Anyone who isn’t enjoying this market is probably not doing options. Yesterday the Dow plunged 300 points and today rose more than 200 points. This 500 point swing has helped to create volatility and lots of opportunities.

I haven’t had a chance to update all my articles on my recent trades, but suffice to say I have been a busy investor. Yesterday I sold puts on Exxon Mobil Stock (xomM) and thanks to volatility I sold the October $55.00 put strike for .54 cents.

I sold puts on Intel Stock (intc) and again thanks to all the volatility I sold the October $16 put strike for .20 cents.

I sold puts on Johnson and Johnson stock (jnj) and once more it is volatility that provided me with the opportunity to sell the October $57.50 put strike for an incredible .80 cents.

I then turned to Kraft Foods (kft) and sold the October $32 put strike for an impressive .58 cents.

Next was Merck and Company Stock (mrk). I sold the October $29 put strike for a very nice .50 cents.

Then I looked at Microsoft Corp (msft) and it had fallen to 25.20. I sold the Sept 17 $24 put strike for .22 cents and the October $22 put strike for .31 cents.

Nucor Corporation (nue) was next. Here I sold the Sep 17 $30 put strike for .31 cents. 1% for a little over a week of risk.

In the morning I was busy with SPY Puts again, buying around 10AM and selling less than an hour later. You can read my write up of how I trade using the 5 day simple moving average, here.

What does this tell you? That I believe the market is moving back up and today’s action shows that yesterday we put in the third leg down which I discussed in the Market Direction call of August 31 – Crossroads.

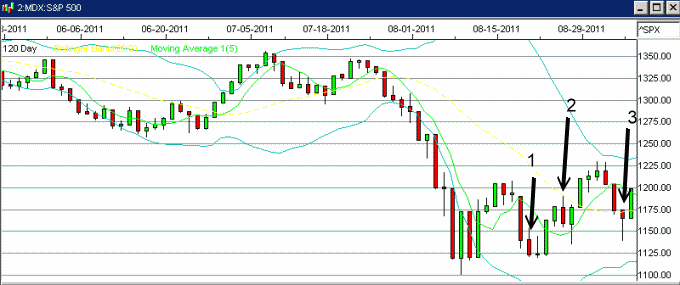

You can see in the chart below the three moves lower in the market. I believe the market direction which remains range bound should now try to move back up and perhaps challenge again the 1260 level on the S&P 500 before selling off again. Overall the market direction appears down.

The last move down yesterday was not on large volume which makes me suspect that there is still some further downside up ahead somewhere. After all this is a bear market (my opinion of course) and there should be lots more volatility ahead.

But thanks to the volatility (and little help from Europe) the puts I am selling have excellent premiums and for the most part are far enough out of the money that if I was assigned I would happily hold them and sell covered calls.

Market Direction – Summary for Sep 7 2011

It’s important to remember that a bear market can last a long time. The market could be in a range for weeks before finally breaking either higher or lower. I still think the 1000 on the S&P will be tested and perhaps even broken. But that could be weeks or months from now. Meanwhile I am pleased to see that volatility is pushing my option premiums higher and adding to my overall portfolio returns for the year. This plays very well with my cautious bull strategy which I have been using since the beginning of the year. Gotta love the volatility and until the market direction changes it will continue to push up my option premiums.