Market timing technical analysis this week continues to reflect weakness as investors question whether the economy is going to be strong enough to support the market direction continuing higher. However my market timing technical tools are saying that there is still more upside to come.

Meanwhile, short-term the market direction could move higher, a tremendous amount of capital has not found its way back into stocks and because of this it may be difficult for the stock market to push a lot higher short-term.

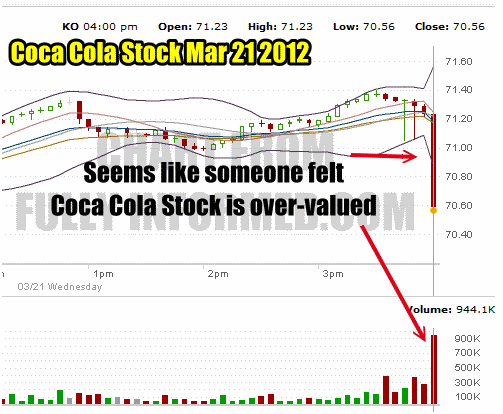

I saw stocks like Coca Cola Stock today set new highs as it reached $71.37 and then fell last-minute to close at $70.56. 900,000 shares traded in that last minute as obviously someone felt the stock was too high and they wanted out.

Obviously someone wants out of Coca Cola Stock.

Coca Cola Stock is now trading at 19.1X price to earnings and in my opinion is not cheap but over-valued. Coca cola stock is not alone.

YUM Stock is now trading at all time highs and with a PE of 25.6X, this stock is just not cheap. There are literally dozens of such stocks. The comment today by Goldman that the market is cheap is laughable. Their comment that it was time to say a long good-bye to bonds and instead give a long good buy to stocks tells me that I may soon be able to start adding to my bond portfolio.

Someone needs to tell Goldman that stocks were cheap in March 2009. They were not quite so cheap in the summer of 2010 and they were only slightly cheap in November 2011, but for many stocks they are not cheap now. When analysts indicate that stocks are “fairly valued” you know that the upside is very limited as obviously they are trying to get out while telling retail investors that “things are fine”.

Perhaps this endorsement of stocks by Goldman is an attempt to bring in fresh money from the sidelines. Good luck with that. Investors have long memories and the shadow of the bear market collapse or 08-09 is still fresh for many investors.

Market Timing / Market Direction And The Over-Valued S&P 500

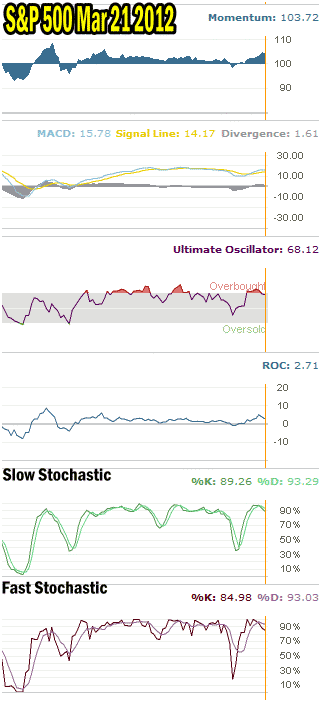

Below is the chart of the S&P 500 for the past year and it has been a very nice rally. The recent weakness of just a few trading sessions ago is gone and the S&P is trying to move higher but it would appear to stuck and the market timing technical tools I use, might just give investors a clue about why.

Market Timing / Market Direction Technical Tools Indicate Market Is Still Overbought

My market timing technical indicators in general are still flashing that this market is overbought. In earlier articles I indicated that a market can stay overbought far longer than investors realize. However eventually it has to break one way or the other. Usually there are a few days of heavy selling and then the overbought condition is worked out and the market can move back higher.

This is what happened at the start of the month and perhaps the market needs to have another pullback before the market direction continues higher. However from a market timing technical analysis perspective, the market is having trouble because every dip is being bought and the market pushed back up. In order to work out the overbought condition there has to be some sustained selling for at least a few days. They is not happening and the market timing tools therefore are reflecting the dip buyers.

My market timing technical tools are still flashing an overbought warning which could be the reason market direction seems to have stalled.

The Ultimate oscillator, Slow Stochastic and Fast Stochastic market timing tools are all still in overbought territory. The slow and fast stochastic market timing tools are turning down but only sllightly which indicates there is no real fear of a downward move right now. The VIX resting between 14 and 15 is confirming this.

The other market timing technical tools are beginning to show the signs of sideways momentum and their readings are starting to drop off but they are far from negative.

Market Timing Tools Show No Top Yet

None of the market timing tools show any signs of worry yet. They also show no sign that a market top is beginning to form. Leaving aside the market timing tools for the moment, there are also no charting signs of a market top either. Normally the market sells-off and then it tries a climb back which is not quite as high as where it started selling off. From this second rally there is selling as market direction turns down. We are seeing none of that so it is obvious there is not even the hint of a market top. Therefore the market timing tools are indicating that once the overbought condition is worked out, the market direction is still higher.

Market Timing / Market Direction Summary for March 21 2012

While the stock market looks like it may be treading water here, it could easily be continuing to slowly work the overbought condition out of the market before moving higher. A couple more days like the past two days and the overbought condition will be gone allowing the market direction to continue higher.

The past two days have seen good pullbacks which are waited out by the traders. Once the selling begins to slow, they step in and buy stocks for another push up. Even .50 cents for traders in many of these stocks is still profit and that’s what they are looking for. Until they tire of buying the dips the market direction remains higher and the overbought condition will have a hard time being worked out of the market place. Sometimes market timing doesn`t need technical tools but just signs like when a few bigger players dump stock like happened to Coca Cola Stock at the close of the market today, then we will all know that the market direction is going to change.