Another week has passed and today’s Weekly Initial Unemployment Insurance Claims have been released showing a rise to 348,000. As most readers of FullyInformed.com know I consider the Weekly Initial Unemployment Insurance Claims to be one of the best Market Timing System methods. It has a proven track record going back more than 2 decades. This Market Timing System often spots pressure building on spots and those who follow this market timing system often get a “heads up” before other investors. Interested investor can read the entire article on this market timing system method and how it works through this link.

Feb 27 2014 Weekly Initial Unemployment Insurance Claims

Today’s Weekly Initial Unemployment Insurance Claims moved higher coming in at 348,000. While this could be attributed to the severe weather, that really does not matter to us as investors. What matters most is that this is another warning signal to be aware of. It is rare with the Weekly Initial Unemployment Insurance Claims continuing to rise closer to 350,000 that the market direction can rally significantly. Instead normally stocks enter a period of weakness. If the Weekly Initial Unemployment Insurance Claims move over 350,000 next week, there will be more weakness among stocks.

Economists Expectations

Economists in general had been expecting the Weekly Initial Unemployment Insurance Claims to come in around 335,000. Meanwhile the average of new claims over the past month came in almost unchanged from last weeks 338,500 at 338,250.

This is telling us that whether it is the weather or not, the employment trend is flattening out and has been for several months.

348,000 Warning

At 348,000 investors need to be aware that pressures to the downside will be building. If next week’s numbers come in unchanged or slightly higher than the chance of a prolonged rally in March is questionable.

Trading Chart Based On Weekly Claims

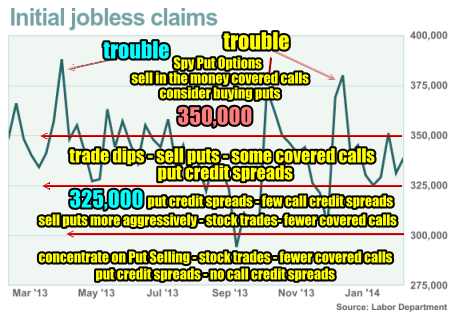

Just to repeat what I wrote about two weeks ago, I base the extent to which I apply my available capital to trades on a pattern developed around the Weekly Initial Unemployment Insurance Claims. Here is that information again.

Weekly Numbers Above 350,000 and Climbing

I focus more on selling in the money covered calls and doing Spy Put Options aggressively. As the weekly claims rise and get closer to 400,000 I normally buy puts on stocks that based on chart patterns I believe are overvalued and will pull back if the market direction corrects. I tend to place fewer trades and begin to raise cash. Above 400,000 I raise a lot more cash.

Weekly Numbers Between 325,000 to 350,000

When the weekly numbers move below 350,000 but stay above 325,000, such as the period now, I focus on trading dips in stocks through selling puts usually naked, doing some put credit spreads and doing some covered calls. This is because in this range normally the market can still move higher but it is more difficult for it to be a straight line up. This means I can sell some covered calls when the market is pushing higher because the likelihood of it not pushing too high is much greater. This will leave my covered calls normally out of the money and expired. I also pick up some stocks for short-trades often referred to as swing trades or even day trades although I do not do many day trades. I only pick up stocks in dips whether they are in a dip themselves such as Cisco this morning, or the market in general is dipping such as it did last week, which pressures almost all stocks. This is a good place for put credit spreads as well since it offers more protection than selling puts naked. This is also not too bad an area for call credit spreads as stocks may have a more difficult time rising too quickly or high enough to place call credit spreads at risk. I tend though not to do a lot of call credit spreads. I prefer being on the Put Selling side.

Weekly Numbers Between 300,000 to 325,000

When the numbers fall below 325,000 stocks have a much easier time moving higher. This means being careful with covered calls unless I do not want to own the stock and would like to be exercised out. It also means being careful on call credit spreads which I do rarely anyway. I sell puts far more aggressively here and will definitely consider put credit spreads as well.

Weekly Numbers Below 300,000

Below 300,000 the market direction rarely corrects. This means I concentrate heavily on Put Selling, doing stock trades particularly using the Bollinger Bands Strategy Trade.

I do very few covered calls, although in my retirement account I do a lot of covered calls on stocks I want exercised. This is because in Canada investors are not allowed to sell puts, even cash secured puts, in our retirement accounts. Therefore I look to set up covered calls trades wherever practical to earn profits that can compare to Put Selling trades. This is not always as easy as it might appear. Put Selling is far superior to covered calls in my opinion. You can read this article to understand why.

At the level below 300,000 I increase the quantities of naked puts I sell and as the numbers fall to 250,000 or more I bring more cash into play. I do no call credit spreads but the number of naked puts is easily 4 or more times higher. When the Weekly Initial Unemployment Insurance Claims get to this level the economy is usually booming and stocks are doing well.

Market Timing System Summary

The outlook based on the Weekly Initial Unemployment Insurance Claims is moving into a more cautionary stance. We are sitting close to 350,000. By following this trading system for my capital use I have rarely been caught with a lot of capital in the market in any major downturn which leaves me with plenty of cash to take advantage of corrections and weakness. Meanwhile the number of articles comparing 2014 to 1929 continue to circulate. Aside from the problems in the Ukraine, the slowdown in China and now the Weekly Initial Unemployment Insurance Claims it has to be an event that is totally “out of the blue” to catch investors unaware (think May 2010 flash crash). There are always warning signs of pullbacks and this morning’s Weekly Initial Unemployment Insurance Claims when rolled into the market timing system I use, is another such sign.

At present I am ignoring all their doom and gloom articles and simply staying aware of the environment I am trading in.

Internal Market Direction Links

Profiting From Understanding Market Direction (Articles Index)

Understanding Short-Term Signals

Market Direction Portfolio Ongoing Trades (Members only)