PepsiCo Stock is well worth watching. It is held by literally hundreds of institutions. I have engaged in put selling against PepsiCo stock for years. My website shows my PepsiCo put selling trades since Feb 11 2009. Here are the PepsiCo Stock Trades for 2009; PepsiCo Stock Trades for 2010; PepsiCo Stock Trades for 2011.

If someone had bought PepsiCo Stock on Feb 11 2009 they would have been able to buy it for $50.25. By November 2009 PepsiCo Stock was at $62.00. Since then the stock has wandered but stayed in a tight trading range making put selling very profitable without worrying about assignment. This is because if assigned shares within such a tight trading range an investor could easily sell covered calls, be exercised back out and continue along with the trade.

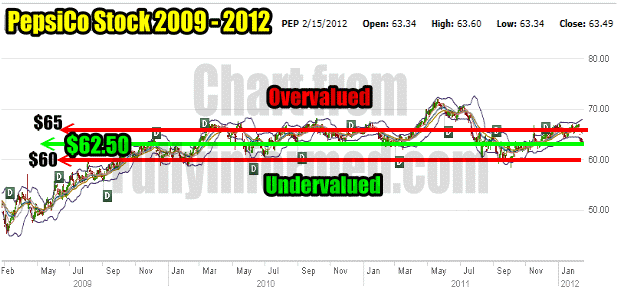

PepsiCo Stock 2009 to 2012

Looking at the 3 year chart below it’s easy to see the range I am discussing. Once PepsiCo Stock recovered from the bear market collapse of 2008 to 2009, the stock quickly ran back up to $62.50. Over the next 3 years the stock wandered within its defined range until the spring of 2011 when PepsiCo Stock pushed into overvalued territory.

When the stock moved into an overvaluation I held off put selling as there was not enough put option premiums to make put selling worthwhile versus the risk of assignment at too high a valuation.

Basically anywhere above $65 was too high a valuation for the stock.

Meanwhile anywhere below $60 was undervalued but PepsiCo Stock rarely fell below $60.00.

The prime put selling price has been $62.50.

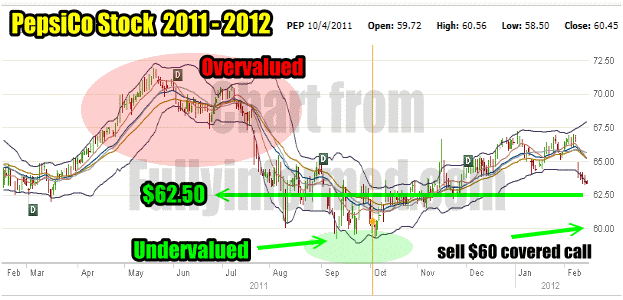

PepsiCo Stock 2011 – 2012

Looking at the one year PepsiCo Stock chart below you can get a better understanding of the trading range for the stock. In April the stock commenced a climb into overvalued territory. I received a lot of emails from worried investors in August who had bought the stock above $70.00. I explained how to spot overvaluation in a stock and that the best recommendation for stock holders who did not want to stay within PepsiCo Stock would be to consider selling the $65 covered call.

That’s because at $65.00 they had a good chance to be able to bring in some call premium and probably keep rolling ahead of any possibly assignment. By doing that they could earn the dividend, keep bringing in covered call premiums and reduce their cost basis in PepsiCo Stock while waiting for the stock to possibly run up again past $67.50 and take them out.

They could then WAIT and buy the stock on the next pullback below $65.00. For very long-term holders I would have sold leap covered calls at $67.50 and earned the annual dividend. Within a year they would have reduced their cost basis and would not have to be concerned that they bought the stock at $70.00

Right now though PepsiCo has faced a downgrade of its stock which is bringing the stock back into its trading range.

PepsiCo Stock Put Selling The $62.50 Strike

You can see how the $62.50 remains the prime put selling strike which is why I sold PepsiCo Stock puts at $62.50.

I may need to roll those put contracts forward before they expire as the stock could slip below $62.50 as it works its way down to the low-end of its range. However in this present market climate with so many bulls I am anticipating that PepsiCo Stock may stay above the prime put selling strike of $62.50.

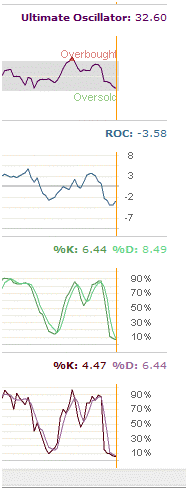

Yesterday I bought stock at $63.38 as my market timing indicators show the stock as very oversold. The Ultimate Oscillator shows PepsiCo Stock at 47.48 and both the slow and fast stochastic indicators show the stock extremely oversold. Lots of selling pressure. However the rate of change shows that the stock may be getting ready for a bounce before more selling comes in.

PepsiCo Stock Trade Summary

If the stock bounces I will sell out. If it does not and continues to move lower I will sell the April $62.50 covered call, earn the dividend and wait for the stock to either move lower or run back up and exercise me out.

If I was following the Mr Conservative Covered Call Strategy, I would be splitting my covered calls between $62.50 for April and then either the July $60 or Jan 2013 $60 which offers superior protection and would reduce the overall cost basis of my position in PepsiCo Stock.

Select this PepsiCo Stock link to check out PepsiCo Company Investor Relations.