Put selling is looked upon by most investors as not “truly investing”. For myself, Put Selling is my principal investment method. It is important to remember that for me, I am not “just” randomly put selling for income. I am put selling as a long-term investment method. I need stocks that stay within a trading range to make selling puts consistently profitable. Just as in the featured picture of the man jumping with joy as his plant starts to grow, put selling is about small gains that grow larger and larger over time.

For my put selling strategy to work month after month, year in and out, stock selection is of prime importance. I am selling puts against stocks that I would own if the stock declined and I was assigned, but the beautiful thing about put selling is I can determine when I want to commit my capital through a strategy of rolling puts out in time that get caught in the money.

Many Stocks Do Not Meet My Put Selling Requirements

In a recent put selling question from a reader he used Lexmark stock as an example, but Lexmark would be a poor choice.

Lexmark stock doesn’t meet my requirements. It has some things going for it like low PE (price to earnings) and a decent debt to capital ratio, but it does not pay a dividend which is a put selling requirement. Most important, the long-term chart on Lexmark stock does show a definable trading range which is what I look for in a stock for put selling. Remember I am looking for stocks that I can use for put selling over long periods of time.

Below is Lexmark Stock’s 10 year chart. It has been over $90.00 and below $15.00. That’s quite a range. Imagine buying it at the high and trying to average down when it turns back up? At what strike would you do this? How would you rescue your capital if you have invested at $90.00? How much more capital would you need to risk to rescue your original capital or how long might you wait to get your capital back? This is not the type of stock I would choose for put selling.

A stock with a trading range like Lexmark Stock does not meet my Put Selling requirements.

Picking The Proper Stock For Put Selling Is Key

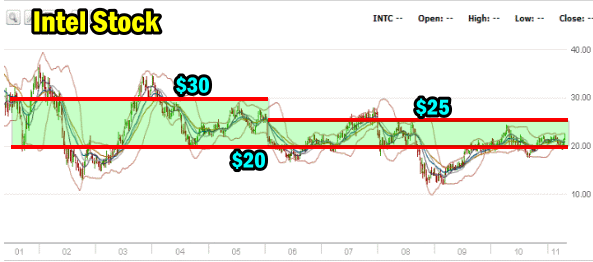

The most important aspect of my Put Selling Investment Method is picking the proper stock. Below is a 10 year chart of Intel stock. The stock has been in a perfect trading range for almost the entire 10 years.

With Intel stock I sold puts between $20 and $30.00 from 2001 to midway into 2005. Then between $25 to $20 from mid-2005 to 2011. This represents a ten-year period in which I generated consistent monthly income and double-digit annual returns all based on following an easy to spot trading range.

If I had sold puts at $30.00 and then found the stock falling lower placing my sold puts in the money, I would not have been concerned. I would buy back the $30 puts strike I had sold and rolled the puts lower for a net credit working my way lower as the stock moved lower. The key to this strategy is to roll early enough to avoid being assigned.

There are more articles in the put selling index that look at put selling rolling techniques and my ongoing trades such as Microsoft stock show how I handle rolling sold puts that end up in the money.

In the case of assignment, again I would be unconcerned as Intel Stock pays an excellent dividend which has been annually increasing. If assigned the stock, I would earn the dividend and sell covered calls until exercised out of the stock and then start the put selling process again.

The key to successful put selling is selecting the proper stock which is trading in an easy to spot range, making put selling easier and predictable.

Put Selling As A Long Term Investment Method

For me, put selling is a long-term investment method. I am not jumping from stock to stock, chasing this one up and then searching for the next great stock to try to buy low and sell high. I have a clear goal and know which stocks it will take to make that goal a reality. I also want a stock that when it falls, it does not end up going from 90 to 15 over a period of years. I want a stock that might fall from 25 to 15, like Intel Stock has. It is much easier to recover lost capital in a stock like Intel than a stock like Lexmark.

The reader also asked further:

LXK Lexmark Puts,

Currently (as of April 26) the May $37 puts are selling for $1.70 Five contracts @ $1.70 = $850.

Stock stays below $37, I get assigned 500 shares at $37 = $18,500 (true cost $18,500 – $850= $17,650) Stock goes past $37, assignment never happens, keep $850

I suppose you could answer Yes to the reader’s question, but I don’t look at put selling as the reader describes above.

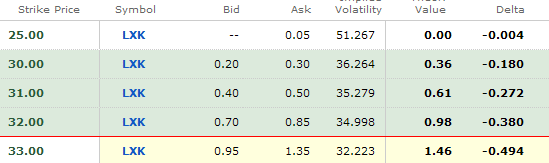

Put selling is a strategy that requires goals and planning. Below in the chart, are the Lexmark strikes available for MAY 2011 which expired in 24 days from April 26 2011. The stock had fallen dramatically, down over 15% which is really more like a bear market than a pull back. It closed a day earlier above $38.00. On April 26 Lexmark closed at 32.76, but set an intra-day low of 31.84.

Below are the puts from $33.00 down. I see no point in selling the $37.00 put unless you have confidence that Lexmark stock is going to rebound. Yet with my Intel Stock if I had sold at $25.00 and it fell to $20.00 I would be unconcerned as I have confidence that the stock will return to $25.00 and I can keep rolling my puts forward while waiting for the stock to recover. You must have confidence in your stock before engaging in put selling.

Put selling requires goals and objectives to be consistently successful. Why sell the $37 strike on a stock like Lexmark unless you have confidence the stock is going to rebound.

Before Engaging In Put Selling Ask Yourself These Questions

Before the reader gets into a put selling strategy on Lexmark he should ask himself these questions:

Is the stock in a tradeable range?

Has he set clear goals and reasonable objectives?

Is this stock of a company you would own if assigned shares?

If assigned shares what is your plan? Will you sell covered calls and if so at what strike and how far out in time?

If the stock falls further what is your plan?

Where do you think support is for this stock?

How low has this stock been before?

How long has it taken before to recover or did it ever recover?

Before selling puts did you look at Delta which some investors believe can give a rough idea of the chance of assignment? For example some investors believe at the $31 strike Delta indicates a 27.2% chance of being assigned by May options expiry.

Consider for a moment that today Lexmark stock collapsed to $31.84 and then closed at $32.76. At the close the May $31 put strike was .40 cents bid which is a 1.29% premium. Would you sell this strike and put your capital at risk in a stock that just plummeted 15% for a gain of just 1.29% when there are hundreds of stocks available with the same return that have not seen this type of collapse? Select this Put Selling link to check out the present prices of Lexmark Stock.

Below are the 3 lowest available put options for JUNE 2011 options expiry. Did you look at them to consider much larger premiums and a time frame that might give Lexmark stock longer to recover?

Put selling is more than just premium earned. It is a strategy requiring advanced planning.

In effect though this is not what Delta is about. In simple terms Delta is advising the theoretical movement of the option pricing based on a $1.00 movement in the underlying asset. Therefore when we look at the $31 strike and we see a delta of -0.272 this is advising us that every $1.00 movement in the stock will change the $31 put strike by 27.2 cents. An increase in Lexmark stock by $1.00 then theoretically will mean the put strike will drop by 27 cents. If Lexmark stock falls $1.00 the put strike will increase in value by 27 cents. There are many other factors as well though and Delta is just another method that some investors believe can assist them in picking put strikes with the least amount of chance of the stock falling to their chosen put strike.

Instead for simple use, consider taking the Delta reading and look at the chance of the underlying stock moving up or down for an opportunity. For example there is also the theoretical value which at present is .61 cents. Therefore we know that in theory the put premiums are too high. Obviously the put premiums are this high as the stock is under pressure to fall. This is an abberation in the price of the put premium. When I see an abberation like this I often will sell the put. When the selling pressure eases the put premium will move back toward theoretical value. This is another plus for those who use Delta to assist in Put Selling, as investors look for abberations in put premiums and sell them for quick trades. I will write more on this in a future article.

Successful Put Selling Requires Goals and Objectives In Advance

To be consistently successful with put selling an investor needs clear goals and objectives BEFORE entering the trade. Once a plan is formulated and you are following a stock for put selling, you can take advantage of pull backs. For example just a few sessions ago Intel Stock sold off and I sold many Intel Stock $19 strike puts.

It was an easy trade to make because I have my goal and objectives in place long before making the trade. I have followed Intel Stock for 10 years and since it is a stock I follow, I know the trading range and my plan.

I know in advance how I will handle the sold puts should the stock plummet and how I would handle the stock if it was assigned to me.

I’m Investing Through Put Selling

Put selling is not a strategy of just pick a stock, sell a put and hope it works out. I’m investing through careful planning, not “just” selling puts.

What About Put Selling Downsides?

The reader then went on to ask about the downsides of put selling. He said: Downsides: Assigned stock and price continues to fall?

If you have planned properly than the downside of Put Selling should already have been decided into your overall plan.

What was your plan? Did you want Lexmark stock? Did you want it now? Did you think about a plan to roll puts continuously to keep generating more income until you end up being assigned the shares. How much money do you want to earn before being assigned? Do you never want the stock? If not then perhaps a different strategy is in order?

So is this really a downside? If I had sold the May $31.00 for .40 cents, then my true cost is $30.60 on the stock, which is the lowest it has been in a year. Is this a good entry point? Would I be happy here? If that was my plan than there is no downside if assigned.

What About Put Selling Upside?

The reader continued and asked: Upsides: $850??

Well no, there is a lot more to the upside than just $850.00. How about $850.00 and a chance to do it all again monthly, or the chance to roll for more income, or what about split the position and sell some put contracts this month and some put contracts into JUNE? What about splitting up the entire trade over 3 months? Sell 2 puts for the closest month, 2 for June and 1 into October? How about selling each set of contracts at a lower strike so for May you sell the $32, June the $31 and October the $30? Now you are averaging yourself lower into the stock and gathering more premium.

Without A Plan Put Selling Will Not Be Consistently Profitable

Without having a plan in place the investor is not going to see consistent monthly returns, profit growth and be prepared for the stock falling or rising. Without a plan, put selling is not consistently successful. Put selling is about earning small monthly sums month after month. All it takes is one or two bad trades and months of small earnings are wiped out.

What The Reader Missed About Put Selling

The reader concluded his email to me by asking: What else am I missing? Is the goal to Sell a put with no hopes of assignment, while gaining a smaller profit from each sale?

What the reader is missing is that put selling is a practical and powerful investment method for consistent and reliable profits, portfolio growth and income. It is much more than simply selling a put and hoping not to be assigned shares. The goal is much bigger.

Put Selling Summary

I suggest reading more articles from the Put Selling Index and Treat Your Investing Like A Business, and I would definitely read My Strategy.

Paper Trade Put Selling

Pick some stocks for put selling and paper trade for 6 months to a year. See how much you can earn. Try being assigned on your paper trade and see if you would in fact risk your capital at assignment. You might be surprised to find out that many investors “say” they want the stock, but when it comes time to pony up the capital, they buy back their put and take a loss. Try being assigned on paper and selling covered calls to get exercised out of the stock and then repeat the process.

Try put selling on dividend paying stocks and sell the naked puts through paper trading to try to be assigned each month before dividends are being paid out. Then sell a covered call two months beyond the dividend payout to see if you are exercised out, yet earn the dividend. Check out the earnings potential on that type of trade through paper trading first.

Read More On Put Selling

Pick up some books on options and get to learn the various strategies that are employed every day by investors. Check out other websites including The Money Tree by my friend Troy where he does put selling investing through a variety of strategies including probability of assignment. Troy has not updated his website since 2018 but it may be of interest to others still.

Put selling investing is a wonderful investing strategy that offers a lot of potential, is exceptional for rescuing capital caught in downturns and it is very enjoyable to see those earnings month after month and year after year. But it is a strategy of small monthly returns which if not done properly can result in one or two bad trades wiping out the earnings made over many months of successful put selling.