Put selling has so many advantage it’s hard to name them all. One of the most interesting aspects of put selling is being totally in charge of my risk, my capital and my trade from the moment I sell puts until I decide to close the trade.

Recently I received a number of emails inquiring about the 2008 to 2009 market crash and whether I was assigned on a lot of stock since I was put selling during what turned out to be one of the most fierce bear markets in history. I also received an email from a reader who told me his horror story of put selling and being caught in the 9/11 attacks and the subsequent 13% collapse of the S&P.

Put Selling During Market Crashes

I have been put selling against stocks for decades. I started when only a handful of stocks had options available and there were no ETFs or Ultra Type funds. I have been caught put selling during market crashes such as the 1987 collapse when the S&P lost 27 percent; 1990 when the market fell 17% in two months; 1998 when the market lost 21% in two months; and of course the bears of 2000 to 2003 and 2007 to 2009 and let’s not forget the May 2010 market crash. In every one of those events I was holding puts and watched stocks plummet past my sold puts and place them deep in the money.

Investing in equities is risky. But by having a plan and realizing the importance of strategy I believe put selling presents the distinct advantage of being able to decide when to take assignment on stocks and when not to.

Put Selling Against Historic Records

My style of put selling is picking those stocks that I would hold long-term if I had to. I am put selling only with stocks that have a historic track record of recovering from severe bear markets or even declines within their own sector or declines within the stock itself. It is this historic pattern that gives confidence that the stock will eventually recover when the bear ends, affording me an end to my trade and no loss on my original put selling trade.

Bear Markets Hurt All Stocks

In a bear market almost all stocks fall. That’s the reality. In a recovery though not all stocks participate and that too is reality. I prefer to be in a stock that pays a dividend, can support that dividend and has that historic track record of post-bear recovery.

I pick only strong, stocks for put selling. They must have a track record of dividend increases, be able to support that dividend and have a history of recovering from market crashes and stock weakness.

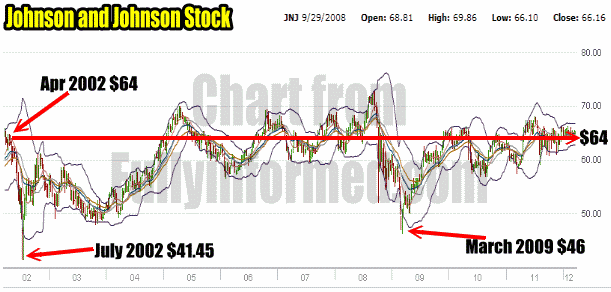

For example, stocks like Johnson and Johnson stock. You can see the past 10 years of JNJ Stock above. JNJ Stock has been in my put selling portfolio for over 10 years. Johnson and Johnson Stock has the historic track record I am looking for. When the stock pulls back whether do to a market collapse or simply weakness in JNJ Stock itself, I know that at some point it will recover. This provides two advantages.

1) I can do put selling into weakness knowing that if JNJ stock collapses and places my sold puts deep in the money, I can buy them back and roll them out or out and down, and eventually the trade should end successfully.

2) Any weakness in the stock can be taken as an opportunity to sell puts. If I am wrong and the stock falls below my sold puts I can consider rolling out and continue put selling at lower prices.

Put Selling Should Be Based On Confidence

Successful put selling needs confidence in the underlying security, otherwise when puts are sold and the stock falls many investors jump back in and buy to close their losing put positions fearful that “this time it will be different”. The losses from this type of knee-jerk reaction can quickly mount.

Put selling is a strategy that earns small amounts which over time become large amounts. If an investor places too many trades and finds he has a number of losses, this will impact the overall return.

When A Collapse Becomes An Opportunity

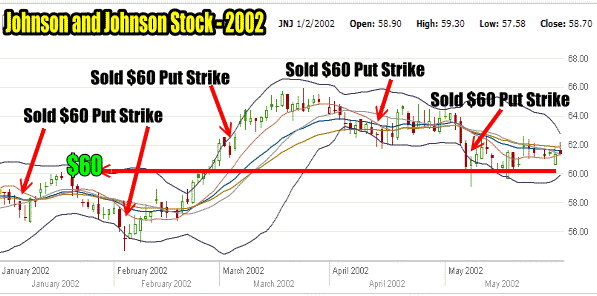

With a stock such as JNJ Stock when it falls, I can look upon it as an opportunity rather than a problem. For example in the period from January 2002 to May 2002 I was put selling at the $60 strike on JNJ Stock. I have marked on the chart below the 5 different periods when I sold the $60 put strike. My belief was that $60 at that time represented fair value for the stock which is why I continued to sell that put strike.

In the winter and spring of 2002 I was put selling JNJ Stock at the $60.00 strike.

In late May the stock market fell apart and commenced a rapid decline. My $60 put strike in JNJ Stock fell deep in the money.

Rolling Naked Puts Down And Out

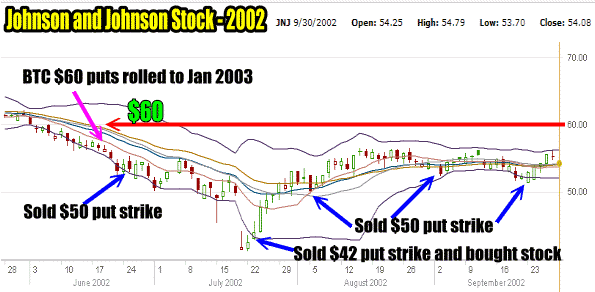

The chart below shows my actions from June to September 2002. In mid-June 2002 before options expiry with JNJ Stock around $55.00 I bought back my June $60 sold puts and rolled them into January 2003 at $57.50. I reduced the number of put contracts from 10 to 9 on the roll out.

I made .35 cents on each put but there was no loss. I then commenced put selling at first $50.00 and then by late July 2002, as JNJ stock fell to $42 I sold the $42 put strike and bought shares. JNJ Stock recovered somewhat and I kept selling the $50 put strike.

Put selling on JNJ Stock from June to September 2002

During the entire period I was not assigned shares.

Put Selling Into The Recovery

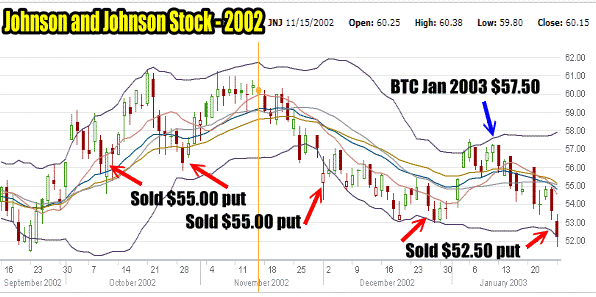

My JNJ Stock trades for the period from September to January are below. I continued to sell puts into the fall of 2002 and as the stock recovered I first was put selling at the $55.00 strike and then as JNJ Stock weakened I was put selling at the $52.50 strike. In mid January 2003 I bought and closed my January $57.50 puts for .20 cents.

Put Selling On JNJ Stock from September 2002 to January 2003

Put Selling And The Successful Roll Out

There were a number of things that I did with my JNJ Stock trade in 2002 that made the roll out successful.

Part of that success came from having confidence in the historic chart of JNJ Stock and my personal belief that if the stock did fall below $40.00 it would be a steal. As well if JNJ Stock had fallen below $40.00 and did not recover I knew I still had the option of buying back my January $57.50 puts and rolling down lower and out another 6 months. I would have rolled to the July $55 put and reduced the number of contracts to 8 from 9.

No Actual Profit From Rolling Naked Puts

The problem with rolling out puts that far is that the capital tied to those puts is earning very little if any return. In my case I rolled for .35 cents and closed for .20 cents. No much of a profit considering I had $51,750.00 committed to the trade.

This though is part of the reason I keep 30% of my capital always available in cash. Because I had cash available, I continued to sell puts on JNJ Stock at lower strikes while waiting for the stock to recover. I also used some of the cash to buy stock in July 2002 at what I considered fire-sale prices for a bounce.

Patience When Put Selling The Stock’s Decline

It is important when a stock falls to be patient and wait for the stock to make a turn or certainly to make a new bottom before put selling against it again. By waiting for clear signals that the stock has bottomed, you can avoid being caught in the downturn, or as many investors term it “catch a falling knife”.

Reducing The Number Of Sold Puts With Each Roll Down And Out

The other factor in successfully rolling the in the money sold puts out in time, is reducing the number of puts with that roll. Many readers may recall my Microsoft Stock trade from 2010 where I was caught when my sold puts ended up in the money. Each roll further out that I did saw a reduction in the number of put contracts I had sold. For example, upon selling 10 put contracts, the roll would mean buying to close 10 put contracts but rolling out 9 or even possibly 8 depending on the cost to roll. It is always preferable to roll for a profit no matter how slight, than to roll out and down for a loss.

By reducing the number of puts sold with each roll out, I have in the past been able to take a position where I was put selling 10 contracts and over a period of rolls get that number down to 5 or less put contracts sold. Each reduction in the number of put contracts frees up capital from risk of assignment and allows for additional puts to be sold at lower levels. By reducing the higher number of put contracts sold and selling at lower strikes I am reducing my average cost of stock ownership should I eventually accept shares in the underlying stock.

With my Microsoft Stock trade of 2010, the stock fell 20% from my sold put strike but I was never assigned shares as I stayed far enough away from the closest month and kept rolling while waiting for the stock to recover all the while reducing the number of put contracts at risk of assignment at higher strikes with each subsequent roll out.

Summary

During the bear market collapse of 2007 to 2008 I rolled a lot of puts and did pick up numerous stocks. Some of those stock trades you can view here.

View The 2009 Canada Stock Portfolio Bear Market Trades

View The 2009 Retirement Portfolio Bear Market Trades

View The 2009 USA Stock Portfolio Bear Market Trades

However the important aspect of put selling is that investors have total control over their put trade and the underlying stock, if they control rolling their naked puts down and out and reduce the number of naked put contracts with each roll out. Put selling successfully needs a sound strategy and strong underlying fundamentals and with both in place, any investor can sleep nights when their naked puts have fallen deep in the money.