Put selling on Kraft Stock is viewed by many option sellers as not worth their time or capital. I disagree. Many option sellers see Kraft stock as not having enough option premiums worthy of put selling or covered calls, but it all comes down to watching the stock and picking the times and strikes to sell. To do this doesn’t actually need much work. In fact most stocks do not need a lot of work if done properly. This is why I have a standing list of stocks that I watch and check daily. In just a few minutes I check my stocks at mid-day (advantage of being old) and at the end of the day. I am looking for patterns or signs that the stock is ready for the next round of put selling.

(This article was written Feb 17 but not posted until Feb 23 as I was working on the AGQ ProShares Part 3 article)

The other belief among option sellers is never sell options around earnings announcements, but again I disagree. I invest in put selling against stocks that I would own so I am keen to grab earnings premiums. Kraft stock is among those stocks I would own and actually have owned including today Feb 17 2012.

Options tend to rise near earnings announcements making it an ideal time to sell options. Put selling though for many investors is a strategy of selling puts against stocks they do not want to own. They just want the put option premium, but never the stock. I have a lot of investor friends who invest through put selling and NEVER want the underlying stock.

If the stock gets assigned most will dump it immediately whether there is a loss or not. They invest so heavily in put selling that they have dozens of positions open every week. They play the odds of assignment against the option premiums they are earning. They are always asking me how do I manage to work with just a handful of stocks and I always tell them the same thing. I have a plan BEFORE I do any put selling on any stock.

Again the importance of having a plan cannot be understated. I must have written this a dozen times on my site. I know in advance what I will do if the trade goes either way. I know in advance what my plan is, if my Kraft Stock falters because earnings are a surprise to the downside.

The Put Selling Plan For Kraft Stock

If you look at my 2012 US Investment portfolio list you can see the put selling for Kraft Stock for this year. Earnings will be coming out on Tuesday Jan 21 and I will be watching for a jump up if they are good and a pullback if they are bad.

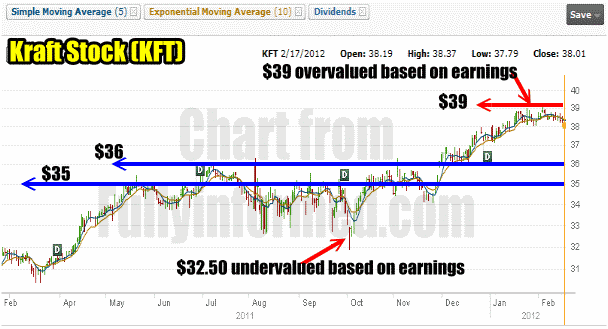

To decide the course of action for both put selling and a possible buy of stock I go to the one year chart on Kraft Stock. (below) Obviously the $39 is too expensive and based on present earnings it is overvalued. The problem is the dividend on Kraft Stock is $1.16, which means that long-term investors look at the stock differently keeping the stock up.

First with a dividend of $1.16 although it has not been increasing at all, dividend investors consider that over the next 5 years they will earn $5.80 in Kraft Stock. If they buy Kraft Stock today at $38.00 that will put them into the stock at $32.20 which, guess what, is back to undervalued based on today’s earnings. With the knowledge that Kraft Foods is continuing to grow and has new markets in Asia and Africa as well as existing markets those earnings should support Kraft stock at around the $32 level. Dividend investors often look at dividend stocks for a 5 year period. For Kraft Stock they calculate that they may breakeven on the stock or even have a small gain when they want out in 5 years and with low volatility, the stock wanders in a tight range most times.

The Kraft Stock dividend at $1.16 also provides a 3% yield, which a lot of dividend investors like, especially in this low dividend environment.

You can see where I am going with this. Kraft Stock dividend investors have long horizons. If Kraft Stock bumped the dividend another 10% to $1.27 over the next 5 years this stock is going to have a hard time falling below $30.00 except in a market panic. Kraft stock has everything dividend investors like except the increasing dividend.

Now you can see why Kraft Stock has so much support. $36.00 really is the top range for me though. A lot of investors interested in put selling would steer away from Kraft Stock. Premiums are not great but that’s because it has a tradeable range with low volatility keeping put selling interest low. The 20 day historical volatility as of Feb 17 is 15.95, so it is indeed low.

Put Selling On Kraft Stock As A Strategy

But what about if the strategy were to eventually own shares OR even better, keep selling the prime put strikes using a combination of put selling and buying to close and moving ahead of the closest month. Or what about a put selling strategy on Kraft Stock of laddered puts. By put selling the prime strike of $38 which is at the money presently, $37 1 strike lower and then the highest level I would own shares at, $36, I could keep rolling possibly indefinitely or certainly until a market panic or even better a rise in Kraft Stock which could put me out of Kraft Stock with all my earnings intact.

The strategy could be to eventually end up with just 500 shares which means:

Sell 5 March $38 puts at $0.58

Sell 5 April $37 puts at .62

Sell 5 June $36 puts at .81

Total income = $1005.00

Total Capital if assigned on all 15 put contracts = $55,500.00 Return = 1.8%

I have already made $18,660 in my Kraft put trades since 2008. The amount of new capital I will need is $36840.00.

Add In Kraft Stock Trading

Let’s add in another strategy with the Put Selling on Kraft Stock and that will be some Kraft stock trades. Like every stock Kraft Stock has its ups and downs. Earnings season is a great time to wait for weakness and buy some stock for a quick bounce. As well the above chart shows me that if the stock falls below $36.00 I should check it daily for signs of it being oversold and consider some stock for a quick bounce.

Technical Tools To Time Put Selling On Kraft Stock

As readers know I would never go blindly into put selling on any stock. It doesn’t matter if the stock is strong, weak, volatile or not, I always use some technical timing tools to pick my moment to sell my put strikes. The reason is simple. The premiums are highest when the stock is falling and pressure is building to the downside. The technical timing tools can easily assist when it comes to selling put options.

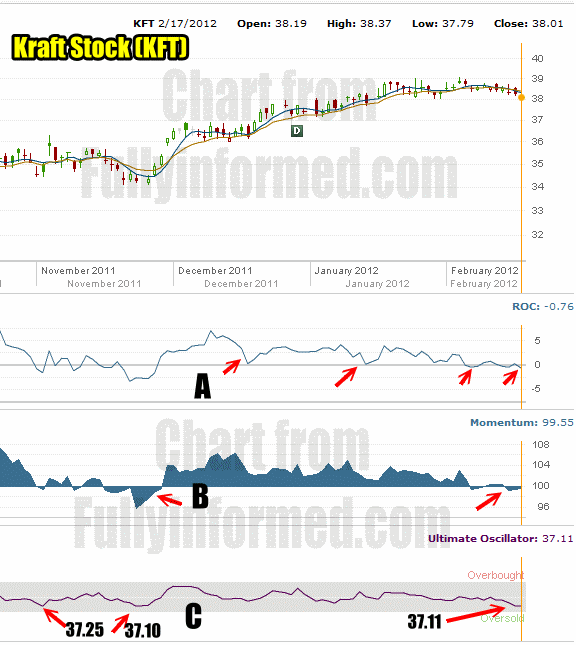

Readers know that among my favorite tools is the Ultimate Oscillator. I also added momentum and Rate Of Change. The Ultimate Oscillator is being used for put selling Kraft Stock because it will show oversold and overbought quickly and simply. When the stock is oversold I want to consider selling my puts AND consider whether to pick up some shares in Kraft Stock for a quick bounce.

The Momentum indicator and rate of change are going to be used to advise me when the downward momentum is starting to taper off or slow. That will be another indicator that it is a perfect point to sell my put strikes in Kraft Stock and consider the stock for that bounce I am looking for. I can then use Momentum to pick the upside when again up momentum slows signalling it is time to sell my Kraft Stock.

For the other side on the trade I can use the same three technical indicators to spot when the stock is overbought and I can buy back my put options and close the trade. If I bought shares I can also consider selling them at that level. Then I can wait to repeat the cycle on the next oversold signal from the Ultimate Oscillator.

Kraft Stock is not a high flyer so often there will not be an extreme oversold or overbought signal. But the Ultimate Oscillator can show that the stock is entering a neutral or sideways action. That again is where momentum and rate of change will come into play. Those two timing indicators can assist is advising me when buying or selling is tapering off or going flat and I can consider whether to close my put options early or in a similar strategy, sell my shares in Kraft Stock which I want to pick up for a bounce.

The above chart showing the technical timing tools for my trade on Kraft Stock. I have marked the important points with A, B and C.

A) shows that every time the Rate of Change signal gets back to zero, this low volatility stock has had a bounce. This means the rate of change can assist me in timing the purchase of shares and put selling entry points.

B) is the Momentum technical timing tool. The arrows show that every time momentum drops off and turns, again low volatility Kraft Stock rises. So now I know to watch for that signal from the momentum indicator.

C) The last indicator for Kraft Stock is the Ultimate Oscillator. You can see where I have placed the arrows. While Kraft Stock does not flash an extreme oversold signal most of the time, it does get down to about 37 which for Kraft Stock, is extreme enough for me to consider selling puts and buying stock for a bounce. The low volatility is why Kraft Stock does not have extreme readings often, but that’s okay because I want to sleep nights knowing that the chance of the stock plummeting overnight it slim and my put selling should produce the results I want for this year.

Put Selling Strategy On Kraft Stock The Rescue

One final piece to the puzzle has to be put in place. What if the unforeseen does occur and Kraft Stock or the market takes a dive. What is my course of action. In order for any plan to be successful an investor must know in advance what he will do.

In my case I have already made $18,660.00 to date. My capital needs for this trade then would be $55,500 less $18,660 less $1005.00 earned from the most recent put selling round. Total new capital needed then is $35835.00 which would put my share valuation at $23.89.

I also always look at present covered call options to see what is available. Let us take the example of $55,500 less $1005 earned and not consider the $18,660 made to date. This would put my average cost at $36.33 right near my top end range of $36.00. Today the $36 calls for June 2012 are at $2.51 and in the case of a calamity the $34 call options are at $4.35 for June. So while I realize that in a crash these premiums will disappear, except for the 1 day wonder in May 2010 when the market had its worse crash ever, markets tend to pull back in stages which will allow me to sell covered calls in stages if I was assigned shares, and I would pick up the dividend.

Finally, there is the rolling of my puts that I could do. Again in a downturn I should be able to roll my puts in stages as the market pulls back. Even the market crash of 2008 – 2009 was in stages.

To try to figure out a strategy I look out to January 2013 and I see that the $35 put option today could be sold for $2.10. This means that my 36, 37 and 38 puts that I have just sold today, could be bought back and rolled down, today, to $35.00 out to January 2013 and I would have a net credit.

The net credit amount is unimportant in this strategy. What is important is this tells me that the put premiums on Kraft Stock have enough premiums in them that in the event of a serious pullback I have room to maneuver. In a severe pullback my closest Kraft Stock puts will naturally rise in value but not as much as those further out in time. Indeed today the January 2013 $30 put strike is at $1.07 which is above all the premium amounts of my Mar to June put strikes I have sold. Again this value will naturally rise in a collapse but that is not what is important. What is important for my trade is knowing that in the event of a serious decline in valuation I will have opportunities to buy back and roll down further out in time and perhaps have a breakeven on the roll out, a small net credit or a small loss.

Put Selling On Kraft Stock Summary

To conclude then, the strategy is straight forward. I don’t mind owning 500 shares at $36.33. I will buy and sell stock on bounces to bring in more capital to assist in a final purchase of Kraft stock if that should happen. I will be selling against a put ladder approach and keep rolling the puts. In extreme selling I will buy back the highest put strike sold (presently $38) and roll it out and lower.

I now have my Kraft Stock goal in place for 2012 and the strategy including what I will do in the event of a major decline. I am ready to proceed with put selling on Kraft Stock. To that end I sold puts today and bought Kraft Stock for what I see as a bounce after earnings. It will be interesting to see how the year turns out for Kraft stock and put selling in general.

View Kraft Stock Trades For 2011

View Kraft Stock Trades For 2010

View Kraft Stock Trades For 2009

View Kraft Stock Trades For 2008

This Kraft Stock link with take you to Kraft Foods Investor Relations

MDLZ Stock Internal Links

Review Mondelez Stock Trades for 2013

Review Kraft and MDLZ Stock Trades for 2012

Review Kraft Stock Trades For 2011

Review Kraft Stock Trades For 2010

Review Kraft Stock Trades For 2009

Review Kraft Stock Trades For 2008

Review All Mondelez Stock Trade Strategy Articles