As regular readers know I use the Weekly Initial Unemployment Insurance Claims as part of the market timing system. You can review the entire strategy through this link. Suffice to say, anything below 350,000 a week in initial claims is considered bullish for stocks and anything above it is considered weak for stocks.

General Market Direction Trend

As well it is important to see that a trend is developing and continues to develop with regards to the Weekly Initial Unemployment Insurance Claims. Back in 2009 with the market direction collapsing, the Weekly Initial Unemployment Insurance Claims were climbing. It was not until those claims started to decline that the stock market turned back up.

At present the trend is staying below 350,000 but the weekly numbers are not improving but instead moving sideways. For stocks to remain bullish the Weekly Initial Unemployment Insurance Claims needs to continue to decline until it gets below 300,000. From there it can trend sideways but for example, last week’s average was revised back to 351,250 which puts it in the corrective environment for stocks.

Any movement higher in the Weekly Initial Unemployment Insurance Claims almost always has been followed by weakness in stocks and a round of selling.

Current Market Direction Trend – Up

In the week ending July 13 the Weekly Initial Unemployment Insurance Claims was down 24,000 to 334,000. On the surface this looks good, but overall the 4 week moving average is at 346,000 which is just slightly below the 350,000 threshold where stocks enter selling periods.

Problems With Unemployment and Market Direction

While stocks keep flirting with all time highs, it is obvious from the unemployment figures that the stock market direction is high thanks to the stimulus efforts of the Federal Reserve.

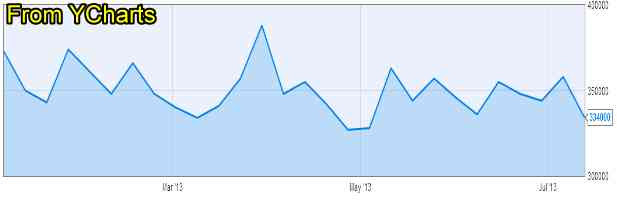

For example, these two charts below from Ycharts show the problem being faced by unemployment statistics. While the numbers remains fairly decent, there are not really declining but are instead trending sideways. This is obvious from the weekly chart below. Only in April and May were there weekly periods with claims below 330,000. There have been no periods with claims down to the 300,000 mark.

The graph below shows the Weekly Initial Unemployment Insurance Claims since January and you can see the sideways movement in the release of these figures and the stubbornness of unemployment to fall back to the 300,000 weekly initial claims level.

Increase Versus Decrease in Unemployment Stats

Increase Versus Decrease in Unemployment Stats

Another area of concern is the number of states with increasing employment versus those with decreasing employment. For example the chart below from the US Labor Department website tells the ongoing problem with the unemployment statistics. To sum up the chart below, unemployment is still a major problem and many states are seeing more layoffs versus hirings.

Market Direction To Keep A Watch On

All of this points to a juicing of the stock market through Fed activity. It should be remembered that the stock markets are very small in assets versus classes like Bonds. Therefore stocks are much easier to manipulate and Quantitative Easing programs impact the overall stock market far more than many other classes.

Therefore as long the Federal Reserve maintains its Quantitative Easing programs stocks should continue to do well, but when the scaling back does occur, stocks will most likely see a correction that could start slow and shallow but if the Weekly Initial Unemployment Insurance Claims start to rise and reach the 350,000 plus threshold, I will be adding additional protective measures to my positions and certainly buying Spy Put Options which have performed incredibly well when the Weekly Initial Unemployment Insurance Claims rise above the 350,000 price level.

Market Timing System And Investing Decisions

To sum it up then, it is important to watch the Weekly Initial Unemployment Insurance Claims for any sign that the trend is:

- Not improving

- Stats are rising toward 350,000

- Stocks are stalling

When those three points occur watch MACD for a sell signal on the market direction before buying Spy Put Options or for those who follow my market direction portfolio, buying SDS or other ultra short type ETFs.

Internal Market Direction Links

Market Direction Portfolio Ongoing Trades (Members only)

Profiting From Understanding Market Direction (Articles Index)

Increase Versus Decrease in Unemployment Stats

Increase Versus Decrease in Unemployment Stats