon stock and then buy back the puts on any move back up in the stock or when the Ultimate Oscillator moves from Oversold towards Overbought.

Selling Puts On Oversold Indicator And Closing Them Early

By applying this strategy in a disciplined and consistent style, an investor could profit handsomely from the high volatility in Amazon Stock. While Amazon stock would not be my choice, volatile stocks can often be quite profitable if a strategy of selling puts is applied conservatively with a careful eye on closing the sold put contracts early when profit potential is clear.