On January 1 2011 I sent out an email and posted to the forum that my financial investment strategy for 2011 would be the Cautious Bull. For those who are following my last two trades (Jan 20 2011), they are in tune to my financial investment strategy of the Cautious Bull.

On January 1 2011 I sent out an email and posted to the forum that my financial investment strategy for 2011 would be the Cautious Bull. For those who are following my last two trades (Jan 20 2011), they are in tune to my financial investment strategy of the Cautious Bull.

Why Use The Cautious Bull Now

In Oct 2008 to March 2009 Stocks set new lows during the market collapse. These lows were worse than the bear market of 2000 to 2003. Since the March 2009 lows, many stocks have recovered to their old trading ranges but most have not hit the highs they saw in 2007. The majority of stocks have recovered to the trading ranges they were in from 2006 to early 2007 and certainly many blue chips have put the Lehman Brothers collapse behind them. The fact though that so few have reclaimed their 2007 highs before the last bear market is itself a possible warning that the bull market could be slowing early.

Financial Investment Strategy – Selling Naked Puts

From spring 2009 to December 2010, selling naked puts was an easy financial investment strategy on many stocks, mine included. As stocks recovered it was a matter of selling naked puts at the money, in the money and just out of the money and for the most part stocks just kept climbing, leaving me with naked puts that expired or could be rolled.

It’s an easy and profitable strategy when the market is in a bull phase simply because it lifts the majority of stocks. Even if I was assigned shares I would be able to sell covered calls and be exercised out of the shares. The risk of capital loss in a bull market is slim for my financial investment strategy of selling puts.

Financial Investment Strategy – Return Of The Cautious Bull

In my view based on being an option seller for 35 years, the easy money has been made and now my financial investment strategy requires a more cautious approach. I call this my Cautious Bull Strategy. Select this financial investment strategy link to view a 10 year chart of the S&P500. You can readily see the recent climb but the 2007 top is still a long way off.

I believe stocks have to perform based on earnings or at least the belief that earnings are improving. Once the Fed money taps start to dry up in June 2011, the floor under this market may get a little “creaky”. (Read the article Dance Near The Exit)

Remember that markets are driven by fear and big players with billions of dollars in the market – the so called “smart money”. A whiff of a trouble and they will bail like they are fleeing the Titanic. In my opinion “smart money” is really no smarter than the retail investor, but their sheer size of holdings can push a stock to extremes both up and down if they are fearful.

FEAR DRIVES STOCKS

I have always believed that it isn’t fear and greed that drives stocks, but FEAR alone. There is fear of missing out on the rally and fear of losing capital in a decline.

SMART MONEY VS RETAIL INVESTOR

For those who believe “smart money” really knows what they are doing I can only point out that while retail investors sustained large losses in the 08-09 collapse, it pales in comparison to what “smart money” lost. When stocks like Citicorp fell to .99 cents, it was not caused by the retail investor fleeing ship. It was caused by “smart money” bailing out.

CITICORP

When I put in my offer to buy Citicorp for $1.00 I laughed because my offer was for 1000 shares. A thousand shares is not going to move Citicorp. If “smart money” was buying Citicorp with billions throughout the crisis the likelihood of it falling to .99 cents would have been unthinkable.

BANK OF MONTREAL STOCK

In Canada I started buying Bank of Montreal stock in March 2009 at $28.00 in lots of 300 shares until I owned 3000 shares. I bought it all the way to $25.00 over a period of 5 days. The dividend is $2.80 which was my pivot to jump in. At $2.80 they are paying 10% a year to hold their stock. My buying did not support BMO stock because I am too small an investor. But smart money was selling these stocks all the way down.

SMART MONEY MOVES STOCKS

Retail investors did not move any of these stocks, but “smart money” with billions of shares traded certainly did. As I bought BMO stock it continued to fall on huge volume. I wondered if I was the “dumb money” as I bought it all the way down.

I think the important aspect of “smart money” is to remember that when they buy or sell, it is their fear that can really hurt your position. Years ago my mentor told me, that the only way to beat smart money is to stay out of their game, be patient, watch volumes and charts. This is why I sell options only against stocks I would own, because in the past I have been assigned in market meltdowns.

STAY PREPARED

I like to be prepared for any eventuality. While some see another collapse, I doubt anyone can truly predict what is going to happen. There are many analysts who have recently (Jan 20 2011) predicted that the NASDAQ will hit 3700 this year. I personally doubt it.

OVERALL MARKET TREND IS IMPORTANT

The overall market trend is what is important. Right now the trend seems intact, BUT the Russell 2000 is showing signs of “strain” which may mean a pullback is coming before a move higher.

Financial Investment Strategy – The Cautious Bull Outlined

LIST OF STOCKS

My financial investment strategy for a market that has recovered is the Cautious Bull and the first step is to create my list of stocks, and yes I write them down on paper. Then I look at the stock charts each day to see those that are pulling back and wait for a jump in volatility.

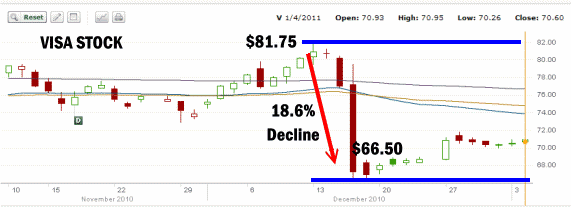

Normally when a quality company pulls back, it can be dramatic and many times short-lived. Visa stock is a good example as you can see in the chart below for December 2010.

I DECIDE ON PUT STRIKES TO SELL IN ADVANCE

I then write on paper the strikes I would be happy to own the shares at, if I WAS ASSIGNED, because it is important to remember that once I have sold the put, if the stock falls I am open to assignment at any time.

I then write down the premiums I would like and then I wait.

THIS FINANCIAL INVESTMENT STRATEGY IS SIMPLE BUT REQUIRES PATIENCE

My financial investment strategy is simple and doesn’t require a lot of monitoring. It does however require patience and often I may have only some of my capital invested. If you look at my VISA Stock chart (Jan 20 2011), you can see that VISA reached the lower Bollinger a few sessions ago. That’s when I get ready. I watched Visa Stock, saw Wednesday’s selling, and I put in my price of .85 cents on the Feb $65 Visa Stock put.

I TAKE MY TIME

I take my time and fill the put contracts in groups. That way if the stock falls further I can still sell more puts. If the stock rises, I can look elsewhere, decide to accept less put premium to sell the same put or wait patiently for the stock to pull back again.

In the case of Visa Stock, I got a fill which surprised me. Then today (Jan 20 2011) I saw Visa stock $65 naked puts go through for $1.10 and then $1.15, I put in my offer for $1.20 and waited. I got filled on the $1.20.

My financial investment strategy of the Cautious Bull is straight forward and has worked for me in every bear market and market correction since the mid 1970’s.

Financial Investment Strategy – NUCOR STOCK

The same with NUE stock. Today I got some filled on the Feb $41 put and I had offers out to sell the April $38 at .90. I saw some puts of other investors get filled at .70, so perhaps in the next few sessions I may get a fill. It requires patience and knowing that not every trade will be a winner or filled. However staying far out of the money is key to this financial investment strategy working.

WATCH FOR VOLATILITY TO INCREASE

If I am correct and there is trouble ahead, volatility will rise making selling puts far out of the money easier and still profitable as higher volatility will push put premiums higher in value. Volatility and market whipsaws are most welcomed in this financial investment strategy.

NO NEED TO HOLD UNTIL OPTIONS EXPIRY

One of the steps in my financial investment strategy of the Cautious Bull is not to hold onto these naked puts until options expiry. Far from it. If the stock holds or climbs and I can buy to close my sold puts for decent profits, then I close them and free up my capital to go back to my stock list and watch for the next possible trade.

STAY LIQUID

The important point here is to stay as liquid as possible. When the trade has worked, close it, take the profit and keep cash on hand. I set a realistic goal of 12% for the year. Many of my readers know that I aim for about 1% a month.

KEEP REALISTIC EXPECTATIONS WHICH REDUCES RISK

If I have realized 6% within 4 months, then my goal is now 6% for the remaining 8 months. This reduces my having to take higher risks to reach my goal and reduces the amount of cash I need to have in the market.

My return is still 12% for the year, but with each passing month of gains:

- I can reduce the amount of capital I need use

- I can stay further out of the money with my naked puts or naked calls

- I can turn to less profitable but sometimes more secure option strategies such as spreads

- I can focus on fewer trades and stay with those that are more profitable with less risk

I have no set amount for what I would consider decent profit. I pick and choose as the trade unfolds.

FINANCIAL INVESTMENT STRATEGY – THE CAUTIOUS BULL Summary

The steps above are simple and have helped to protect my capital during periods of increased volatility. This financial investment strategy will be my strategy throughout 2011. I have used this strategy in every recovered market since 1975 and it has served me well. The last time I used it was during the bear market of 2001 to 2003 after stocks had recovered from selling in 2000.

It worked very well as it turned out that 2002 and 2003 were dangerous markets with high volatility and heavy periods of selling. This is a perfect environment for selling far out of the money puts.

Then in 2006 as the market recovered and tried to push into newer highs I turned back to this financial investment strategy of the cautious bull. It worked again for 2006 to 2007 and protected my capital all the way down into 2008 and early 2009.

The chart below shows the number of times I have used this financial investment strategy since 1999. By starting the investment strategy in January 2011, it marks the shortest time space since the 1970’s between periods when I have used the cautious bull strategy.

With stocks now trying to push into higher territory and many stocks starting to become overvalued I believe it is time to put in place this financial investment strategy.

My using this financial investment strategy does not mean that the bull market is coming to an end. It just means it may be more difficult to judge when the now maturing bull market is ready for a rest. For me, it just means the easy money has been made and now I have to be more selective, watch for my opportunities and take advantage of them, when and as they appear.

It is time to dust off my cautious bull strategy, which I have found to be a very capable financial investment strategy.