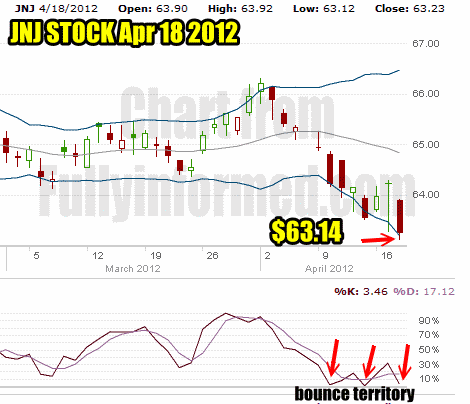

Johnson and Johnson stock is taking it on the chin this morning! What a big drop for the stock with it down 1.62% at the time of my writing this. At 1:15 Johnson and Johnson Share Price has fallen to $63.14. Investors don’t like the near term outlook for Johnson and Johnson stock after they released their latest earnings and lost the third round of an appeals battle. The earnings were just okay but the outlook a bit murky and this morning some analysts have downgraded it from a buy to a hold. Just a few days ago JNJ Stock was listed as a STRONG buy by dozens of analysts. I even read one report where they believed Johnson and Johnson Stock would be flying higher than $80 by the end of 2012. Even this morning’s downgrade saw many analysts rating it a hold but still calling for the stock to reach $74.00. What’s up with that? By changing the grade on JNJ Stock they have sent JNJ Shares a lot lower. Could this be an attempt to pick up the stock cheaper? The most telling has to be the market timing indicator Fast Stochastic.

Johnson and Johnson Stock Fast Stochastic

The fast stochastic plunged on the selling and at the time of my writing this article is it down to 3.46. Wow that is quite the tumble and shows the strong selling pressure. This marks the third strong pullback in the stock which each time has generated a low fast stochastic signal. Whether this is the bottom is a tough call, but short-term this should mark an area for a bounce.

Johnson and Johnson Stock Put Selling Option Opportunity

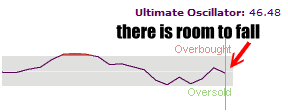

Johnson and Johnson Stock Ultimate Oscillator Reading

The Ultimate Oscillator reading this morning shows that there is room for the stock to fall further. It is important to understand how stocks react with strong selling pressure. JNJ Stock is a strong blue chip with a huge number of institutional investors. However when a stock like Jjohnson and Johnson falls this far in one day, there is almost always a bounce and then a RE-TEST of the fall to make sure there is support. Often on the re-test put premiums will move higher. I might be able to sell the May $62.50 for more than the .60 cents I earned today.

Ultimate Oscillator with JNJ Stock

JNJ Stock Put Selling Opportunity

This afternoon then I sold just 5 put contracts on Johnson and Johnson shares for 21MAY12 expiry at the $62.50 strike. I received .60 cents for those puts. I only did 5 put contracts because if there is a second test of the $63.00 strike level, then I can re-assess and sell more put options against Johnson and Johnson stock if I believe it appropriate.

It never hurts to take your time when putting in place a trade, whether it be stock or option. Put selling is a full-time investment strategy and by checking the technical timing tools I can get a good idea about what is happening with the stock.

JNJ Stock Where Is Support

According to my TD Waterhouse account technical tools, they peg support at $63.29 and resistance at $65.00. For investors TD Waterhouse places a stop-loss at $63.09.

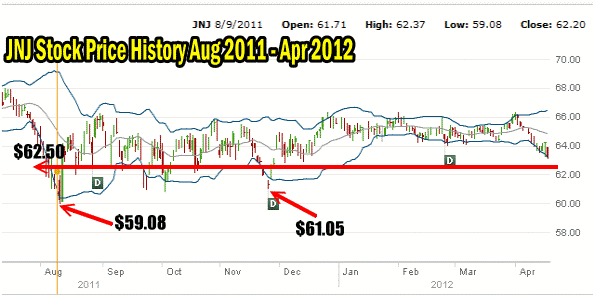

Johnson and Johnson Stock Price History

If I go all the way back to August 2011 Lows of last year. Johnson and Johnson stock hit a low of $59.08. On November 25 2011 the low was $61.05. Looking at my chart for the months from August you can see why I have sold the $62.50 put consistently on Johnson and Johnson Stock.

This marks a very good level to not only earn decent put premiums but also a good entry point for Johnson and Johnson share price should I get assigned shares. Even though I do not expect to end up being assigned, my put selling strategy always includes the “what if” scenario. I believe in no surprises when it comes to put selling against stocks.

Johnson and Johnson Stock Price History

Remember stocks, even JNJ Stock can always surprise to the downside. A surprise to the upside is always welcomed but not to the downside when I am intent on not being assigned shares.

Johnson and Johnson Stock Put Selling Summary

The strategy for today then was to start another grouping of puts from the month of May. By selling only 5 put contracts I have lots of room to maneuver in the future. I can take advantage of further selling in Johnson and Johnson share price should that occur and I have lots of cash available if I should want to buy some stock for any kind of bounce.

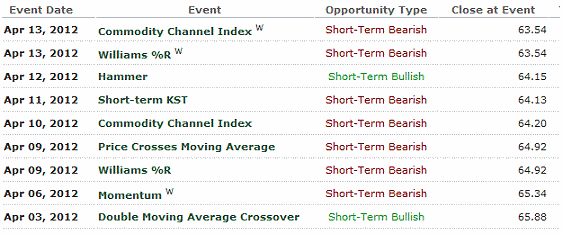

Below are all the recent technical indicators that are on my chart from TD Waterhouse. You can see there is lots of downside pressure on Johnson and Johnson stock. This means there is probably more time ahead for put selling or buying stock on the cheap so there should be no need to rush.

Johnson and Johnson stock technical outlook chart

The success of put selling is founded on having solid strategies that have been tested and used in all kinds of markets. Johnson and Johnson stock is a great example of how applying put sell strategies properly can earn annual double-digit returns while controlling risk of large losses.