This, the third article in my Teach The Bear New Tricks looks at a Stock And Option Strategy for rising stocks in bear markets. Bear markets are not all doom and gloom. They provide increased volatility which push option premiums high making put selling and covered call selling very profitable. Fund managers cannot simply pull all their capital out of stocks and wait out a bear market. This never happens. They therefore look for value in diversified large cap dividend payers. Stocks like Johnson and Johnson, PepsiCo, McDonalds, Yum Brands and the like.

This movement of capital into these large cap stocks creates a great stock and option strategy that I have used often in bear markets. Thanks to higher option prices and wide swings in stock valuations I often find that one day I am selling options and sometimes just a few days later buying them back for profits.

Starting in January 2011 my Stock and Option positions moved into a conservative stance. My favorite stock and option strategy for these situations is the cautious bull which I have mentioned many times throughout the year. It is becoming increasingly clear that the heavy market manipulation by governments around the world is not going to diminish and over the next few years it could have dire consequences for every investor, whether they hold stock and option, bonds, forex, or commodities. Being ready for any market meltdown is prudent thinking.

So where does this leave investors? Investors need to realize that the markets they are invested in are dangerous. Equities of every kind have always been risky assets but today that risk is elevated beyond the norm. That risk is now extended to bonds as the chance of bankruptcy in everything from municipalities to governments grows.

Back To Stock and Option

So that brings me back to today’s stock markets. It is the only place that I as a small investor feel that I have more control over how I will invest my money. The advantages stock and option markets gives are obvious. The chance to get in, make a profit, then close the position and get back out with my capital still intact.

To accomplish this in this bear market, I believe strongly that the only stock and option positions to consider are those of large cap dividend paying companies. The reason should be obvious. It is not the dividend I care about, but the very fact that as widespread market manipulation by governments continues, the chance of a market meltdown grows. Therefore who would you rather put your money into? Italian, Spanish, French, Greek, Irish, Portuguese, even American debt or large cap companies that are still generating profits.

During the Great Depression many large cap companies not only survived but continued to generate profits. While many companies slashed dividends just as many did not. The problem in the late 1920’s was that many companies stock values were over-inflated so when markets crashed, many stocks fell back to being very under-valued. Coca Cola began trading in 1919 and did a 4 for 1 split in 1935. Select this stock and option link to learn more stock history about KO Stock.

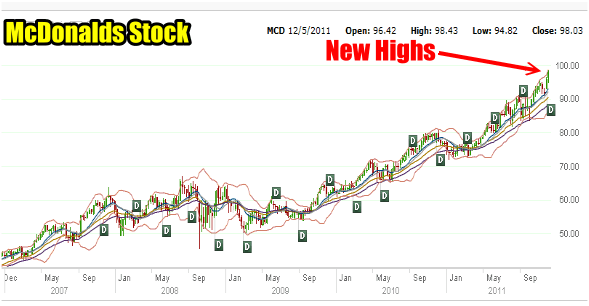

As today’s markets grind sideways smart money continues to buy every dip of large cap diversified dividend paying companies and they shy away from speculative, junior and foreign stocks. Even with the recent market sell-offs, McDonalds stock, YUM Brands stock, VISA stock and MasterCard stock continue to set new all time highs and they are not alone.

Below are a few stock and option examples. Coca Cola Stock is setting all new highs.

Stock and Option / Coca Cola Stock setting new highs

McDonalds Stock is setting new highs.

Stock and Option / McDonalds Stock Setting New Highs

Mastercard Stock is setting new highs

Stock and Option / MasterCard Stock Setting New Highs

The above 3 are just a sampling. The number of large caps setting new highs is growing despite the market gyrations. This is where the fund managers are dumping their capital on every dip.

Stock and Option Advantage Of Large Caps

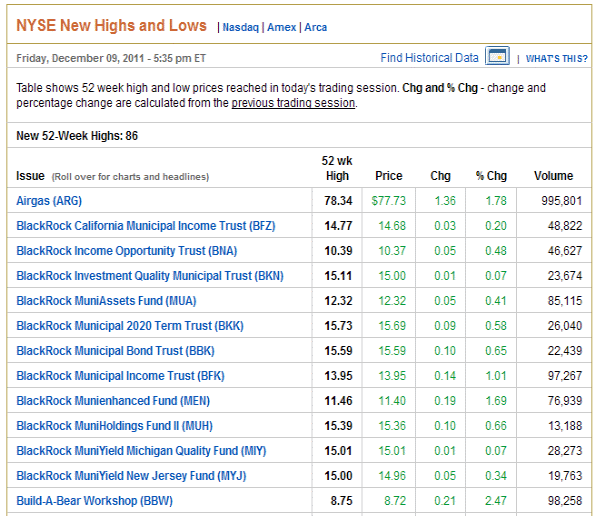

This movement of capital into the large caps is a distinct advantage for the small investor like myself. To find likely candidates there are many online services that can provide a listing of stocks setting new 52 week highs. Select this stock and option link for the daily new highs and lows from the Wall Street Journal. The chart below is from the Wall Street Journal website.

Stock and Option / There are many online services that list 52 week

Once you have found your listing, search through for stocks and weed out juniors, speculative stocks and look for large cap, diversified dividend payors and then go to their stock and option charts.

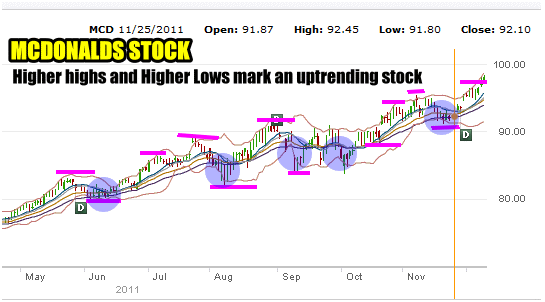

You are looking for stock and option charts similar to MCDONALDS STOCK. You need stocks that have strong uptrends. McDonalds Stock show the typical higher highs and higher lows which marks an uptrending stock.

Every dip in McDonalds stock makes for great put selling opportunities as every dip creates volatility and increases put option premiums. McDonalds Stock in this bear market, is perfect for my stock and option strategy.

Stock and Option charts such as McDonalds which shows Higher Highs and Higher Lows Mark An Uptrending Stock . The Blue Circles show dips where put selling would be a great strategy as the stock continues to climb.

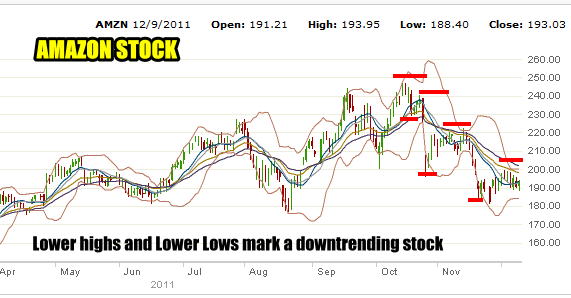

It is important to stay away from stocks that show a break in trends to the downside. Amazon stock and option chart below is one such stock and shows the typical lower highs and lower lows as it moves down. Stocks trending lower run higher risk of assignment when selling puts. There are so many stocks to choose from, making it unnecessary to choose stocks that do not meet the proper criteria for this stock and option strategy.

Stock and Option / Amazon Stock shows lower highs and lower lows. The stock is in a downtrend making put selling more difficult and increasing the risk of assignment.

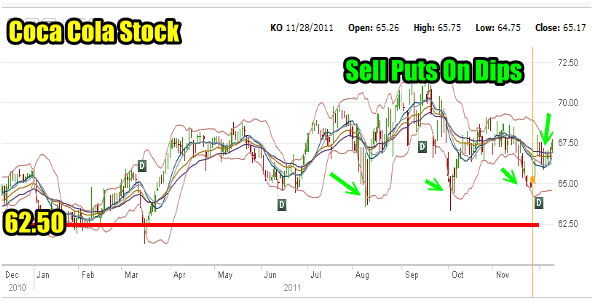

Example of this Stock and Option Strategy On Coca Cola Stock

This stock and option strategy is pretty straight forward. On every dip I sell puts to take advantage of the volatility and the continued rise in the stock while affording myself some protection in the event that the trend suddenly changes. For example on Nov 28 2011 KO Stock fell to $64.75 and volatility spiked. I sold 20 Puts for Dec17 expiry at the $62.50 strike for .70 cents. I then sold 10 puts for Jan 21 expiry at the $60.00 strike also for .70 cents. You can view my stock and option trades for KO Stock here.

On Friday Dec 9 I bought back the 20 Dec17 $62.50 puts for .03 cents. On the Coca Cola stock and option chart below you can see the support at $62.50. Selling the January $60 put affords a lot of protection. Coca Cola Stock has not been to $60 in the past 12 months.

Stock and Option Coca Cola Put Selling The Dips

This Stock And Option Strategy Can Be Done In Reverse For In The Money Calls

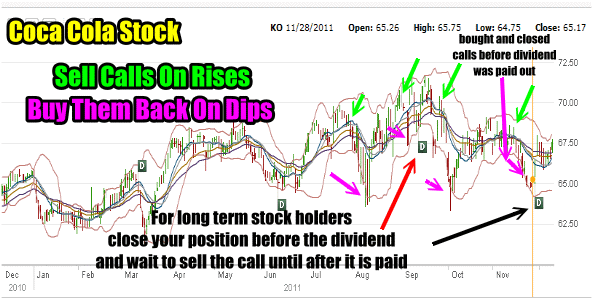

This same stock and option strategy can be done for in the money calls. Taking the same Coca Cola Stock and Option chart the strategy can be reversed. Sell slightly in the money calls AFTER the stock has risen and BEGINS to fall. As the stock falls, check the call option premiums for what was once a slightly in the money call. As the stock falls the premium decreases. Usually at 75% of the premium earned, I buy back my calls and wait for the stock to rise again.

In other words with this stock and option strategy, if I sold the in the money call for $2.00 and it fell in value to .50 cents I would buy to close the position and then look for another stock to trade.

This stock and option strategy is excellent for doing covered calls by investors who are long-term holders of Coca Cola Stock. By buying back on the dips you are protecting yourself from being exercised from your stock. Take care to never sell the call near the dividend date. Wait until after the dividend is declared and then sell the covered call.

By selling slightly in the money, you will earn more on the covered call then selling out of the money calls. When a stock falls, a slightly in the money call will lose premium quickly. This gives you more room for earning income when you purchase back the sold call. For example on Coca Cola Stock below, with the stock at $70.00, I would sell the $67.50 call. In September the call premium for the Oct $67.50 was at $3.05 when I sold my covered calls. Within a few days the stock fell to $67.50 and the Oct premium was down to $1.10. Meanwhile if I had sold the $72.50 call instead, the premium was at .46 cents. With the stock at $67.50 the $72.50 was trading for .12 cents.

Therefore the slightly in the money $67.50 call yielded a return of $1.95. The $72.50 call yielded a return of just .31 cents.

Stock and Option Strategy / Sell Calls On Stock Rises and Buy The Back On The Dips

Calls And Puts In Bear Markets Are Not Equal

It is important to remember when engaging in this stock and option strategy for in the money covered calls, that a bear market will produce higher put premiums than call premiums despite what covered call strategists tell investors. Covered calls and naked puts do not always have equal values for equal strikes. This is because in a bear market the risk to the downside makes put premiums far more attractive than call premiums for option sellers and the market makers know this. Therefore when doing this stock and option strategy remember the best way to earn in the money call premiums is to wait for the stock to rise before selling in the money calls.

How To Insure This Stock And Option Strategy Works

For this stock and option strategy to work an investor has to have confidence in their stock. I have a lot of confidence in the stocks I sell options against. Without that confidence investors second guess themselves and the ability to profit from this stock and option strategy is reduced. When stocks fall investors tend to worry that it may fall further this time than last. They wait rather than following the stock and option strategy consistently. This is usually because the investor is worried about being caught in a large dip and facing assignment.

This is why it is important to select stocks carefully as you may end up owning shares in stock when you least expect it. As the bear market progresses the chance of more whipsaws and even a meltdown grows. Selling a put for $1.00 and then rushing to buy it back for $5.00 creates an enormous loss which takes dozens of additional trades to recover from. Pick stocks that you would own in any market meltdown and which you are confident will recover after the panic ends.

Don’t Use This Stock and Option Strategy On Declining Stocks

There are some steps you can do to put the odds of success on your side. Make sure the stock has not been setting lower highs and lower lows. That is a sure sign that the uptrend may be coming to an end. You don’t want to be engaged in this stock and option strategy and selling puts on a stock that can rapidly fall past your sold puts and place them in the money.

This Stock And Option Strategy Demands You Close Early

To benefit from this stock and option strategy you must consider buying to close your sold option positions early. When the profit is there, take it. A bear market can turn nasty overnight. The concept of this stock and option strategy is to keep your capital safe and risk it for just short periods of time.

Don’t Aim For Big Returns With This Stock And Option Strategy

Don’t go for big returns. Think safety first. The goal of this stock and option strategy is to grab a profit, close the position and return your capital back to safety. It doesn’t matter whether the return is half a percent or two percent. It is the safety of the strike sold that is the most important aspect of this stock and option strategy. Doing dozens of little trades will add up. That’s all you need to continue to profit and grow your capital in a bear market.

Remember The Higher The Stock Climbs, The Faster and Farther It Can Fall

As a stock climbs higher, eventually the rise will end and the stock can rapidly decline. This is why with this stock and option strategy it is important to take your profit and get your capital back out of the stock. This works hand in hand with the previous tip. Forget big profits when selling options in a bear market. Thing protection first and pick your strikes accordingly. Selling at the money puts in a bear market leads to a high risk of assignment. Be sure you want that stock at high prices if selling at the money puts.

With this stock and option strategy the same holds true for selling covered calls. As explained, selling out of the money covered calls generates little protection. In a bear market even the best stock will rise and fall allowing plenty of opportunity to sell and buy back sold in the money call positions. I pick slightly in the money as I have found that in general they provide the best return against long term stock holdings.

This Stock And Option Strategy Needs Large Cap Diversified Companies

Stay clear of foreign stocks, juniors, commodity stocks and in general any stock that is not heavily diversified. This stock and option strategy only works on large cap companies that are heavily diversified. Stocks like Johnson and Johnson, McDonalds, Coca Cola, PepsiCo, Yum Brands, Proctor and Gamble and Visa to name just a few.

Consistency Wins With This Stock and Option Strategy

In closing let me repeat that being consistent is the only way for this or any strategy to work repeatedly and successfully. A stock and option strategy such as this requires investors to have confidence in the stock they are selling options against. Without confidence investors second guess and the opportunity to benefit from this stock and option strategy, is lost.