SPDR 500 ETF when it was first introduced in 1993 delighted me as within weeks of paper trading I realized that it offered the very best means for hedging with options using the SPY PUT. At the outset of using the SPDR 500 ETF I made lots of mistakes as I tried hedging with options. I bought both spy calls and spy put options depending on the market direction as I tried to time the market and benefit from either direction. When the market trended up I would buy SPY CALL options and when it trended down I bought SPY PUT Options. I found that it was difficult to gauge both market directions and benefit as well as profit through using the Spy Call and Spy Put on the SPDR 500 ETF. I spent months paper trading and continued to find a number of errors with my SPDR 500 ETF for hedging with options. These included:

SPDR 500 ETF Mistakes Made

1) Holding my spy puts or spy calls too long and thereby getting caught on whipsaws in the market where the trend seemed down and suddenly turned back up.

2) I sometimes held my SPDR 500 ETF options over the weekends which continually was the right move only half of the time. When I was right I did okay but if I was wrong on the SPDR 500 ETF options, buying back the SPY PUT options or SPY CALL Options was killing my portfolio.

3) Putting too much capital into trading the spy. The more capital I put into the SPDR 500 ETF, the harder it was to earn profits. I found when I used less capital my returns were better.

4) I tried hedging with options by spreading out both the SPY CALL and SPY PUT out over a period of time and at varying strikes which was in the end a disaster as volatility could raise and lower the SPDR 500 ETF option premiums faster than I could react.

5) I began trading the spy rather than concentrating on hedging with options using the SPY CALL and SPY PUT to trade back and forth as the market direction dictated. It was exciting but not profitable.

6) I tried selling the SPY PUT options and SPY CALL options as I thought hedging with options could be attained by shorting either side of the SPDR 500 ETF and benefiting from the rise or fall of the S&P 500. This was not worthwhile as when the S&P 500 rose I basically earned a dollar or two on my SPY Put short. When the market fell I again earned just a dollar or two on the SPY Call short. I also found that to earn a decent return from the SPY Options I had to hold them longer than a week which meant I was often killed by the volatility and swings in the SPDR 500 ETF as it fluctuated with the overall S&P 500. My hedging with options through the SPDR 500 ETF was not working out.

7) I found when either selling the SPDR 500 ETF options or buying them that I went for too short a time period often going out less than a month and at other times going out longer than two months. Again this attempt at hedging with options did not work and instead of hedging my portfolio with options I was actually adding more losses through the SPDR 500 ETF to my overall portfolio.

Hedging With Options On The SPDR 500 ETF

After paper trading for months and studying the charts I decided to attach a market timing tool or two to trading spy options. I tried different market timing tools including my 10 20 30 Moving Averages Strategy which failed miserably on the SPDR 500 ETF. However I found that the fast stochastic market timing tool did very well at spotting when the overall market seemed ready for a bounce and I found that the ultimate oscillator if I tweaked the settings showed me strong oversold and overbought conditions in the S&P 500.

Hedging With Options Using The Fast Stochastic

The fast stochastic market timing tool was the first real success in my attempt at hedging with options by using the SPY PUT and SPY CALL options. I used the fast stochastic every evening to look at the market direction of the S&P 500. For example below is the S&P 500 fast stochastic chart from yesterday. The reading yesterday shows a %K at 2.21 and a %D at 15.30. The %D being higher than %K is an indication that the overall market direction is lower. The %K however being down to 2.21 is an extremely oversold reading which means the market could bounce from here.

SPDR 500 ETF and the fast stochastic reading for May 14 2012 on the overall S&P 500

I have seen readings in the Fast Stochastic on the S&P 500 as low as 0.05 which is an extreme reading. When using the SPDR 500 ETF I found that if I waited for that low reading in the %K from the fast stochastic I could often buy SPY Call Options and benefit enormously in the bounce up. If though I was wrong and the market kept falling which the %D warned continuously about, then I had to be quick to buy back my SPY Call options.

Instead I found it better to use the %D reading as an indication of overall market direction and stay to the short side by buying SPY PUTS on market downturns. When paper trading against the %D readings I found my spy put options were continually profitable and losses when the market direction did not work out were minimal.

This was the beginning of my hedging with options through using the SPDR 500 ETF options.

Hedging With Options Using The Ultimate Oscillator

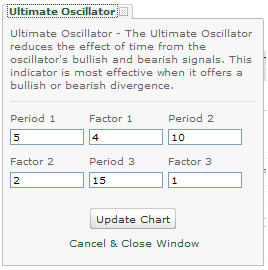

Next up was the ultimate oscillator market timing tool. I found the Ultimate Oscillator was excellent when I changed the settings to what you see in the image below. These made the time periods shorter than the standard 7, 14, 28 and provided me with better timing indicators on the S&P 500.

Hedging With Options through the Ultimate Oscillator became better when I changed the settings of the ultimate oscillator to a shorter period.

Hedging With Options And The 1 Minute S&P 500 Setting

I then changed the S&P 500to a 1 minute setting and immediately found that the Ultimate Oscillator gave me strong oversold and overbought readings. The S&P 500 chart below is from my SPY PUT Trading from May 14 2012. You can see how right from the start the S&P 500 fell and the Ultimate Oscillator readings showed a strong oversold indications. I originally tried using both the fast stochastic and the ultimate oscillator on the SPDR 500 ETF itself but the readings were not accurate and did not reflect strongly enough the actually selling and buying in the S&P 500.

By adding the 1 minute SPX Chart to the Ultimate Oscillator I immediately saw the oversold and overbought indications on the overall market trend. I have marked overbought and oversold on the Ultimate Oscillator below. You can see how in the morning I bought SPY PUTS and then within an hour the overbought readings as the market fell, continued to signal that it was time to sell my spy put contracts.

Hedging With Options and the Ultimate Oscillator Readings made for a perfect combination

I knew at this point that the SPY PUT option on the SPDR 500 ETF would become the best means of hedging with options my entire portfolio. I also learned that there were many days when the opportunity to earn profits from my SPY PUT options Hedge came more than once or twice.

SPY PUT Profiting From Day Trading

I found that when stock markets are in a state of alarm or concern, the volatility within the market itself pushes the indexes to extremes both up and down and do this often more than once in a day. When markets sell off such as the S&P 500 yesterday, there are strong counter reactions as investors determine that stocks are undervalued. They jump in and push those stocks back up. Then sellers emerge and push the stocks back down. The amount of day trading on the S&P 500 is enormous in size, volume and scope and continues to grow annually. This helps with volatility. On days like yesterday (May 14 2012) the market fluctuates widely creating numerous opportunities with the SPDR 500 ETF to buy and sell both SPY Call options and SPY PUT Options various times during a single day.

Below is my second trade from yesterday. It took me several years to become better at judging optimum moments to both enter and exit my SPY PUT trade. For example, when trading with options there are small signals that are worth watching. In the second trade there was a rally attempt in the afternoon and the a second and finally a third rally attempt. Each rally attempt saw a lower high which is a clear indication that the momentum has shifted from the buyers back to the sellers. That’s when I buy my spy put contracts. The Ultimate Oscillator reflected those rally attempts but you can see in the ultimate oscillator that the overbought indications were less strong with each rally. The loss of strength in the overbought indications is my clue that it is nearing time to buy SPY PUT Contracts.

It is also important to remember the reading from the Fast Stochastic which was clearly showing market down. Therefore the chance of a rally into the close of trading with such a strong bearish sentiment is rare. I held my spy puts until almost the close before selling them.

My second SPY PUT Trade for the day is shown in the chart. The ultimate oscillator has remained my guide for hedging with option when day trading with options on the SPDR 500 ETF

A lot of the hedging with options ability comes from trading with options against the SPDR 500 ETF for the last 18 years. Paper trading is incredibly important but it must be done right but that will be another article in the future. Through paper trading for months I perfected my strategy enough to be able to start hedging with options through the SPY PUT.

SPY PUT VS SPY CALL

I found during the first few years that the capital I earned when timing uptrends and buying and selling the SPY Call options was considerably less than buying and selling the SPY PUT options on the way down. I calculated that volatility when market direction was down was much higher than market direction up and it inflated SPY PUT Premiums more than the SPY Call premiums. Even when the market was climbing SPY Call premiums were not as attractive as the SPY PUT premiums when the market direction turned down. Obviously the market makers want investors to pay more for protection.

As well I found that the SPY Put Premiums as the market fell even during the day were inflated beyond what I would consider normal premiums simply I believe, because the market makers want to make sure they “squeeze” as much money as possible out of those investors scared that the market is going to fall further and faster. As well I am sure market makers are like a lot of investors and worry that “this time is different” and the market may indeed tank, and they will be covering large losses in the event that they did not charge adequately for the spy put option.

Naked Put Selling , Covered Calls and the SPY PUT

I found that my naked put selling and covered calls when the market direction was up made more than buying and selling SPY Call options. I therefore determined that the SPY PUT would become my best means of hedging with options my entire portfolio. It was from here that I developed the concept of building up a large cash cushion over the course of a year to protect my portfolio positions.You can read further about my cash cushion concept in the three-part strategy articles in the links below:

Understanding SPY PUT Hedge Strategy Part 1

(When I Can Watch The Market During The Day)

Understanding SPY PUT Hedge Strategy Part 2

(When I Am Unable To Watch The Market)

Understanding SPY PUT Hedge Strategy Part 3

(Short version using only ultimate oscillator)

SPY PUT – The Ultimate Hedging With Options Strategy

To conclude then, there is of course more to the story of my SPY PUT options hedge and there have been many tweaks over the years including my method of trading when I was younger and could not watch the market as I was at work. But the important message is that the SPY PUT contracts of the SPDR 500 ETF changed forever the method I used for hedging my entire portfolio. Thanks to the SPDR 500 ETF I have enjoyed significant returns and plenty of protection more almost two decades and I see no reason to believe it will change any time soon. It took years to perfect this SPY PUT hedge and hours of trading with options on paper to get my system to work consistently. I still make mistakes such as last year when I held my SPY PUT Contracts too long despite the signs from the fast stochastic that the market trend was changing to up. That was one of my bigger losses for the last few years.

In a stock market crash or bear market the SPY PUT is an enormous benefit that I have not found with any other hedging method or strategy as a small investor. I have presented this article here as I hope to continue to discuss all the methods I have tried and used for hedging while delving deeper into how I have formed my strategy and how it continues to perform. For those investors interested in the SPY PUT as a hedge, I suggest reading the various articles on the SPY PUT which I publish with each SPY PUT trade and I suggest reviewing the past couple of years of my spy put trades. Finally I would recommend paper trading to learn how to use the SPY PUT Hedge effectively to protect and profit from stock market downturns.

SPY PUT OPTION LINKS

Internal References:

Listing Of SPY PUT Trade Articles

Articles Discussing The Ultimate Oscillator

External References:

SPY PUT Option Chain

SPY ETF Home Page From State Street Global Advisors (SPDR)

month or two