Market Timing indicators are still showing that the market direction remains under strong pressure. It is interesting the articles I have read lately about the market direction. I read a great one yesterday that talked about how this is the end of the Bull Market. I read another one that indicated this is the start of a new Bull Phase. I read an even better one that discussed how the institutional investors use their huge billions to push stocks lower to create doom and gloom and frighten smaller investors out of their positions so they can scoop up shares and then push the entire market higher. Overall I figure that parts of everything I read probably holds some truth. Market Timing while not a science, can help investors focus on what is important and turn down all the market gossip and noise. By staying focused an investor is prepared for every event, whether up down or sideways. By never being fully invested it allows even the smallest of investors to take advantage of market swings and volatility so remember to keep some cash always available.

Today I wrote a couple of articles on Johnson and Johnson Stock trades. On the weekend I also discussed some Microsoft Stock Trades. Prior to both articles I discussed PepsiCo Stock trades. All of these trades had common elements including using market timing technical indicator tools like the Ultimate Oscillator to pinpoint entry and exit positions. While there is no doubt in my mind that stocks have always been manipulated by bigger investors, I can still enjoy profits through staying focused on my stocks, my option trades and using the market timing indicators to assist in keeping my attention on the trades and away from the noise of the market.

Today is a great example. On the yahoo option forum(shameless plug) there is a discussion regarding selling puts on commodities because they might be better than put selling stocks. This discussion got me thinking. Since trading in the 1970’s I have made a lot of investor friends over the past 40 years. I know investors today who trade in commodities of all kinds, forex, stocks, etfs, bonds, preferred stocks and even penny stocks.

Throughout the year often call or get together weekly and discuss our trades and strategies. What we always end up finding is that there are risks associated with every asset class. We laugh about how in the fall of 2008 many friends were buying gold like there was no tomorrow, convinced that the credit crisis would destroy the US Dollar and push gold into the stratosphere. Instead gold fell and the US Dollar proved once again to be the safe harbor for most investors. Many of my friends suffered large losses.

Still others continue to pay monthly website fees to “gurus” who have convinced them that the US dollar is on the verge of extinction and the USA itself is going to disappear like Rome. I noted at the last few meetings that a number of them are starting to question the sanity of paying these monthly guru fees which by the way are in US Dollars.

Still other investor friends lost big in 2008 when they bet oil was going to push beyond $300.00 only to watch oil pull way back in the fall of 2008. Still others lost money on corporate bonds in the fall of 2008 when the credit crisis seemed to mark the end of the financial world. They dumped their corporate bonds for big losses.

Instead I believe it doesn’t matter what you trade in. Instead it is better to focus on developing consistent winning strategies that you become adept at applying. It is consistency of strategy which generates profit that compounds money and grows wealth. Every asset class has its risk. This is why I have pointed out numerous times my strategy of staying with large cap dividend paying stocks. I keep a trader’s journal in which I have earnings, returns, dividend payout ratios and through these I can keep an eye on the direction the stock is heading. Regular readers know that often I indicate a stock is over-valued (think Clorox) or no longer meeting its earnings potential (think RIM) and I will leave it.

Commodities of everything from wood to coca, to oil, gold and silver have their risk. The key to success in any investment is learning the strategies that can earn profits and protect against losses. This is why I stay with large cap dividend payers. I use strategies that I have developed over a period of many years which earn profit for me and when I am wrong can protect my capital. Johnson and Johnson is a great example. This huge company has significant profit potential year in and out. Investors shy away from JNJ Stock though as they feel it is a “non-performer”. In truth, proper strategies will easily earn double digits every year and the downside risk is limited. If an unforeseen event happens such as in 2008, I can step up and buy the stock and wait for the recovery while earning a great dividend. The strength of the underlying asset is what I am investing in. In JNJ Stock case it is Johnson and Johnson corporation. When that asset changes I can leave and move to another strong stock. But most investors do not see this as they search for the next great high-flying wonder stock.

Every asset class has their place. But I have become proficient in put selling against stocks and trading against stocks. Not every stock class just specific ones. It is by being focused and developing strategies that I can profit from and protect with, that creates wealth. I believe investors can profit from any asset type if they are willing to learn the asset class they have selected to trade in and become efficient at applying winning strategies consistently. This means knowing everything about what they are investing in and knowing how to use technical tools to assist them in following directional changes to both profit and protect.

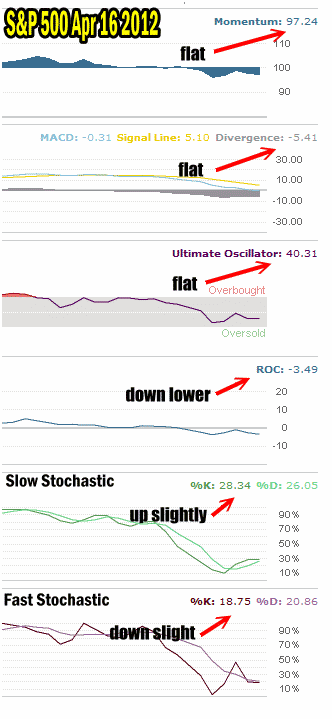

And now the market timing technical indicators for the market on April 16 2012.

Market Timing and Market Direction For April 16 2012

Again this evening there is no need to show the S&P 500 chart. The Dow moved up but not the S&P which was basically flat and not the NASDAQ which was down 0.76% to below 3000. With the NASDAQ below 3000 the index is sitting right at the 50 day moving average. 4 trading sessions ago the NASDAQ bounced off the 50 day. Then on Friday is closed just slightly above it. This fall to the 50 day could be a test for support or perhaps the NASDAQ will pull back from here.

Market Timing Technical Indicators

The market timing technical indicators for today are flat to mixed. Momentum, MACD and the Ultimate Oscillator are flat from Friday. However the rate of change has the biggest change from Friday moving still lower. This indicates the pressure that the market direction remains under. Meanwhile Slow Stochastic is up slightly which is not unusual for today since the market was flat most of the day. Fast Stochastic though is lower showing that investor conviction is still lacking in the market.

Market Timing Indicators For April 16 2012 Show Market Direction Is Still Under Pressure

SPY PUT TRADE CLOSED

I closed my SPY PUTS which I purchased on Friday afternoon. I sold them at noon today as the S&P 500 second pullback was higher than the first and with the DOW rising, it was questionable whether the S&P 500 would fall very far with the DOW higher. Meanwhile the Ultimate Oscillator was also showing oversold despite the second pullback being higher than the first. I will write this up in an article shortly.

Market Timing and Market Direction Conclusion

Where is the market heading from here? With three indicators being flat and two pointing lower (Fast Stochastic and Rate Of Change) there is probably a good chance the market will move lower. However the fast stochastic is at 18.75 and while there is room for it to fall lower, that is a pretty low reading at this point. Therefore another move higher is not out of the question.

It is at times like these that I am glad I sell puts against large cap dividend stocks. Put selling which won’t make anyone rich overnight, does allow me to stay in the market and earn decent premiums with the volatility being higher. Meanwhile I can watch my stock list, turn to my market timing indicators and wait for the Ultimate Oscillator to flash oversold signals which would be my cue to pick up shares or sell more puts on my handful of stocks.