|

|

Coca Cola |

|

|

About The Company |

|

2011 Fundamentals

Market Capitalization $143.9B

Revenue (FYR) $35.1B

EPS $5.05

P/E Ratio 12.4x

Shares Outstanding 2.3 B

Book Value $13.53

Dividend: $1.88

Coca-Cola Co is a profitable Beverages (Nonalcoholic)

company that trades on the NYSE. It is a manufacturer,

distributor and marketer of nonalcoholic beverage

concentrates and syrups in the world. Finished beverage

products bearing its trademarks are sold in more than 200

countries.

The Company markets nonalcoholic sparkling

brands, which include Diet Coke, Fanta and Sprite. The

Company manufactures beverage concentrates and syrups, which

it sells to bottling and canning operations, fountain

wholesalers and some fountain retailers, as well as finished

beverages, which it sells primarily to distributors.

The

Company owns or licenses approximately 500 brands, including

diet and light beverages, waters, enhanced waters, juices

and juice drinks, teas, coffees, and energy and sports

drinks. During 2008, the Company acquired the brands and

licenses in Denmark and Finland from Carlsberg Group

Beverages (Carlsberg).

In my opinion, Coke remains among the strongest of US Companies for

stock holders interested in covered call and naked put

writing. This looks like a good stock for my strategy. |

Terms

Of Use |

|

By using this site,

you agree to be bound by its terms of use.

The full terms of

use can be read here.

If you do not agree to the terms of use, do not access or use

this site.

Nothing presented is financial advice, trading advice or

recommendations. Everything presented is the author's ideas

only. The author accepts no liability for its use including

errors and omissions. You alone are solely responsible for your

own investing and trading. There are considerable risks involved

in implementing any investment strategies and losses can be

large. Trade at your own risk. |

|

| |

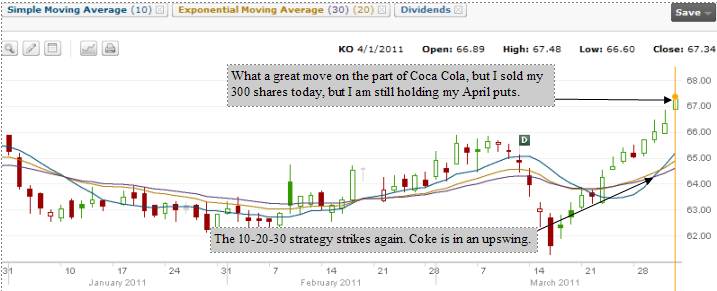

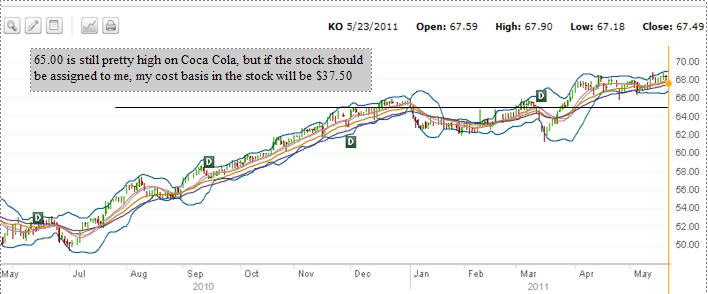

COCA COLA STOCK -

2011

COCA COLA STOCK SYMBOL

- KO

ONGOING EVALUATION

& TRADE

- Year 3

This will

remain an ongoing trade. The chart on Coca Cola shows a

strong company with excellent put selling potential. I

will be selling Naked Puts until I either accept

assignment OR get assigned shares. Then I will turn to

covered calls on Coca Cola Stock. Should Coca Cola stock fall too low making

covered call selling impractical I will add to my stock

position through selling puts to lower my overall

cost and average into the stock at lower prices. This is a long term trade. Over the past two years I

have been using a reverse ladder approach when selling Coca

Cola Stock Options. This is selling

puts at lower strikes the further out I go in time.

This protects in the event the stock has a major pullback

and I end up being assigned on the way down. It would put me

into the stock at an average lower price. This being the

third year of my Coca Cola Stock option trade, I can afford to become more aggressive with my

strike choices and stay closer to at the money rather than

far out of the money puts.

Looking at the fundamentals, if you flip back to the 2009

Coca Cola trades, you can see the increase in earnings,

market cap, earning per share and Coca Cola dividend. The

P/E is up slightly but overall this is the kind of

fundamentals I like to see, annual increases in worth,

dividend and a low PE.

|

|

|

|

TRADE COMMENCED May 1 2009

GOAL FOR 2011:

12%

ONGOING STRATEGY

- SELLING NAKED PUTS UNTIL ASSIGNED

* ACTIVE TRADES ARE HIGHLIGHTED

IN YELLOW |

|

|

|

|

|

|

|

|

|

|

|

| Oct 15 10 |

59.90 |

STO 5 NP JAN 57.50 @ 1.35 |

|

|

13.25 |

|

28763.25 |

661.75 |

2.30 |

18491.50 |

Nov 5 2010: THERE'S NOTHING LIKE COKE

Sometimes making money comes easy and Coke has

been an excellent performer. Today I closed my Jan

55 naked puts which I sold back in Dec 2009 and Feb

2010. - I made $2375.50 at the time of closing, and

held 27,500.00 in capital to secure the position.

The Return is a very nice 8.6% for an average

holding period of about 10.5 months, with not work

on my part. Many people feel that selling naked puts

for income means selling just one or two months out.

But for some companies the long range chart offers a

lot of potential for long range naked put selling.

UPDATE NOV 10 2010: To continue this trade I

have sold 2 Naked Puts for Jan 55 for 2.81. I will

eventually sell more but I want to wait to see if

coke pulls back and honestly, I have a long time

until Jan 2012 so there is plenty of time to see if

KO should pullback and I can sell some more Jan

Naked Puts

for better premiums. |

| Nov 5 10 |

62.29 |

BTC 5 NP JAN 55 @ .23 |

|

|

13.25 |

|

|

(128.25) |

(0.41) |

18363.25 |

| Nov 10 10 |

62.55 |

STO 2 NP JAN (12) 55.00 @ 2.81 |

|

|

9.50 |

|

11009.50 |

552.50 |

5.01 |

18915.75 |

| Dec 7 10 |

64.20 |

BTC 5 NP JAN 57.50 @ .14 |

|

|

13.25 |

|

|

(83.25) |

(0.24) |

18832.50 |

| Dec 7 10 |

64.20 |

STO 5 NP Jan 62.50 @ .68 |

|

|

13.25 |

|

31,263.25 |

326.75 |

1.04 |

19159.25 |

| Dec 31 10 |

65.50 |

STO 5 NP Feb 62.50 @ .61 |

|

|

13.25 |

|

31,263.25 |

291.75 |

0.93 |

19451.00 |

| Dec 31 10 |

65.50 |

BTC 5 NP Jan 62.50 @ .13

COMMENTS: This is an easy trade to decide on. The stock

continues to hold to the upper bollinger and this is a

simple roll from Jan to Feb at the same strike for more

premium. |

|

|

13.25 |

|

|

(78.25) |

(0.20) |

19372.75 |

| |

|

Carry Forward from 2010 $19,372.75 |

|

|

|

|

|

|

|

|

|

Feb 18 11 |

64.55 |

Expiry 5 Naked Puts Feb $62.50 expired |

|

|

|

|

|

|

|

|

|

Mar 16 2011: Last October Coke

was around $60.00 and I was selling the $57.50 put.

With today's pullback I was able to sell April $60

put strike for a 1.5% premium. The chart on Coke

looks poor, but it's more because of the market

condition than Coke itself. I sold just 3 naked puts

and will sell another 3 should the opportunity

present itself for better premiums, if the stock

falls lower. So how low could KO fall? The pullback

for Coke has been very dramatic all week. The stock

has fallen right through the 50 day, and now the 100

day EMA. The stock has broken support which sat

around $62.50. The next major support is at $60.00

I sold just 3

naked puts for April. If the stock falls through

$60.00 there is not much support until around $55.00

to $57.50. The chart below is for the past year.

$60.00 marks the 200 day EMA at the present time. I

would love to sell the $55.00 naked put again on

this stock and I may yet get the opportunity. At

present I am hold Jan 2012 55.00 naked puts and now

the April $60.00. You can see that a pullback

to $57.50 or even $55.00 will take the stock back to

September 2010 and could mark a lower trading range

for Coke. With a dividend of $1.88 - that would mark

a yield of 3.4% at $55.00. I would think there

should be good support at those levels. If KO breaks

through $60.00 then it may be an easy drop to

$57.50. I am holding the remaining puts back to see

where the stock heads from here.

|

|

Mar 16 11 |

61.55 |

STO 3 Naked Puts April 60 @ .90 expired |

|

|

10.75 |

|

18010.75 |

259.25 |

1.43 |

19632.00 |

|

Mar 17 11 |

62.20 |

Bought 300 shares @ $62.20

Comments: Today I am committing my capital earned

and purchasing 300 shares. I believe the trend is

back up for Coca Cola and I will hold my shares for

a week or so and see at what price I can sell at. |

300 |

|

7.00 |

(18667.00) |

(18667.00) |

|

|

|

|

Apr 1 2011: No April Fool's

Joke today, I sold my Coca Cola Shares. I am

continuing to hold my April 60 naked puts. At $60.00

Coke is fairly valued and I would be content to own

it.

|

|

Apr 1 11 |

67.34 |

Sold 300 shares @ $67.34 |

0 |

|

7.00 |

20195.00 |

0.00 |

1528.00 |

8.1 |

21,160.00 |

|

Apr 15 2011:

I am still holding 3 naked puts for Jan 2012 at

55.00. I don't like any of the at the money puts on

KO. I would prefer the 62.50 put. Looking at the

stock it has had a fast run up. MACD is indicating

that the stock may have topped here for a bit. I

will wait for a pullback in KO or see what premiums

are like for June $62.50 on Monday.

|

|

Apr 15 11 |

68.01 |

Expiration 3 Naked Puts Apr 60 expired |

|

|

|

|

|

|

|

|

|

APR 26 2011:

COCA COLA MISSES BY 1 CENT

Earnings were .86 cents per share for the quarter

and the consensus was for .87 and the stock sold off

to 65.81. It wasn't really the 1 cent miss, it was

the fact that the CEO Muhtar Kent, said "I am

pleased with our first quarter results.

Despite ongoing global

geopolitical challenges," That's all it

takes some times. Remember the market is run by

fear. Fear of missing a rally and fear of being

caught in a downturn. It's like US President

Roosevelt said during the depression, "The only

thing we have to fear is, fear itself" and for stock

and commodities markets, that pretty well sums it up

every day.

I jumped in and sold

some JUNE $62.50 puts as I remain risk averse to

selling at the $65.00 strike. I would love to sell

the 65 strike but each time the stock gets up there,

it has trouble. The return for the JUNE $62.50 naked

put is slightly less than half a percent a month,

but if there is some more selling in KO, it could

easily fall back to around $62.70 as it was just a

month ago. I will take advantage of any further

weakness and keep selling naked put contracts to

build up a position, whenever the opportunity

arises.

Remember my strategy

of earning 1% a month on my entire portfolio: Some

naked puts generate higher returns like Nucor and

other stocks such as KO, generate less but are more

stable.

Read about my strategy and how I implement it again

here, if you have not already.

|

|

Apr 26 11 |

65.89 |

STO 5 naked puts JUN $62.50 @ .53 |

|

|

13.25 |

|

31,263.25 |

251.75 |

0.80% |

21,411.75 |

|

May 23 11 |

67.90 |

BTC 5 naked puts JUN $62.50 @ .11 |

|

|

13.25 |

|

|

(68.25) |

(0.21) |

21,343.50 |

|

MAY 23 2011:

.

Today's selling presented an opportunity. I bought

to closed by June $62.50 puts so I could use the

capital to apply to selling 8 naked puts for JULY

$65 at 0.85. I realize looking at the chart that

$65.00 is in the high range, but with Coca Cola I do

not believe it is yet over valued and with it

trading at 13X earnings and earnings being so good,

I believe this is a great strike. Should I be

assigned, my actual cost basis is $37.51 due to the

large amount of income I have made over the past 2

years.

|

|

May 23 11 |

67.24 |

STO 8 Naked Puts JUL $65 @ .85 |

|

|

17.00 |

|

52017.00 |

663.00 |

1.27% |

22,006.50 |

|

Jun 1 11 |

67.00 |

BTC 8 Naked Puts Jul $65 @ .92 |

|

|

17.00 |

|

|

(753.00) |

(1.44) |

21,253.50 |

|

JUNE 8 2011

I bought to close my 8 naked puts

for July on June 1, as it seemed obvious to me that

Coca Cola would pull back. Today I went back in and

sold a small reverse ladder of puts, selling the Aug

$60.00; $62.50 and $65.00. The majority of the puts

are at the $62.50 strike. I am still holding January

$55.00 puts. I believe looking at the past 3 years

in Coca Cola that the stock has a good chance of

ending up somewhere between $55.00 and $60.00 during

the second half of the year. There could easily be a

rally in the fall. My plan is pretty straight

forward. If the stock pulls back to $60.00 by

August, I will be rolling out my reverse ladder into

the fall and I will reduce the number of contracts

in the roll. If the stock falls 10% to reach $60.00,

then put premiums will be larger going into the

fall, allowing me a very good profit to do my

rolling forward of these puts. Meanwhile with the

amount of capital earned since starting the trade

two years ago, combined with the capital now being

used, would afford me 1200 shares at a cost basis of

$42.51 if I was assigned on all shares. Meanwhile I

look forward to more volatility to increase premiums

in my August puts.

|

|

Jun 8 11 |

65.10 |

STO 5 Naked Puts Aug $62.50 @ 1.02 |

|

|

13.25 |

|

31,263.25 |

496.75 |

1.58% |

21750.25 |

|

Jun 8 11 |

65.10 |

STO 3 Naked Puts Aug $60 @ .54 |

|

|

10.75 |

|

18,010.75 |

151.25 |

0.83% |

21,901.50 |

|

Jun 8 11 |

65.10 |

STO 2 Naked Puts Aug $65 @ 1.95 |

|

|

9.50 |

|

13,009.50 |

380.50 |

2.92% |

22,282.00 |

|

AUG

4 2011

I bought to close all my August

puts and luckily since I had sold these puts so far

out of the money all the puts left me with a profit.

I have closed now not so much in case the stock

falls but to free up cash in the event that the

stock falls further and I want to sell puts or naked

calls at a lower level. Right now though I kind of

doubt the stock will fall much further for a few

days. I am still holding my January $55.00 puts

since that would be an excellent price point to

enter Coca Cola should it fall that low.

Today Coca Cola Stock

fell through the 100 day. The 200 day is down just

below $65.00. I don't think the stock will get there

overnight but in a bear market I think it is bound

to happen. Back in mid-March the stock fell below

$62.00. That will be my price point to wait for.

|

|

Aug 4 11 |

66.15 |

Bought to close 3 Naked Puts Aug $60 @ .15 |

|

|

10.75 |

|

|

(55.75) |

(0.31) |

22226.25 |

|

Aug 4 11 |

67.70 |

Bought to Close 5 Naked Puts Aug $62.50 @ .28 |

|

|

13.25 |

|

|

(153.25) |

(0.49) |

22073.00 |

|

Aug 4 11 |

67.67 |

Bought to close 2 naked puts Aug $65 @ .67 |

|

|

9.50 |

|

|

(143.50) |

(1.1) |

21929.50 |

|

AUG

9 2011

After yesterday's market collapse

I thought today might prove eventful for some of my

favorite stocks and Coca Cola turned out to be one

of them. I sold the Sept $60.00 for $1.10

|

|

Aug 9 11 |

63.70 |

Sold 4 Naked Puts 17SEP11 $60.00 @ 1.10 |

|

|

12.00 |

|

24012.00 |

428.00 |

1.7% |

22357.50 |

|

Sep 16 11 |

71.23 |

Expiry: 4 Naked Puts Sep $60 expired |

|

|

|

|

|

|

|

|

|

Sep 22 11 |

66.85 |

Sold 8 Naked Puts 22OCT11 $62.50 @ .88 |

|

|

17.00 |

|

50017.00 |

690.75 |

1.3% |

23048.25 |

|

Oct 21 11 |

68.19 |

Expiry: 8 Naked Puts Oct $62.50 expired |

|

|

|

|

|

|

|

|

|

Nov 21 11 |

65.95 |

Sold 5 Naked Puts 19JAN13 $55.00 @ 3.20 |

|

|

13.25 |

|

27513.25 |

1586.75 |

5.8% |

24635.00 |

|

Nov 28 11 |

64.90 |

Sold 20 Naked Puts 17DEC13 $62.50 @ .70 |

|

|

32.00 |

|

125032.00 |

1368.00 |

1.0% |

26003.00 |

|

Nov 28 11 |

64.90 |

Sold 10 Naked Puts 21JAN12 $60 @ .70 |

|

|

19.50 |

|

60019.50 |

680.50 |

1.1% |

26683.50 |

|

Dec 9 11 |

67.57 |

BTC 20 Naked Puts 17DEC13 $62.50 @ .03 |

|

|

32.00 |

|

|

(92.00) |

(0.07) |

26591.50 |

|

Dec 14 11 |

66.30 |

Sold 10 Naked Puts 21JAN12 $62.50 @ .41 |

|

|

19.50 |

|

62,519.50 |

390.50 |

0.62% |

26982.00 |

|

Dec 30 11 |

69.90 |

BTC 10 Naked Puts 21JAN12 $60 @ .04 |

|

|

19.50 |

|

|

(59.50) |

(0.09) |

26921.50 |

|

Dec 30 11 |

69.90 |

BTC 10 Naked Puts 21JAN12 $62.50 @ .06 |

|

|

19.50 |

|

|

(79.50) |

(0.13) |

26842.00 |

|