Remember the 11 key aspects from Part 1 of this article on AGQ ProShares Ultra Silver ETF, here are some financial investment strategies that may be worth considering for AGQ ProShares. While many of these strategies can be applied to other ETFs and stocks, these are designed to be used for 2X and 4X Ultra ETFs.

Remember for all of these strategies, Dan has 4500 shares in AGQ ProShares ETF with a cost basis of $90 (total capital spent $405,000) and a break-even of $75.00. This means he has already earned $67500.00 through selling covered calls.

You will spot various components of the 11 key aspects sprinkled throughout these AGQ ProShares strategies. No single strategy incorporates all 11 aspects.

AGQ ProShares Strategy 1 – Staying Simple

Sometimes simple is best when it comes to commodities. Dan’s original intent was to ride AGQ ProShares 2X Silver ETF all the way to what he felt would be into the $500.00 range. No one can predict what is going to happen to the price of silver or most commodities for that matter. Since Dan’s outlook is incredibly bullish on AGQ ProShares, why stray from the goal of the trade. The AGQ ProShares Staying Simple Strategy assists the investor in earning income while waiting for AGQ ProShares to rise in value.

Here are the steps for AGQ ProShares Staying Simple Trade.

1) In this strategy NEVER SELL AGQ ProShares Covered Calls BELOW the $90.00 cost.

2) Stay ahead of the game by buying back the sold covered calls each time you have earned 85% or more of the call premium sold. Dan could pick whatever amount he is happy to earn (75%, 80%, 90%) but remember there are always trade-offs.

For example, if Dan had sold the AGQ ProShares March $90 strike 3 months out and AGQ ProShares fell swiftly in value in a 3 week period right after selling the covered call, the 3 month out covered calls at $90 would lose value rapidly. By buying to close the AGQ ProShares covered calls EARLY he could grab better premiums at the same strike further out in time since the further out in time options will hold premiums longer.

Watch most option premiums as they fall further out of the money. At first they lose a lot of premium but then they start to lose a lot less. With AGQ ProShares, option premiums once they fall below .85 cents start to slow despite the length of time. When Dan sold for $6.50 is leaving .50 or .60 cents behind to close and then write further out for another $3.80 or more really that bad an alternative? By holding on for the remaining month and a half just to squeeze out that remaining .50 or .60 cents could mean that premiums further out are falling by $1.00 or more.

It is important to stay ahead of the game by taking advantage of covered calls premiums further out in time when the premiums in the closer months are stalling out.

3) Thanks to Volatility being so high on AGQ ProShares, Dan could look to sell covered calls further out in time to not sell below his cost of $90 in AGQ ProShares shares.

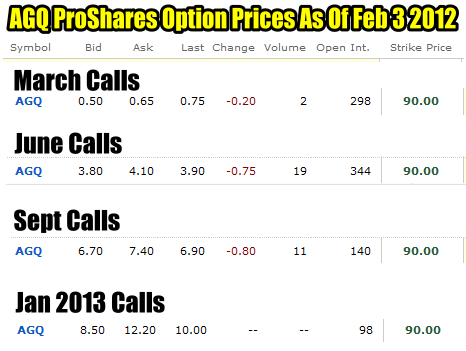

For example below are the $90 strike call premiums for the available months as of Feb 3 2012 market close. Dan has already earned $6.50 from selling the March $90 covered call strike. He could easily buy to close the March $90 covered call strike for .65 cents and then sell June covered calls for $3.80. This would pick up $3.15 additional premium. Total income to date = $6.50 + $3.15 = $9.65. Dan indicated he has already reduced his break-even on AGQ ProShares to $75.00. This would reduce his break-even to $71.85. If AGQ ProShares takes off and runs past his $90 strike exercising him out of his shares he will have made 20% by June. Meanwhile at $71.85 Dan would have earned $81675.00 ($90.00 less $71.85).

AGQ ProShares Ultra Silver ETF Covered Call Options $90 Strike

By continually buying back the covered calls early when the profit percentage Dan wants is reached, he could effectively continue to sell covered calls and keep lowering his break-even in AGQ ProShares.

4) As or when AGE ProShares rises, buy back the covered calls and roll higher to stay with the rise in the ETF. Remember that even if AGQ ProShares moves above your covered calls, silver is volatile and moves all over the place. You will most likely have time to buy and roll up and for that extra protection you could consider staying slightly in the money as you roll higher.

AGQ PROSHARES Staying Simple Strategy Summary

This is a simple strategy but sometimes simple is all it takes. By rolling with the stock and moving further out in time to capture more premium you often will be earning your profit with each roll higher as the ETF rises.

It’s a simple strategy which works in 2X and 4X funds because of the high volatility.

But there are lots of twists that can be added to make Strategy #1 better. These are touched on in Strategy 2 and 3 below.

AGQ ProShares Strategy 2 – Staggered Covered Calls

Take the same strategy as number 1 but let’s stagger the calls. Taking the same AGQ ProShares option chart from above, consider the strategy of buying back the 45 Covered Call Contracts for March $90 at .65 cents.

Total capital earned to date in AGQ ProShares = $67,500.00 (Basically $90.00 less $75, Dan’s break-even)

Here are the steps for AGQ ProShares ETF Strategy 2

1) Cost to Buy To Close Early – 45 CC Mar $90 at .65 = $2925.00

2) Now break the AGQ ProShares covered calls into smaller groups and sell them like this:

4500 shares = 45 covered call contracts

Sell:

10 Covered Call June $90 at $3.80 = $3800.00

10 Covered Calls Sep $90 at $6.70 = $6700.00

10 Covered Calls Jan 2013 $90 at $8.50 (although I would try for $10.00) = $8500.00

Total Income = $19,000.00

Total Earned to Date = $67,500 (less $2925.00) + $19,000 = $83575.00

3) 1500 shares are still left uncovered and can be sold at any time.

Break-even share price on the 4500 shares = $405,000 initial capital, less $83575.00 earned = $321,425 /4500 shares = $71.42.

4) Therefore by staggering the calls Dan has effectively lowered his break-even MORE than in strategy 1, BUT HAS 1500 AGQ Shares That Have No Covered Calls. Therefore if Dan is right and silver climbs in price dragging AGQ ProShares ETF higher and he would rather NOT buy to close his covered calls at the $90 strike, he is still earning 20.5% on the trade up to $90.00 AND because he has 1500 shares or 1/3 of his entire trade unencumbered by covered calls he can continue to hold those and consider covered calls later on those 1500 if AGQ ProShares continues to climb.

AGQ PROSHARES Staggered Covered Calls Strategy 2 Summary

There are lots of VARIATIONS TO STRATEGY 2 that can be done. Among my favorite is a COVERED CALL LADDER. For example, sell the June $90, the Sept $95 (presently there is no $95 available but I’m sure you get the idea) and the Jan $100.00 so that each covered call contract sold further out in time is at a higher strike (Covered Call Ladder) which means capital gains, in the event AGQ ProShares ETF moves higher.

Since 2X and 4X ETFs like AGQ ProShares are so volatile it makes selling at higher strikes further out, quite profitable while waiting out what Dan perceives is the inevitable rise in silver. A COVERED CALL LADDER is a great choice. If AGQ ProShares ETF rises in value you may be lucky enough to have some covered calls expire still out of the money and get to sell them further out in time at ever increasing strikes.

AGQ ProShares Tip

SLOW DOWN WHEN SELLING COVERED CALLS ON AGQ PROSHARES ETF

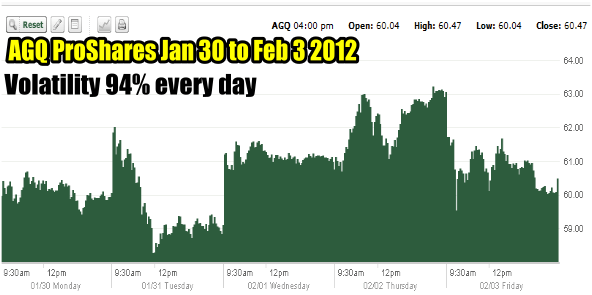

You can easily build on the above two strategies because volatility is so high in AGQ ProShares ETF. Most days volatility is at 94%. Therefore premiums are all over the place. Remember when placing your covered call sell orders you can take your time.

One day you may not get filled, but the next day you might. It’s always worth while taking your time with an ETF like AGQ ProShares. The chart below shows the past 5 days in AGQ ProShares ETF. Jan 30 2012 to Feb 3 2012. Wouldn’t it be great if there was this much volatility in a lot of stocks. Just imagine the option premiums!

AGQ ProShares ETF Jan 30 to Feb 3 2012 Chart

Consider Smaller Lots Sizes For Selling Options In AGQ ProShares or ANY 2X or 4X ETF

Take your time when placing your order to be filled or break the fill order into smaller groups at the same strike and set your covered call offers at staggered prices.

For example:

On Friday the January 2013 $90 call strike at the close was $8.50 Bid and $12.20 ASK.

Consider placing your sell order this way:

STO 3 CC JAN $90 at $9.75

STO 3 CC JAN $90 at 10.50

STO 4 CC JAN $90 at $11.25

The further out in time the option is being sold, the more room to maneuver for your covered call trade prices.

AGQ ProShares Strategy 3 – Go That Extra Mile With Volatility

The beautiful thing about 2X and 4X ETFs is volatility. Make that volatility work for you when selling covered calls by taking your time to build a very long covered call ladder.

Dan is holding 45 covered call contracts at March $90.00. Let’s take the example of Dan buying them all back now.

Here Are The Steps For Strategy 3 – The Extra Mile

1) Dan stretches out the covered call months available right now as of Feb 3. This mean call options are available for March (which he just bought to close), June, Sept, Jan 2013, Jan 2014.

2) The problem now for Dan is that he is bullish on silver and thinks it will move a lot higher. However it could start running up next month, in 3 months, 6 months or it could take a couple of years. Meanwhile if Dan is wrong and silver falls, then he wants some income from his covered calls. What a dilemma.

Solving it is actually pretty easy, especially when you realize that no one knows what the future could bring. Therefore Dan takes his 45 covered call contracts and decides that it is best to “take his time”.

3) Therefore right now Dan sells

A) 10 Covered Calls in AGQ ProShares for June at $90.00 for $3.80 = $3800.00

Since June is the closest available month sell the most covered call contracts for June. It has the least amount of time left (4.5 months) and if silver does begin to move higher, it may not reach $90 by June allowing the best of the covered call world. You get to keep the $3.80 and write the covered calls again but at a higher strike.

B) 6 Covered Calls in AGQ ProShares for Sept at $90.00 for $6.70 = $4020.00

Since Sept is 7.5 months away sell just 6 contracts rather than 10.

C) 4 Covered Calls in AGQ ProShares for Jan 2012 at $95 for $7.70 (although I would try for $10.00) = $3080.00

Again since Jan is 11.5 months away sell just 4 contracts rather than 6.

4) Total Earned to Date = $67,500 (less $2925.00 (cost to close March Covered Calls) + $10,900 = $75,475.00

Break-even on AGQ ProShares is $405,000 less $75,475.00 / 4500 shares = $73.22.

5) Dan has sold only 20 Covered Call Contracts leaving 25 contracts which can still be sold.When Feb Options Expire you look at the new months available and sell 10 at the closest month which will be April.

When July and October appear you sell into those months as well but smaller quantities.

6) You want to continue to build your ladder so that by the time June comes, if AGQ ProShares is not at $90.00, you can go out to March 2013 and sell the $90 strike.

The Concept Behind Strategy 3

The concept of Strategy 3 is that volatility is being used at its greatest – furthest out in time. However by keeping the larger quantities of covered calls to the closest months you have a better chance or selling covered calls with more knowledge about how silver is performing.

All the while you are also keeping some shares back without covered calls on them for when silver takes off and AGQ ProShares moves higher.

If by June AGQ ProShares is at for example $95.00, you let your shares be exercised and then consider whether to buy back in and sell covered calls against your new purchase further out and higher up in time, depending on your outlook at that time.

There are four key elements that make AGQ ProShares strategy 3 work.

1) If AGQ ProShares moves way above your $90 strike (or whatever strikes you have sold covered calls on), YOU MUST NOT BUY TO CLOSE YOUR COVERED CALLS THAT ARE NOW IN THE MONEY. In other words if by June AGQ ProShares was at $195.00, YOU DO NOT CLOSE YOUR SEPT, JAN13 and JAN 14 or any other covered calls. You let them be exercised when the time comes or expire.

AGQ ProShares is commodity based and prices go all over the place. Remember what happened in 2011 with silver prices. If you close and move higher you could easily end up losing on the covered call trade. When you sell each covered call contract consider the trade finished until the option either is exercised or expires.

2) You must always keep at least 1000 shares of AGQ ProShares free of covered calls. You want to always have some shares free to take advantage of prices moving higher. As prices move higher break your lots into smaller contracts, possibly 3 at a time and sell further out and higher up for your remaining 1000 shares. Take your time. Silver will fluctuate but you want to wait for any rise to stall out. (See Part 3 for technical tools to try to time 20 AGQ ProShares moves)

3) Always sell the most covered call contracts at the closest month. When new months appear you must sell covered calls into those months but always sell smaller quantities the further out you go. 2X and 4X funds have tracking problems as we discussed in Part 1. In this regard though volatility is your friend as even if AGQ ProShares falls to $40.00, there will be premiums available on covered calls at $90.00 if you are going out to Jan 2014 for example. But you want your calls to expire if possible so you can reassess AGQ ProShares when the options expire and determine your strike price. If for example by June AGQ ProShares was at $75.00 then you may want to consider selling August $100.00 or $110.00 strikes.

4) DON’T TINKER. Once you have placed your covered calls leave the trade to run its course. If the premiums collapse and you can buy to close your calls for 85% gains AND there is premium to be brought in by going out further with the same number of contracts, then by all means close the trade and sell again, but don’t close early figuring that you are going to close now and win big later. This strategy needs consistency to work.

AGQ PROSHARES The Extra Mile Strategy 3 Summary

If Dan is correct and AGQ ProShares, perhaps by Jan 2013 for example, is at $200.00, he will have a ladder of covered calls possibly stretching into mid Jan 2014 at prices from $90.00 to $150.00 or higher. The ladder is designed to keep following the ETF higher, but if the ETF falls in value Dan is being compensated by bringing in decent premiums while waiting for a recovery. Therefore if layed out properly, by the time AGQ ProShares reached $200.00, Dan should have at least 1000 shares that are not held to covered calls.

This is a strategy I have employed many times on highly volatile stocks and ETFs such as Gold and Oil. The more volatility the better as it creates large enough premiums to make selling far out in time worthwhile and profitable. It also means I can earn income to reduce my cost basis in the stock over a long period of time despite the fact that this is a 2X or even a 4X fund. This strategy works to defeat the notion that an investor cannot stay in a 2X or 4X ETF for long periods of time. I have used The Extra Mile strategy for a 3 year period on a 2X gold fund with great success and decent profits.

The whole idea of The Extra Mile Strategy is to make volatility work for you. You earn big premiums even if the stock falls. For example as of today (Feb 3 2012) the January 2013 $150 call strikes have $3.10 premium. This is only possible because volatility is usually 94% with AGQ ProShares and this call strike is out 1 year.

But for The Extra Mile Strategy to be successful an investor has to be careful to time selling the calls (see part 3 for technical tools to help), not second guess the covered calls after they are sold, take his time climbing the covered call ladder over a period of weeks and months not a couple of days and always have shares with no covered calls on them.

The Extra Mile Strategy might be a good choice for AGQ ProShares Ultra Silver ETF.

Part 3 looks at 4 other strategies including selling puts in the Twin Sister Put Selling Strategy and one of my favorites, The Cry Baby Stock Trading Strategy.

Go To AGQ ProShares Ultra Silver Investing Strategies Part 1

Go To AGQ ProShares Ultra Silver Investing Strategies Part 3

You May Also Want To Read:

Read AGQ ProShares Ultra Silver Investing Strategies Part 1

Read AGQ ProShares Ultra Silver Investing Strategies Part 2

Read AGQ ProShares Ultra Silver Investing Strategies Part 3

Read AGQ ProShares Covered Calls Questions