Advance Decline Numbers – Close Of Tue May 23 2017

Tuesday saw stocks stay in a very small tight range. The Dow Jones index stayed positive all day while the NASDAQ slipped into negative readings a number of times.

By the close however, all 3 indexes were positive in what was a day of a lot of stocks moving sideways.

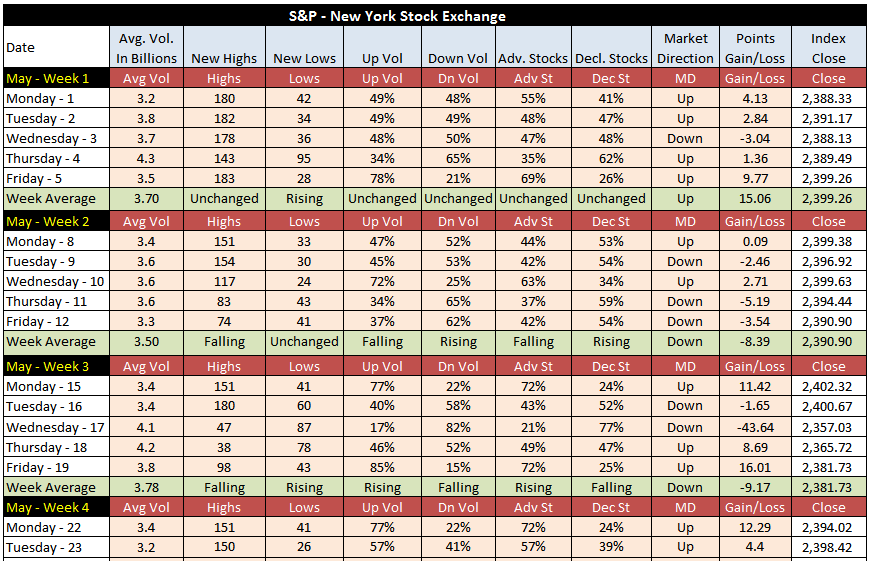

S&P New York Stock Exchange Statistics At The Close

Volume moved lower on Tuesday by 200 million shares but new highs remained constant at 150 while new lows dropped back, falling almost 50% to just 26. This is a bullish signal for the rest of the week.

Up volume and the percentage of stocks advancing were both above 50% and well above negative or declining volume and stocks.

The market was up just 4.4 points by the end but the signals were clearly positive from the Market Breadth Indicators.

Wednesday should see the S&P experience some further weakness but another positive close is expected.

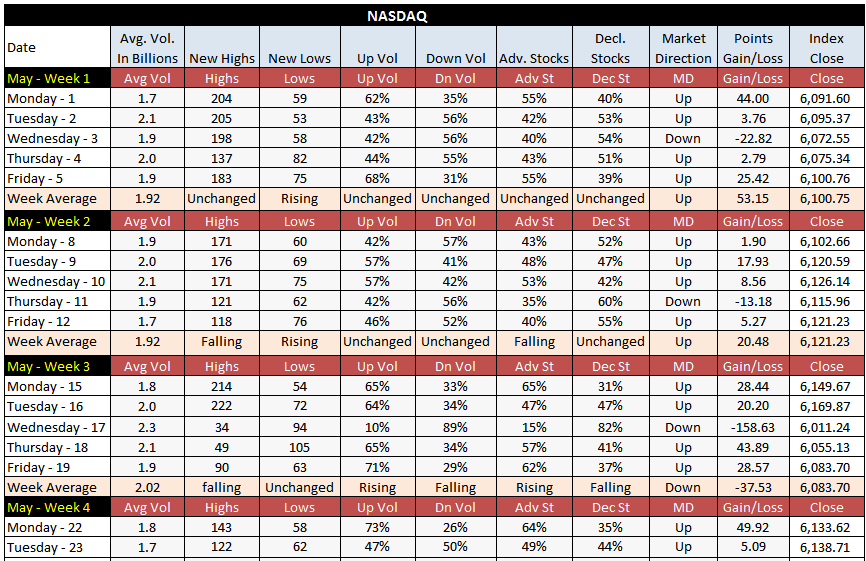

NASDAQ Statistics At The Close

The NASDAQ Volume fell back by about 100 million shares which is negative for stocks. As well the new highs dipped lower and the new lows was almost unchanged, neither of which are positive for stocks.

The NASDAQ is not as steady as the S&P is.

Still the NASDAQ managed to gain 5 points but more important, the index failed to fall after two steady up days.

The market breadth numbers this evening for the NASDAQ are not overly bullish.

Overall Outlook For Wednesday May 24 2017

For Wednesday the NASDAQ should stay weak but try for another positive close.

Market Protection Outlook

Only mild protection is needed as the indexes look steadier than they did mid-week last week.

I am still focusing on smaller trades and scale into them over a period of several weeks.

I think there should be enough time to purchase protection if the signals turn back down for stock indexes.

Remember that you always trade at your own risk. Judging market events which can impact the direction of equities will always have a large chance of error as trading in equities is more emotional than fundamental even at the best of times. Read the full disclaimer.

Any questions can be emailed to members@fullyinformed.com or posted to the Teddi’s Help section of the private members only forum, which you can find through this link.

-

Review All Market Breadth Indicator Articles (listed recent to oldest)

Recommended:

Trade Strategy and Analysis – Rogers Stock (RCI.B) for July 11 2014 – Profit and Protection Through Using Options

Ideas For Repairing Apple Stock (AAPL) In-The-Money Covered Calls – Investor Questions

9 Tips To Tame A Whiplash Market – Become A Better Investor