T Stock has been a favorite at various times this year, but the decision on Aug 31 2011 by the US Justice Department to block AT&T’s planned takeover of T-Mobile USA has created an excellent opportunity for a terrific naked put trade.

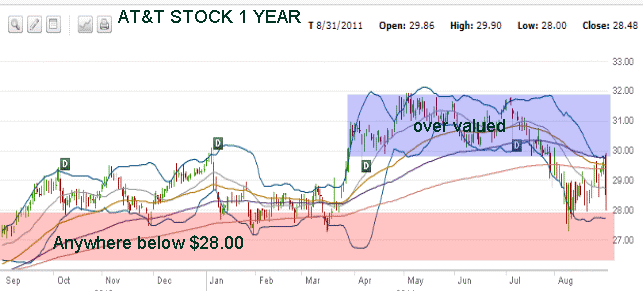

Since I started put selling in T stock (AT&T stock) in January of this year, T stock has provided some exceptional earnings. If you look at the 2011 T stock trade chart you can review the put strikes points I have used in the past. Put selling at the $28 and $27 puts performed very well earlier this year.

With the announcement on Wed by the US Justice Department, the stock fell dramatically making put sellingvery profitable again. On August 31 I sold September $27 puts for 1.1% return and today (Sep 1) I sold Oct $26 puts for 1.8% return.

Yesterday I wrote an article detailing out the methods I use to determine what strike level I would accept assignment on stock that I am not interested in owning long term, but would accept assignment in order to take advantage of a bounce in the stock to lock in a quick capital gain. You can review the article here.

AT&T stock is one of those rare stocks that I would be interested in owning due to the high dividend yield and the fact that it is being pushed back into a realistic valuation range. I also would accept assignment in order to take advantage of a bounce in T stock for a capital gain as well.

T Stock – Reviewing The Past Year

The chart below reviews the past 12 months in T stock. From September 2010 until March 2011 options expiry, AT&T stock was excellent for put selling anywhere below $28.00. I have marked the levels in red below.

After the March options expired the stock moved higher and as per my trade chart of T-stock trades, I stopped put selling as I felt the stock was over valued when it moved above $30.00 and the put premiums at strikes below $30.00 made put selling with T Stock at higher valuations not worthwhile.

T stock in the August sell off, fell back and made put selling at the $28 strike price viable again. However the news on Wednesday from the US Justice department, hammered AT&T stock and as per the chart below, has pushed it back into the red region where the $28 and $27 put strikes are worthwhile for selling again and even considering accepting stock is assigned.

T Stock – Summary Of Current Trade

A couple of things are evident from this trade.

First, there is never a need to chase a stock, no matter how much an investor believes the stock is worth chasing. T Stock shows that for a period of 7 months, Sep 2010 to March 2011, AT&T stock stayed within the perfect trading range for selling puts. If I had been assigned shares it would have been an easy trade to sell the stock in a bounce higher. But after that 7 month period AT&T stock moved into over valued range and therefore I stopped selling puts and moved to other stocks. That period lasted about 4 months and now the stock has returned to a more realistic valuation for this stock.

Again it is worth repeating that there is never any reason to chase a stock. By chasing stocks and selling puts at improper valuations an investor will often end up owning stock at valuation levels that are too high making it difficult to unload the shares for a gain and continue the cycle of selling puts, being assigned shares and selling calls to be exercised out of the shares.

In the case of T stock, I could have considered selling puts at $30 to $32 and then when AT&T Stock pulled back I could have bought and rolled lower, but why bother when the charts showed that the stock was over valued.

Over valuation in stocks is common and in almost every situation the stock will at some time return to a realistic level. In a universe filled with hundreds upon hundreds of stocks to select from, there is no need to ever chase stocks.

Second thing that is evident from the trade is that a lot of investors believe that at $27 or $28 the stock is valued properly and hence the believe is that the stock will not fall further. This is far from the truth. While in the case of AT&T stock I tend to be in the camp that feels at present, the stock is fairly valued at $27.00 and makes for a good naked put trade, with any stock there is always room for it to fall much further than any investor is prepared for.

The chart below shows the bear market in T Stock from October 2008 to March 2009. The stock hit as low as $21.50 a number of times, despite the high dividend yield. From today’s close of $28.55, such a fall would represent a loss of 23%. While I do not believe this will happen, it can in fact, happen and investors need to be prepared for any eventuality in a trade. It is imperative that investors realize that selling options on stocks is not “free money” by any stretch.

When selling an option such as in the case of AT&T stock, it is important for investors to have a plan in place, even if that plan means accepting the shares and selling covered calls.

I believe my selling puts in AT&T Stock is an excellent strategy. I also believe the September $27 puts and October $26 puts, are compelling trades, even based on the bear market chart above. However I always believe every investor should be prepared for the worst outcome and have in place the strategy they will employ should the trade turn sour.

I believe my put trades for T stock is not only sound, but even if the stock should fall and place my puts in the money, it would make a lot of sense to accept the shares. It is because of this confidence that I sold puts yesterday and today in T stock.

View The 2011 Trades for AT&T Stock