Scotia Stock (BNS) is in both my RRSP (Retirement Portfolio) and my Canada Stock Portfolio where I do put selling. In my retirement portfolio I sell covered calls against Scotia Stock because in Canada the law prohibits put selling or cash secured put selling in a retirement portfolio.

Scotia Stock trading symbol is BNS. BNS Stock trades on both New York and Toronto. I trade Scotia stock and options primarily on the Toronto Stock Exchange. Once in a while the options will be better in the USA on Scotia Stock, so I will take advantage and sell puts in the USA instead of Canada.

There is a lot to like about Scotia Stock. Bank Of Nova Scotia is the third largest bank in Canada. With assets over 50 billion it is the only Canadian Bank with a strong presence in South America, Central America and Asia but with almost no presence in the United States. Bank of Nova Scotia wrote down about 893 million due to the credit crisis of 2008 to 2009. When Scotia Stock did fall in 2008 I bought shares in December for $30.00 and then in March 2009 I bought more Scotia Stock at $26.00. I felt the dividend was solid and I did not expect a dividend cut. At $26.00 BNS Stock dividend was paying 7.5%. These shares I have tucked away for my children and will not be selling options against them. Select this Scotia Stock link to read more about Scotia Bank Investor Relations. Select this Scotia Stock link to read a brief history of Bank Of Nova Scotia.

Scotia Stock (BNS) Strategy for 2012: I am very unconcerned about holding this stock long-term. For me long-term means anywhere from months to years. Therefore the strategy being employed is simple and straight forward. I sell puts at the money or slightly out of the money until assigned shares. If assigned shares I sell covered calls to be exercised out of those shares. If the stock should fall too low I may purchase some shares and sell them on a bounce. I will often roll my naked puts if they fall into the money with any decline in the stock and I do expect the stock to fluctuate throughout the year.

Scotia Stock (BNS)Trades For 2012Canada Stock Portfolio Scotia Stock Goal for 2012: 12% |

| Date | Stock At Time Of Trade | Scotia Stock Action Taken (All Figures Are Canadian Dollars) ACTIVE TRADES ARE HIGHLIGHTED | Comm. | Shares Held | Capital In Use | Gain/Loss | Total Income |

| Dec 2 2011 | 49.05 | Sold 5 Naked Puts 21JAN12 $44 for .55 (status: expired) | 13.25 | 0 | 22013.25 | 261.75 | 261.75 |

| Dec 5 2011 | 48.40 | Sold 5 Naked Puts 21APR12 $50 for $4.00 (status: closed for .09 Mar 15 2012) | 13.25 | 0 | 25013.25 | 1986.75 | 2248.50 |

| Dec 19 2011 | 48.80 | Sold 5 Naked Puts 17FEB2012 $48 for $1.50 Final Scotia Bank Trade for 2011 (status: closed for .09 Feb 2 2012) | 13.25 | 0 | 24013.25 | 586.75 | 2835.25 |

| END OF 2011 TRADES | |||||||

| Jan 17 2012 | 51.80 | First Scotia Stock trade for 2012 Sold 5 Naked Puts 21APR12 $50.00 for $1.68 (status: closed for .09 Mar 15 2012) | 13.25 | 0 | 25013.25 | 826.75 | 3662.00 |

| Jan 20 | 54.01 | Options expiry: All Jan options expired out of the money | 3662.00 | ||||

| Feb 1 | 51.88 | Sold 5 Naked Puts 21Jul12 $50 for $2.15 (status: active) | 13.25 | 0 | 25013.25 | 1061.75 | 4723.75 |

| Feb 2 | 50.90 | Sold 5 Naked Puts 17MAR12 $50 for .86 (status: expired) | 13.25 | 0 | 25013.25 | 416.75 | 5140.50 |

| Feb 2 | 51.10 | Bought to close (BTC) 5 Naked Puts 17FEB12 $48 for .09 | 13.25 | 0 | (58.25) | 5082.25 | |

| Feb 3 | 51.75 | Sold 3 Naked Puts 19JAN13 $50 for $3.60 (status: active) Comment: To Understand this Scotia Stock put selling trade read this article | 13.25 | 15013.25 | 1066.75 | 6149.00 | |

| Mar 6 | 53.00 | Sold 5 Scotia Stock Naked Puts 20OCT12 $52 for $3.25 | 13.25 | 26013.25 | 1611.75 | 7760.75 | |

| Mar 15 | 55.00 | Bought to close (BTC) 10 Naked Puts Scotia Stock 21APR12 $50 for .09 | 13.25 | (103.25) | 7657.50 | ||

Scotia Stock (BNS Stock) 5 Year Chart

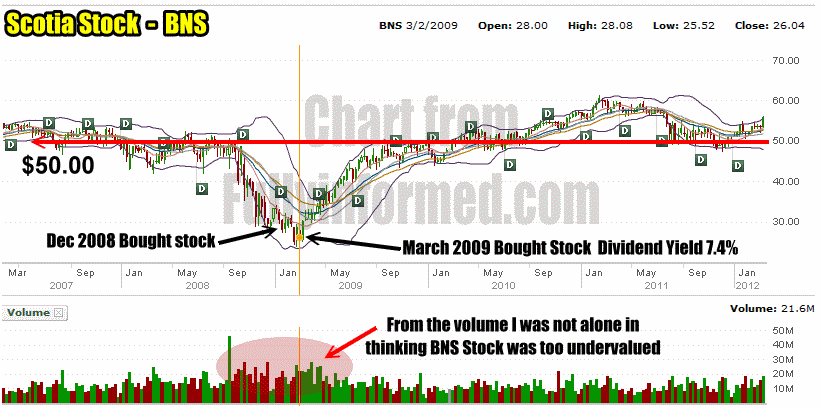

Looking at the 5 year Scotia Stock chart below (BNS Stock) you can see that $50.00 is an excellent strike for put selling. I have also marked the Scotia Stock trades I did in December 2008 and March 2009 when I believed Scotia Stock (BNS Stock) was very under-valued. Looking at the amount of volume during that period it would appear that I was not alone in believing that Scotia Stock was very under-valued when it fell below $30.00

Scotia Stock (BNS Stock) Chart Showing 2007 to 2012