Today was pretty exciting. Overall though it looks like a short perhaps even one day, relief rally. The charts are anything but optimistic that the market has bottomed.

About the only positive thing I can say is that the market still has not shattered the August lows, which is a good sign. But the market can only hold on for so long and then eventually it will fall through.

The market direction cannot be sideways forever. If the market cannot make any headway, than it will eventually break and fall lower. The path of least resistance is lower, so without a reason to move and stay higher, the market will move lower.

The charts for today are not encouraging but who knows, this is just my best guess based on my studying the charts and what they are trying to say. Overall it still seems that it is all about Europe, but in the background I think there is more going on than just Europe. The economy is slowing, housing continues to get worse, unemployment shows no recovery and other countries around the globe are slowing including Brazil, Germany, China, France, Canada and the USA.

It’s hard for the markets to climb when the economy cannot support higher prices in risky assets.

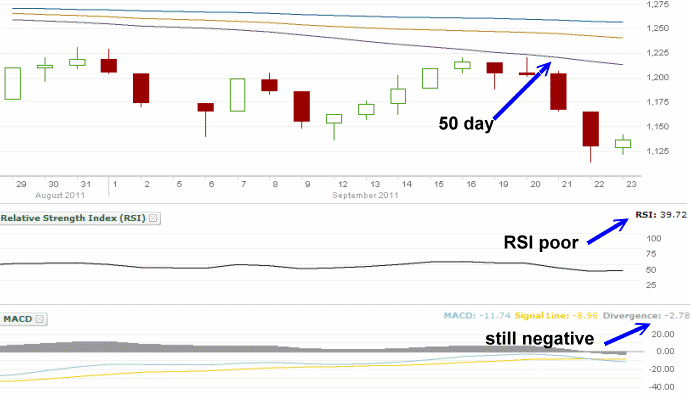

Below is the S&P 500 for the past month. Today’s action left an indecisive candlestick. The 50 day moving average is continuing to fall. Eventually the market will reach it as it will fall far enough for the market to catch it.

The relative strength index is poor with a reading of 39.72 and MACD is decidely negative with a reading of -2.76. Still though it is looking like it might try to turn up.

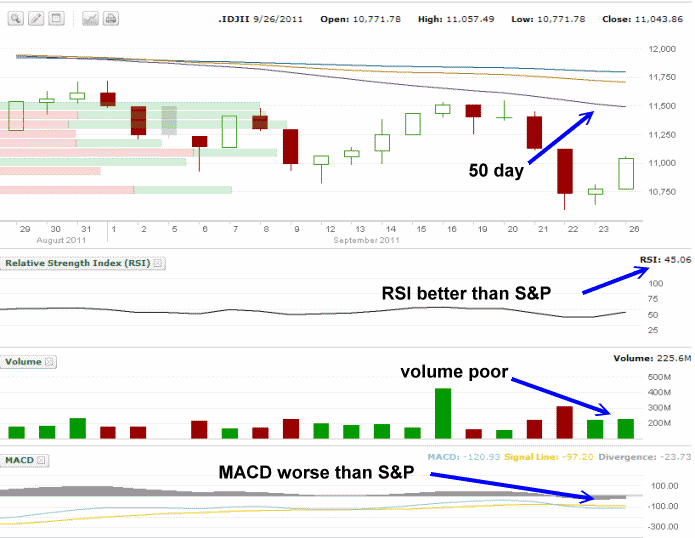

Below is the DOW Jones chart for the past month. The market today recaptured the 11,000 mark although many could argue that this milestone is nothing significant and I would probably be in agreement. The 50 day is about 500 points away but two big rallies like today could get the DOW there. The Dow though hasn’t managed to reach the 50 day for more than a month now and it continues to decline.

RSI is actually better than on the DOW than on the S&P and is close to be neutral, but it is still negative. Today’s rally didn’t see any significant volume, which is a poor sign.

MACD is decidedly worse than on the S&P 500 with a reading of negative 23.73 warning that more selling may lie ahead.

Market Direction Summary for Sept 26 2011

Overall it was a fun day in the market for traders but I do not yet see anything to get excited about. Everything points to further selling ahead but remember, it’s just a best guess and I don’t believe anyone can accurately predict the market direction with any real degree of certainty.

That is why when it comes to market direction I believe my best course of action presently is to stay protected and continue with my bear market strategies including my favorite, selling far out of the money puts on my favorite stocks.